Introduction

The ebb and flow of a nation’s foreign exchange reserves are often viewed as a barometer of its economic health and financial stability. In the case of India, the composition and management of its forex reserves have been garnering significant attention in recent times. This article delves into the nitty-gritty of India’s forex reserves, examining its composition, trends, and the driving forces that influence its dynamics.

Image: www.indiatvnews.com

What are India’s Foreign Exchange Reserves?

Foreign exchange reserves, often referred to as forex reserves, represent the stockpile of foreign currencies, gold, and other assets held by the central bank of a country. These reserves serve as a buffer against external financial shocks and provide the government with the flexibility to intervene in the foreign exchange market to stabilize the value of its currency.

Composition of India’s Forex Reserves

India’s forex reserves are primarily composed of the following elements:

- Foreign Currency Assets: The largest component, accounting for over 70% of total reserves, primarily held in U.S. dollars but also including other major currencies like the euro, pound sterling, and the Japanese yen.

- Gold: India holds a significant portion of its reserves in gold, currently standing at around 11% of total reserves.

- Special Drawing Rights (SDRs): SDRs are an international reserve asset created by the International Monetary Fund (IMF) and are held as part of India’s forex reserves.

- Reserve Tranche Position at the IMF: This represents India’s potential borrowing capacity from the IMF and forms a small portion of its forex reserves.

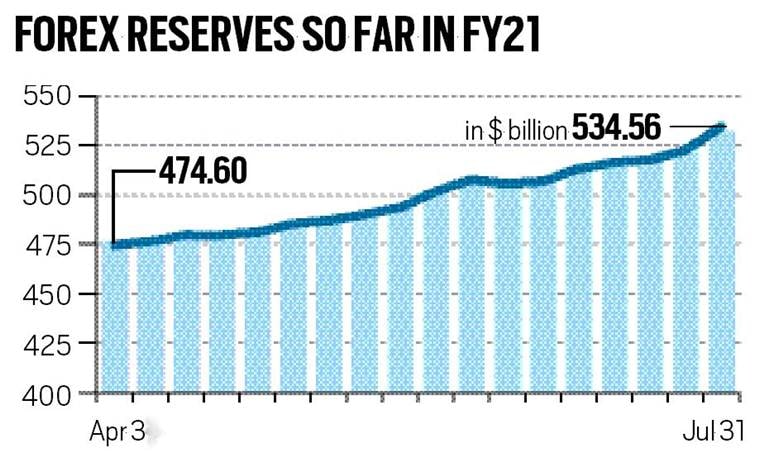

Trends in India’s Forex Reserves

India’s forex reserves have witnessed a steady increase over the past few decades, mirroring the country’s economic growth and improved balance of payments position. The total reserves have grown from around $5 billion in 1990 to over $630 billion as of June 2023, making India one of the top holders of forex reserves in the world.

Image: indianexpress.com

Factors Influencing India’s Forex Reserves

The dynamics of India’s forex reserves are influenced by a range of factors, both domestic and global:

- Foreign Direct Investment (FDI): Inflows of FDI contribute to an increase in forex reserves as foreign investors exchange their currencies for Indian rupees.

- Remittances: Funds sent home by Indian expatriates working abroad also boost the country’s forex reserves.

- External Loans: Borrowings from international financial institutions and foreign banks increase India’s forex reserves.

- Trade Balance: A surplus in the trade balance, where exports exceed imports, leads to an accumulation of foreign currencies in forex reserves.

- Central Bank Intervention: The Reserve Bank of India (RBI) intervenes in the foreign exchange market to stabilize the value of the rupee, buying or selling foreign currencies as required.

Latest Developments and Trends in Forex Reserves

In recent times, India’s forex reserves have been under scrutiny due to several factors:

- Russia-Ukraine Conflict: The conflict has disrupted global trade and financial flows, influencing the demand for Indian exports and remittances.

- Global Economic Slowdown: Concerns about slowing global economic growth have weighed on foreign investor sentiments, potentially impacting FDI inflows.

- Interest Rate Hike Expectations: The U.S. Federal Reserve’s expected interest rate hikes could increase the attractiveness of investing in U.S. dollar assets, leading to potential shifts in forex reserves.

Expert Advice and Tips for Managing Forex Reserves

Managing forex reserves effectively requires a careful balancing act, taking into account both short-term and long-term objectives.

- Diversify Holdings: Central banks are advised to diversify their forex holdings beyond the U.S. dollar to reduce concentration risk.

- Monitor Market Trends: Continuous monitoring of market trends and economic conditions is crucial for informed decision-making.

- Maintain a Balance: Striking a balance between the adequacy of reserves to meet potential shocks and the cost of holding reserves is essential.

FAQs on India’s Forex Reserves

Below are answers to some frequently asked questions about India’s forex reserves:

- Why does India hold foreign exchange reserves?Forex reserves provide a buffer against external financial shocks, such as a sudden outflow of capital, and allow the RBI to intervene in the foreign exchange market to stabilize the rupee.

- How are India’s forex reserves invested?India’s forex reserves are invested in a range of assets, including U.S. Treasury bonds, German government bonds, and gold.

- What are the risks associated with holding forex reserves?Forex reserves are exposed to currency fluctuations, interest rate movements, and geopolitical risks, which can lead to potential losses in value.

Break Up Of Indian Forex Reserves

Conclusion

India’s foreign exchange reserves play a crucial role in the stability of the country’s economy and financial system. The composition, trends, and dynamics of these reserves are influenced by a myriad of factors, both domestic and global. Careful management and prudent investment strategies are key to ensuring the reserves continue to serve as a strong buffer and support India’s economic development goals. Is there anything else you’d like to ask about India’s forex reserves?