Unlocking Optimal Trade Exits with CCI Forex EA MQL Code: A Comprehensive Guide for Informed Decisions

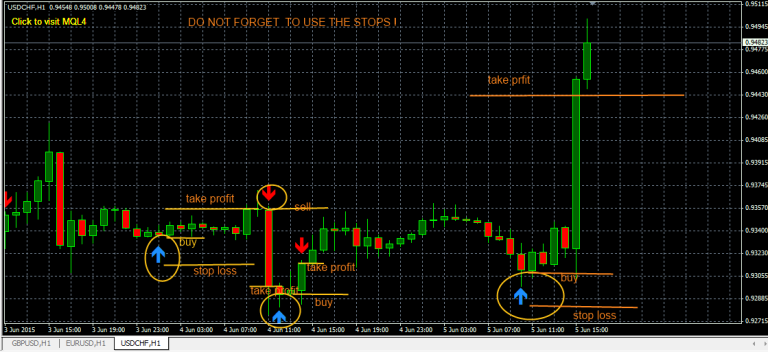

Image: www.fxcracked.com

Introduction:

In the ever-dynamic realm of forex trading, precise entry and exit strategies hold paramount importance. The Commodity Channel Index (CCI) Forex Expert Advisor (EA) offers an invaluable asset in this pursuit, empowering traders with its advanced algorithms and customizable parameters. Understanding the closing conditions embedded within the CCI Forex EA’s MQL code is crucial for maximizing its efficacy and achieving consistent profitability.

Exploring CCI Forex EA MQL Code Closing Conditions:

The CCI Forex EA MQL code employs various closing conditions to determine the most opportune moments to exit trades, ensuring optimal returns and risk management. These conditions are designed to detect specific market movements and technical indicators that signal a shift in trend or a potential reversal.

1. CCI Crossovers:

One of the primary closing conditions employed by the CCI Forex EA MQL code is the CCI crossover. This condition monitors the CCI’s movement relative to a predetermined threshold value. When the CCI crosses above or below this threshold, it triggers a signal for a trade exit.

2. Moving Average Convergence Divergence (MACD):

Another commonly utilized closing condition is based on the MACD indicator. The MACD compares two exponential moving averages (EMAs) to identify trend changes. The CCI Forex EA MQL code can be configured to exit a trade when the MACD crosses above or below its signal line, signaling a potential reversal.

3. Parabolic Stop and Reverse (SAR):

The Parabolic SAR is a trailing stop indicator that marks potential reversal points in a trend. The CCI Forex EA MQL code can incorporate this indicator to exit trades when the price crosses below the SAR, indicating a possible trend change.

4. Time-Based Exits:

Time-based exits are another closing condition available in the CCI Forex EA MQL code. This condition sets a predefined time limit for each trade, ensuring that positions are automatically closed after a specified period, regardless of market conditions.

5. Custom Script Indicators:

Advanced users may also develop and integrate their own custom script indicators into the CCI Forex EA MQL code. These indicators can monitor complex market conditions and provide signals for exiting trades based on specific criteria.

Expert Insights and Actionable Tips:

1. Optimize Parameters for Specific Market Conditions:

The parameters associated with each closing condition in the CCI Forex EA MQL code can be fine-tuned to optimize performance under different market conditions. Backtesting and thorough optimization are crucial to determine the best settings for varying market scenarios.

2. Combine Multiple Closing Conditions:

Combining multiple closing conditions within the CCI Forex EA MQL code enhances reliability by requiring multiple signals for a trade exit. This approach provides an additional layer of confirmation and reduces the risk of false exits.

3. Prioritize the Risk-Reward Ratio:

The risk-reward ratio is a key consideration when determining trade exits. The CCI Forex EA MQL code can be customized to prioritize either profit maximization or risk minimization, ensuring alignment with individual risk tolerance and trading objectives.

Image: www.usmart.sg

Cci Forex Ea Mql Code Closing Conditons

Conclusion:

Mastering the closing conditions embedded within the CCI Forex EA MQL code is a fundamental skill for successful forex trading. By leveraging these conditions, traders can automate their exit strategies, enhance their decision-making process, and significantly improve their profitability. With the knowledge gained through this comprehensive guide, traders can confidently navigate market fluctuations and seize optimal trade exits to maximize their financial gains.