Introduction

In today’s dynamic and globalized economy, financial markets offer a plethora of opportunities for investors seeking growth and diversification. Among these markets, foreign exchange (forex) trading and contracts for difference (CFDs) have emerged as instrumental strategies for astute investors. This comprehensive guide aims to demystify the world of forex and CFD trading, empowering you with the knowledge and skills to navigate these exciting markets effectively.

Image: play.google.com

Forecasting future price movements in the vast forex market, where trillions of dollars are exchanged daily, is an art form mastered by experienced traders. CFDs, on the other hand, provide a compelling alternative, allowing you to trade on the price fluctuations of various financial instruments without actually owning them. Understanding the intricate workings of these markets opens doors to potentially lucrative financial ventures.

Section 1: Unraveling Forex Trading

Forex, the global marketplace for currency exchange, stands as the largest and most liquid financial market worldwide. Its significance stems from the constant demand for currency conversion, driven by international trade, tourism, and investment. As a forex trader, your goal is to predict currency movements and capitalize on the price differences between various currency pairs.

1.1 Currencies and Currency Pairs

In the vast world of forex, currency pairs reign supreme, representing the relative value of two currencies. For example, the widely traded EUR/USD pair measures the value of the euro (EUR) against the U.S. dollar (USD), indicating how many euros are required to purchase one U.S. dollar.

1.2 Spot Market vs. Forward Market

The forex market comprises two primary segments: the spot market and the forward market. The spot market facilitates immediate settlement of currency trades, typically within two business days. Conversely, the forward market allows traders to lock in currency exchange rates for future dates, providing a mechanism for managing and mitigating currency risk.

Image: ecceconferences.org

1.3 Trading Strategies

Forex traders employ diverse strategies to enhance their profitability. Scalping involves making numerous small-scale trades to accumulate profits from tiny price movements. Position trading, on the other hand, adopts a long-term perspective, holding positions for extended periods to capture larger market trends. Each strategy requires a tailored approach, matching the risk tolerance and investment goals of individual traders.

Section 2: Exploring Contracts for Difference (CFDs)

Stepping into the world of CFDs unveils a different dimension of trading. Unlike traditional investments where you own the underlying assets, CFDs allow you to speculate on price movements without acquiring actual ownership. This unique feature provides access to a vast range of financial instruments, from stocks and indices to commodities and currencies.

2.1 Types of CFDs

The versatility of CFDs extends to a wide variety of underlying assets, embracing stocks, indices, commodities, and currencies. This diversification opens avenues for traders to pursue customized investment strategies based on their risk appetite and market preferences.

2.2 Leverage: A Double-Edged Sword

CFDs introduce the concept of leverage, a potent tool that magnifies both potential profits and losses. Leverage allows traders to amplify their market exposure with minimal capital investment. However, it’s imperative to exercise caution, as heightened leverage intensifies risks and could result in substantial losses.

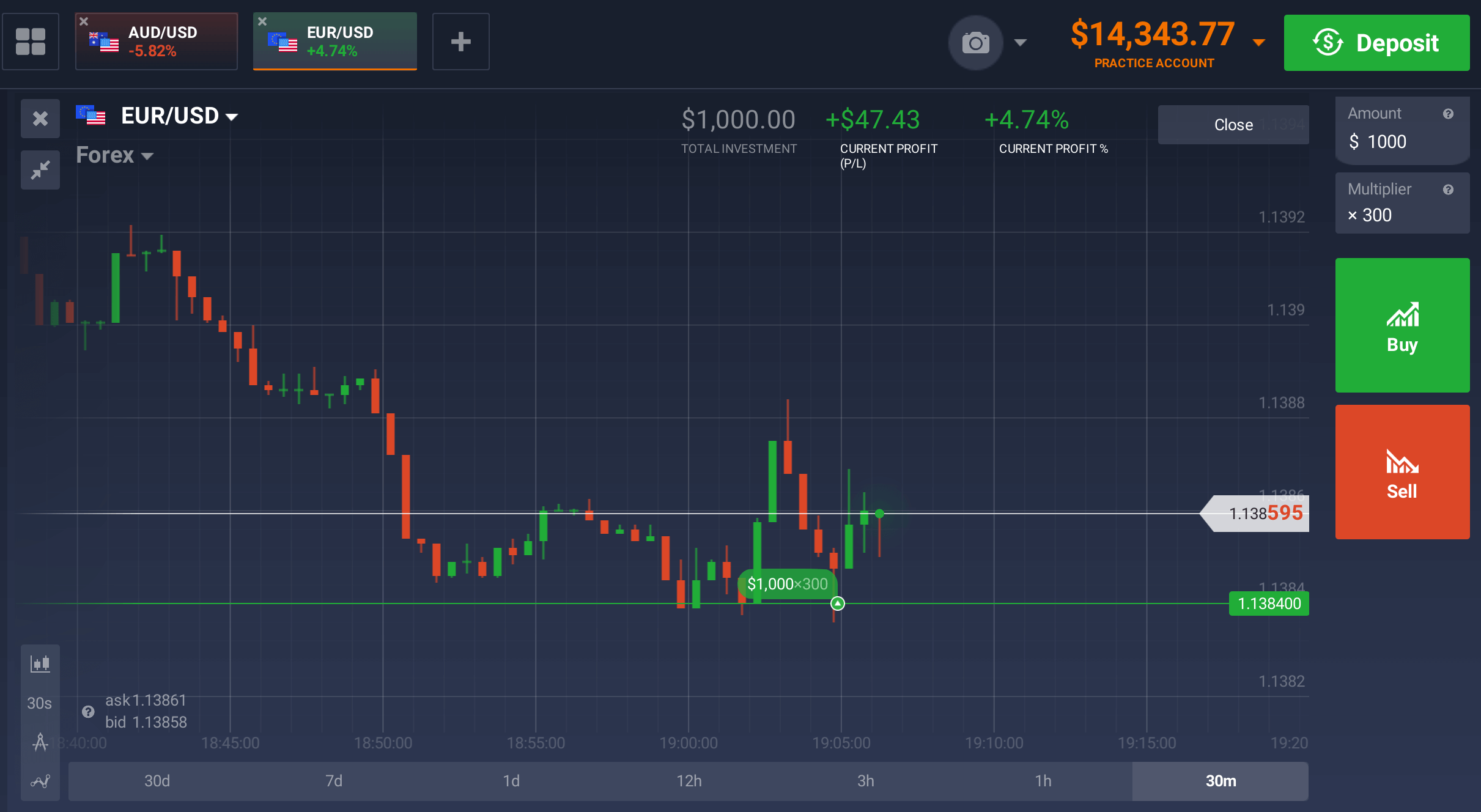

2.3 CFD Trading Platforms

Navigating the world of CFDs requires a robust and user-friendly trading platform. These platforms provide real-time market data, advanced charting tools, and comprehensive order management systems. Choosing a reputable and technologically advanced platform is crucial for a seamless and efficient trading experience.

Section 3: Risk Management in Forex and CFD Trading

The exhilarating pursuit of profit in forex and CFD trading is inextricably linked with the need for comprehensive risk management. Ignoring this crucial aspect can lead to devastating consequences for even the most skilled traders.

3.1 Stop-Loss Orders: A Lifeline in Volatile Markets

Stop-loss orders, aptly named, act as a lifeline in the unpredictable realm of market fluctuations. These orders automatically trigger the sale or purchase of a currency pair or CFD when the price reaches a predetermined level, effectively protecting traders from excessive losses.

3.2 Position Sizing: Trading Responsibly

Position sizing, the art of determining the appropriate trade size, lies at the heart of responsible trading. Matching the trade size to available capital ensures that a single adverse market move doesn’t jeopardize your financial stability.

3.3 Hedging: Mitigating Risks Proactively

Hedging, a time-honored risk management technique, involves offsetting a current market position with an opposing position. This strategic maneuver can effectively neutralize potential losses arising from unfavorable price movements in the underlying asset.

Section 4: Trends and Developments in Forex and CFD Trading

The ever-evolving landscape of financial markets demands that traders stay abreast of the latest trends and developments in forex and CFD trading.

4.1 Rise of Algorithmic Trading

Algorithmic trading, the automation of trading strategies through sophisticated algorithms, is rapidly transforming the financial industry. These algorithms analyze market data, execute trades, and monitor market conditions with lightning-fast speed and precision.

4.2 Mobile Trading: Trading at Your Fingertips

Technological advancements have revolutionized the way traders access the markets. Mobile trading platforms empower traders to monitor and execute trades from the convenience of their smartphones or tablets, regardless of their location.

4.3 Social Trading: A Collaborative Approach

Social trading platforms have emerged as vibrant online communities, where traders can connect, share insights, and learn from one another. These platforms offer opportunities for collaboration and knowledge exchange, empowering both novice and experienced traders.

Forex And Cfd Trading

Conclusion

The realm of forex and CFD trading offers a captivating blend of potential financial rewards and inherent risks. By arming yourself with the knowledge and skills outlined in this comprehensive guide, you can confidently navigate these dynamic markets and pursue your financial goals.

Remember, successful trading in forex and CFDs is an ongoing journey that requires diligent learning, disciplined risk