Are you baffled by the dizzying array of foreign exchange (forex) rates offered by different banks? As a seasoned globetrotter, I understand the frustration of searching for the best deal. In this article, we will delve into the world of forex rates, empowering you with the knowledge to make informed decisions and save a bundle on your currency exchanges.

Image: www.facebook.com

Navigating the forex market requires a keen eye for the nuances. Banks offer varying rates based on their own policies, operating costs, and market conditions. It’s not uncommon to find a significant spread between the highest and lowest rates available, which can translate into substantial savings or losses.

Factors Influencing Forex Rates

To grasp the complexities of forex rates, it’s crucial to comprehend the underlying factors that shape them. These include:

- Economic and political conditions: Global events, economic growth, and political stability can significantly impact currency values.

- Interest rates: Central banks’ interest rate decisions can influence the attractiveness of their respective currencies.

- Supply and demand: The exchange of goods and services between countries creates demand for different currencies.

- Currency pegging: Some countries fix their currency to a stronger currency (e.g., the US dollar) to stabilize their economy.

Unveiling the Secrets of Bank Forex Rates

Banks use a variety of methods to determine their forex rates. One common approach involves setting a “spread” around the mid-market rate, which is the rate at which banks trade currencies with each other. The spread is essentially the bank’s commission or profit margin. Additionally, banks may incorporate other factors into their rates, such as the cost of funding, regulatory compliance, and risk management.

Understanding these factors can equip you with the knowledge to select a bank that offers competitive rates and minimizes hidden fees. It’s worth noting that the forex market is highly volatile, and rates can fluctuate rapidly. Therefore, it’s advisable to keep a close eye on market trends and compare rates from multiple banks before making a decision.

Maximizing Your Currency Conversions

There are several strategies you can employ to optimize your forex conversions:

- Compare rates from multiple banks using an online currency converter.

- Negotiate with your bank for a better rate.

- Avoid using your credit card for large international transactions due to higher fees and exchange rate markups.

- Consider opening a multi-currency account to minimize conversion fees.

- Stay informed about market trends and anticipated currency fluctuations.

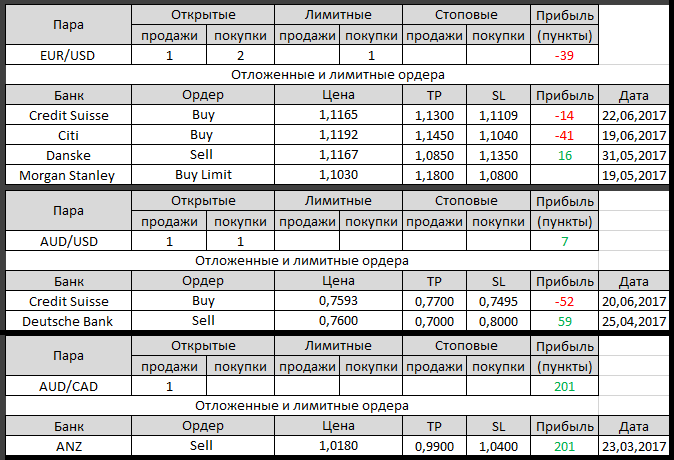

Image: forex-1.info

Frequently Asked Questions on Forex Rates

Q: How often do banks update their forex rates?

A: The forex market operates continuously, 24 hours a day, 5 days a week. Banks update their rates throughout the day based on changing market conditions.

Q: Is it possible to predict forex rates accurately?

A: Predicting forex rates with absolute certainty is virtually impossible due to the myriad of factors that influence them. However, by monitoring market trends and staying informed about economic and political developments, you can make educated estimates about future movements.

Empowering Yourself with Expert Advice

To enhance your currency exchange savvy, seek advice from financial experts or seasoned travelers who have mastered the art of navigating the forex market. They can provide valuable insights, share practical tips, and help you stay ahead of the curve.

By following the strategies outlined above, you can become an informed consumer in the world of forex. With patience, research, and a willingness to learn, you can maximize your currency exchanges and save a significant amount of money on your international adventures.

Compare Forex Rates Of Banks

Are You Ready to Embrace the Forex Market?

Now that you’re armed with this comprehensive guide, the forex market is no longer a mysterious enigma. Embark on your next currency exchange with confidence, knowing that you have the tools to make the most informed decisions. Remember, knowledge is power when it comes to navigating the complexities of the forex market.