Introduction

Have you, as a Canadian Indian resident, ever wondered if you could take advantage of the global financial markets by trading foreign exchange (forex)? Forex, the largest and most liquid financial market in the world, presents a compelling opportunity for savvy individuals to capitalize on currency fluctuations and potentially generate profit.

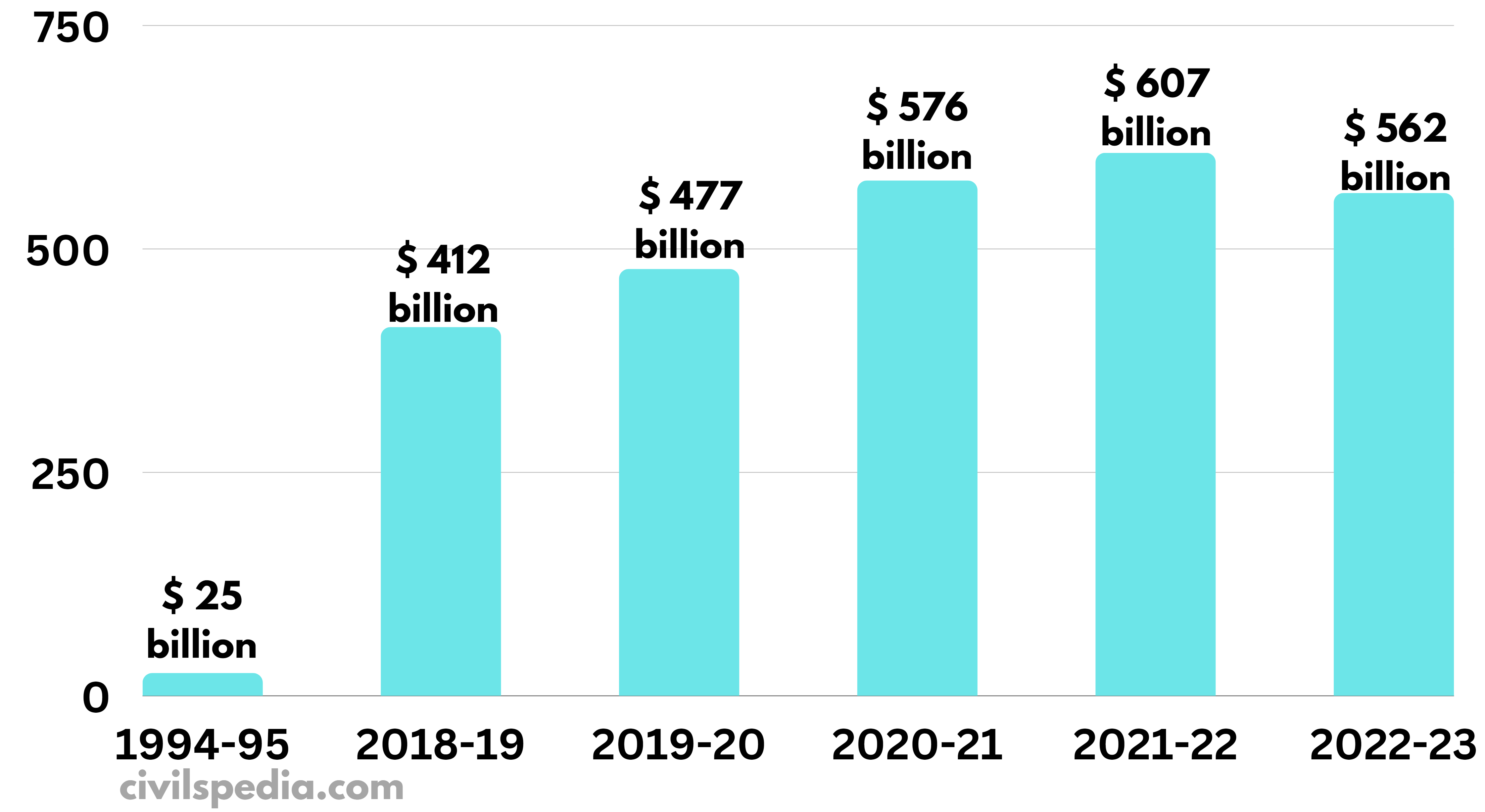

Image: civilspedia.com

This article will provide you with a comprehensive overview of forex trading for Canadian Indian residents in the USA. We will explore the basics of forex, its legal and regulatory landscape in the US, and the practical steps you can take to start trading. By the end of this article, you will be equipped with the knowledge and resources to make informed decisions about forex trading.

Understanding Forex Trading

Forex trading involves the exchange of currencies between two parties. Participants buy or sell currencies in pairs, such as the US dollar (USD) and the Canadian dollar (CAD). The value of each currency pair fluctuates constantly, influenced by various economic and geopolitical factors.

Traders aim to profit from these fluctuations by buying currencies when their value is low and selling them when it rises. They can do this either by trading directly on the spot market or through financial intermediaries like brokers.

Forex Trading in the USA for Canadian Indian Residents

As a Canadian Indian resident living in the USA, you have the right to trade forex under certain conditions. The Commodity Futures Trading Commission (CFTC) regulates forex trading in the US, and it requires all participants to register with a Futures Commission Merchant (FCM) to trade legally.

It’s crucial to note that not all FCMs are created equal. Some cater primarily to US citizens, while others offer services to non-US residents. It is your responsibility to choose an FCM that is authorized to offer forex trading services to Canadian Indian residents.

Choosing a Reputable Forex Broker

Selecting a reputable forex broker is vital to your success as a trader. Consider the following factors when making your choice:

- Regulatory compliance: Ensure that the broker is registered with the CFTC and follows all applicable laws.

- Platform and technology: Choose a broker with a user-friendly platform and reliable execution technology.

- Fees and spreads: Compare the fees and bid-ask spreads offered by different brokers to find the most competitive deals.

- Customer support: Check the broker’s reputation for providing responsive and informative customer support.

Image: www.zeebiz.com

Getting Started with Forex Trading

Once you have selected a broker, you can start your forex trading journey:

- Open a trading account: Provide the broker with your personal and financial information and fund your account.

- Learn the platform: Familiarize yourself with the broker’s trading platform to execute trades effectively.

- Develop a trading strategy: Research different trading strategies and choose one that suits your risk tolerance and market understanding.

- Execute trades: Analyze market trends and place trades accordingly, managing your risk and following your trading strategy.

Canan Indian Resident Trade In Forex Usa

Conclusion

Becoming a successful forex trader requires knowledge, discipline, and practice. Canadian Indian residents in the USA have the opportunity to join the global forex market, but they must carefully navigate the legal and regulatory landscape. By understanding the basics of forex trading, choosing a reputable broker, and developing a solid trading strategy, you can unlock the potential of currency markets while mitigating risks.

Remember that forex trading involves inherent risks. It is essential to thoroughly research and understand the risks involved before putting your capital at risk. Always seek professional advice from a qualified financial advisor if necessary.