Forex trading, the buying and selling of currencies on the foreign exchange market, is a highly lucrative but risky endeavor. While the potential for gains is substantial, so too is the possibility of significant losses. One of the most alarming concerns for forex traders is the potential to lose more than their initial investment. In this comprehensive article, we will delve into the intricacies of forex trading and explore whether it is possible to incur losses exceeding your initial capital.

Image: edu.sina.com.cn

At the outset, it’s crucial to understand that forex trading involves the exchange of currency pairs, such as EUR/USD or GBP/JPY. When you open a forex trade, you are essentially speculating on the future value of one currency against another. If your prediction is correct, you can profit from the exchange rate fluctuations. However, if your prediction is incorrect, you can incur losses proportional to the difference in exchange rates.

Leverage: The Double-Edged Sword

One of the unique aspects of forex trading is the use of leverage. Leverage allows traders to amplify their profits and losses by borrowing funds from their broker. While leverage can magnify profits, it also has the potential to magnify losses. In the event of an adverse market movement, traders can lose more than their initial investment. This is because the borrowed funds are added to their trading account, essentially increasing their potential exposure to risk.

Unforeseen Market Fluctuations

The forex market is notoriously volatile, and prices can fluctuate rapidly due to a myriad of economic, political, and social factors. While most traders engage in thorough market analysis and risk management practices, it is impossible to predict all market movements with absolute certainty. Unforeseen events, such as political turmoil, central bank policy changes, or natural disasters, can trigger significant market volatility, leading to substantial losses for traders who fail to adapt or close their positions in time.

Trading Errors and Flaws

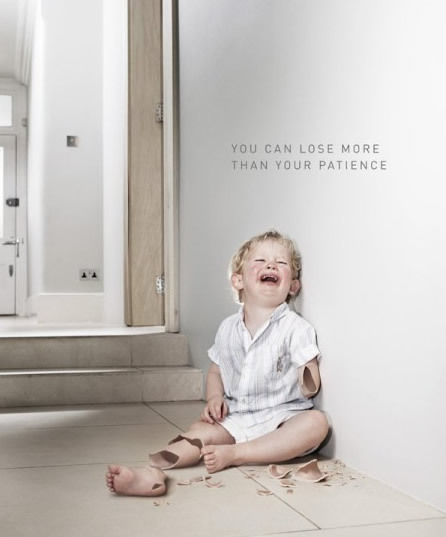

Even experienced forex traders are susceptible to making mistakes. Human error, such as misinterpreting market signals, executing trades with incorrect parameters, or failing to manage risk effectively, can contribute to substantial losses. Moreover, psychological flaws, such as trading in an emotional state or chasing losses, can cloud traders’ judgment and lead to poor decision-making.

Image: www.evilforex.com

Lack of Discipline

Forex trading requires a high level of discipline, both in terms of risk management and adherence to a trading plan. Traders who lack discipline may overtrade, leverage their accounts excessively, or fail to cut their losses, all of which can lead to significant financial setbacks.

Educate Yourself and Manage Risk

The key to minimizing the risk of losing more than your initial investment in forex is through meticulous education and robust risk management. Ascertain that you have a thorough understanding of forex trading, its inherent risks, and how to develop and execute a sound trading plan. Additionally, employ strict risk management techniques, such as setting stop-loss orders, limiting leverage, and maintaining a positive risk-to-reward ratio.

Can You Lose More Than Your Initial Investment In Forex

Conclusion

While it is possible to lose more than your initial investment in forex, it should not be the norm. By understanding the risks involved, employing appropriate risk management strategies, and continuously educating yourself, you can mitigate the potential for significant losses and enhance your chances of success in the dynamic world of forex trading.