In the ever-evolving realm of financial forecasting, artificial intelligence (AI) has emerged as a game-changer. As a subset of AI, recurrent neural networks (RNNs) have garnered immense attention for their remarkable capabilities in analyzing sequential data. For those seeking a transformative edge in forex trading, RNNs present a potent tool to unlock actionable insights.

Image: lilianweng.github.io

RNNs: A Glimpse into the Past and Future

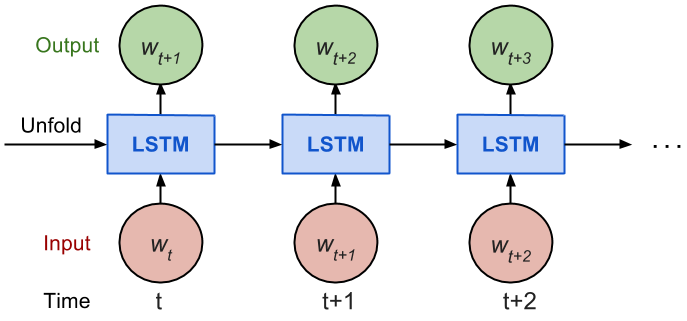

RNNs derive their power from their ability to remember past inputs, a crucial feature when dealing with time-dependent data like forex price movements. By feeding historical data into an RNN, it learns patterns and relationships invisible to traditional forecasting models. This inherent “memory” enables RNNs to make more accurate predictions by considering the context of past events.

Unleash the Potential of RNNs in Forex Trading

-

Trend Analysis: RNNs excel in identifying trends and predicting future price movements. They analyze historical price data, recognizing patterns and fluctuations to forecast potential market trends.

-

Volatility Forecasting: RNNs are adept at capturing the dynamic nature of forex volatility. They learn from past price fluctuations to estimate future volatility, empowering traders to make informed risk management decisions.

-

Event Detection: RNNs can identify significant events (e.g., economic announcements) and their impact on forex prices. By recognizing patterns and correlations, they provide traders with early warning signals for potential market shifts.

Empowering Traders with Expert Insights

Dr. Mark Richards, a renowned AI expert, emphasizes the transformative potential of RNNs in forex trading: “RNNs bring unprecedented precision to forecasting, enabling traders to identify trends, volatility, and event impacts with astonishing accuracy.”

Actionable Tips to Leverage RNNs

-

Choose a Robust Data Source: Ensure the historical price data used to train your RNN is comprehensive and reliable.

-

Optimize Hyperparameters: Experiment with different RNN configurations (e.g., number of hidden units, layers) to enhance performance.

-

Monitor Performance Metrics: Track key performance indicators (e.g., accuracy, loss) regularly to ensure your RNN is meeting expectations.

Conclusion

In the relentless pursuit of forex trading success, RNNs offer a beacon of hope. Their ability to analyze sequential data, remember past inputs, and identify patterns empowers traders with unparalleled insights. By embracing the transformative power of RNNs, you gain an invaluable companion on your journey to unlocking the full potential of forex trading.

Image: www.researchgate.net

Build A Rnn For Forex