Unlocking the Potential of Forex Trading as Proof of Funds

The financial world is constantly evolving, and proof of funds (POF) requirements are no exception. In this digital age, traders seek innovative ways to demonstrate their financial capabilities, and forex trading has emerged as a viable option. Forex, or foreign exchange trading, involves buying and selling different currencies to capitalize on exchange rate fluctuations. With its potential for substantial returns, forex trading has gained immense popularity among those looking for alternative investment opportunities. This article explores the intricacies of using forex money as proof of funds, examining its advantages, limitations, and potential risks to guide your informed decision-making.

Image: forexpropreviews.com

Forex Money as Proof of Funds: An Overview

Proof of funds is a crucial document often requested by banks, lenders, and immigration authorities to verify an individual’s financial stability or to meet a specific financial threshold. Traditionally, individuals have relied on traditional assets such as bank statements, pay stubs, or investment portfolios as POF. However, with the advent of online trading and the accessibility of forex platforms, traders now have the option of leveraging forex trading profits as proof of their financial means.

Essential Considerations for Using Forex Money as POF

While using forex money as POF offers various benefits, it’s imperative to proceed with caution and navigate potential drawbacks. Here are key factors to consider:

-

Volatility and Risk Management:

Forex trading involves inherent risk due to currency market fluctuations. The value of currency pairs can fluctuate rapidly, potentially resulting in substantial losses. Therefore, it’s vital to engage in responsible trading practices, employing risk management strategies like stop-loss orders and position sizing to mitigate potential losses.

-

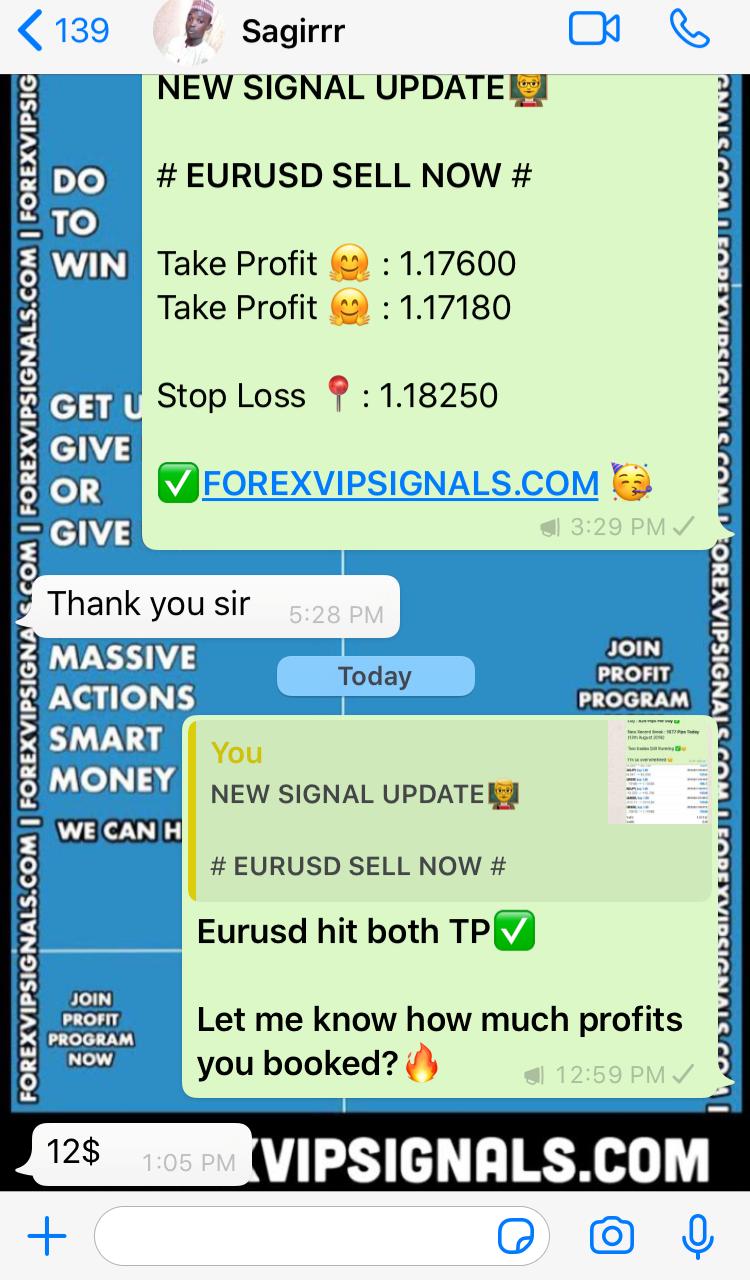

Image: www.forexvipsignals.comTax Implications:

Forex trading profits are subject to taxation in many jurisdictions. Depending on the tax regulations of your country, forex trading profits may be classified as capital gains or income, incurring varying tax liabilities. It’s essential to consult with a qualified tax advisor to ensure compliance with all applicable tax laws and avoid any legal implications.

-

Choosing a Reputable Broker:

Selecting a trustworthy and regulated forex broker is paramount. A reputable broker will provide a secure trading environment, transparent execution, and customer support. Conduct thorough research, read online reviews, and consider the broker’s regulatory status to minimize the risks associated with forex trading.

-

Documenting Your Trades:

When using forex money as POF, it’s essential to maintain meticulous records of your trades. Trading platforms typically provide account statements that can serve as documentary proof of your trading activity. These records should include details such as trade dates, currency pairs traded, positions taken, and profits or losses incurred.

Tips and Expert Advice for Successful Forex Trading

-

Develop a Solid Trading Plan:

A well-defined trading plan is the cornerstone of successful forex trading. It outlines your trading strategy, risk management measures, and trading objectives. By sticking to your plan, you can maintain discipline and avoid impulsive decision-making that could lead to losses.

-

Continuous Education and Research:

The forex market is dynamic, and staying updated with market trends and economic developments is crucial. Dedicate time to ongoing education, read market news and analysis, and attend webinars or workshops to enhance your knowledge and sharpen your trading skills.

Frequently Asked Questions on Forex Trading as POF

-

Q: Is it acceptable to use forex trading profits as proof of funds for a mortgage application?

A: While forex trading profits can potentially be used as POF, it’s crucial to note that different mortgage lenders have varying requirements. It’s advisable to contact your mortgage lender directly to inquire about their specific guidelines and documentation requirements.

-

Q: How much forex trading profit do I need to show as POF?

A: The amount of forex trading profit required as POF depends on the specific entity or institution requesting such documentation. It’s recommended to check with the relevant organization to determine their minimum POF requirements.

-

Q: What are the tax implications of using forex trading profits as POF?

A: The tax implications of using forex trading profits as POF can vary depending on your jurisdiction. Forex trading profits are generally subject to income tax or capital gains tax, and it’s essential to consult with a qualified tax advisor to fully understand your tax obligations.

Can I Show Forex Money As Pof

Conclusion

Forex trading presents both opportunities and challenges for those considering using it as proof of funds. By embracing responsible trading practices, choosing a reputable broker, and maintaining meticulous documentation, traders can leverage forex profits as a viable POF option. Remember, understanding the intricacies of forex trading and adhering to established guidelines are fundamental to navigating the market successfully.

Are you interested in exploring the exciting world of forex trading and its potential as a means of providing proof of funds?