The Pivotal Pulse of Inflation: Core CPI Unraveled

The tapestry of a nation’s economic well-being is intricately woven with threads of inflation, and in Canada, the Core Consumer Price Index (CPI) stands as a crucial gauge. Stripped of volatile food and energy components, this indicator paints a clearer picture of the underlying inflationary pressures at play. Its significance extends beyond its snapshot of the past, as it also holds sway over the future trajectory of the Canadian dollar and the financial decisions you make.

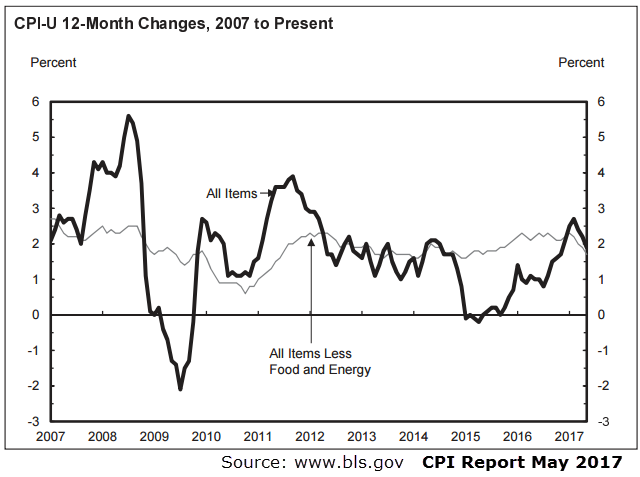

Image: the5ers.com

A Weakened Currency: The Domino Effect of Rising Core CPI

Imagine a teetering tower of blocks, each representing a factor in currency valuation. When core CPI surges, it triggers a cascading effect. The Bank of Canada, charged with keeping inflation in check, is likely to raise interest rates to cool the economy and curb price increases. This move, while necessary, exerts a downward force on the Canadian dollar.

Investors, like moths drawn to a flame, seek currencies with higher interest rates, attracted by the promise of better returns. This exodus of capital weakens the loonie, making Canadian goods and services more expensive for foreign buyers and potentially inflating your travel and import costs.

Inflation’s Bite: The Impact on Your Purchasing Power

The ramifications of core CPI extend beyond foreign exchange markets, reaching deep into the pockets of Canadians. As inflation erodes the purchasing power of currency, it can make groceries, gas, and everyday items more expensive. This insidious squeeze impacts household budgets, reducing the value of savings and forcing consumers to make tough financial choices.

A Compass for Forex Traders: Navigating the Core CPI’s Impact

Forex traders, ever vigilant for market signals, closely monitor core CPI data. A spike in core CPI often triggers a selloff of the Canadian dollar, as traders anticipate a Bank of Canada rate hike and the currency’s subsequent weakness. Conversely, a subdued core CPI reading can bolster the loonie, as it suggests inflation is under control and rate increases are less likely.

Image: forextraininggroup.com

The Prudent Path: Hedging Against Currency Fluctuations

If you’re planning an overseas vacation or expecting to receive foreign income, understanding core CPI’s influence on currency markets is essential. Consider hedging strategies to mitigate the risks associated with a weakening Canadian dollar. Forex contracts, for instance, allow you to lock in exchange rates, protecting your finances from unfavorable fluctuations.

Core Cpi Canada Forex Effect

Harnessing the Power of Knowledge: Making Informed Decisions

The Core Consumer Price Index is not a mere economic barometer; it’s a vital guide for navigating the complexities of currency markets and safeguarding your financial well-being. By staying abreast of core CPI data and its ripple effects, you can make informed decisions that cushion you from potential financial headwinds and empower you to reap the benefits of a stable and prosperous economy.