In the dynamic world of forex trading, understanding currency correlations is paramount for making informed decisions that maximize profit potential and mitigate risk. Just as understanding the ebbs and flows of the ocean is crucial for sailors, grasping correlations in forex is vital for traders seeking to navigate the ever-shifting currents of the financial markets.

Image: forexretro.blogspot.com

Picture this: you’re a novice trader, embarking on a journey into the realm of forex. As you dive into the world of currency pairs, you realize the importance of grasping their correlations to optimize your trades. That’s where this comprehensive guide comes in – a detailed roadmap to help you unlock the secrets of correlation and become a savvy trader.

What is a Correlation Chart for Forex Pairs?

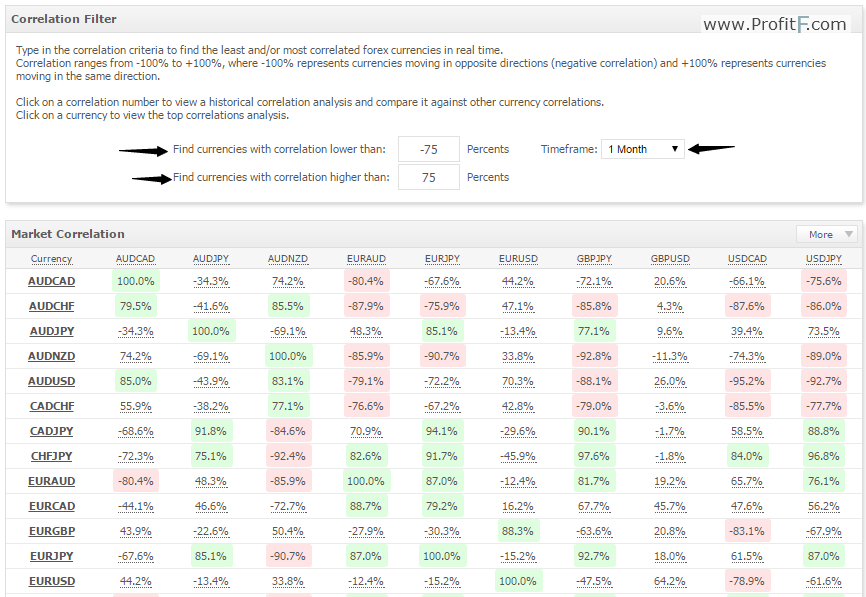

A correlation chart is a graphical representation that showcases the relationship between the movements of two or more currency pairs. It helps traders gauge how one pair’s price fluctuations affect another, providing valuable insights into potential trading opportunities and risk management strategies.

In the forex market, correlations can be positive, negative, or zero. A positive correlation indicates that the two pairs move in the same direction – when one rises, the other tends to rise as well. Conversely, a negative correlation implies that the pairs move in opposite directions – as one goes up, the other typically goes down. Zero correlation means there is no discernible relationship between their price movements.

Benefits of Using a Correlation Chart

Harnessing the power of a correlation chart for forex pairs offers numerous benefits:

- Informed Trading Decisions: Understanding correlations allows traders to make more informed trading decisions, as they can anticipate how currency movements might affect other pairs in their portfolio. This foresight empowers traders to identify potential opportunities and minimize risks.

- Diversification Strategy: Correlation charts aid in portfolio diversification, which is crucial for risk management. By selecting pairs with low or negative correlations, traders can spread their investments across assets that react differently to market fluctuations, thereby reducing overall risk exposure.

- Hedging Strategies: Forex correlation charts play a pivotal role in hedging strategies. By identifying currency pairs with opposite correlations, traders can hedge their positions, safeguarding their portfolios against losses stemming from adverse market conditions.

- Identifying Trends: Correlation charts help traders identify trends in the forex market. By observing the historical correlations between pairs, traders can anticipate potential price movements and discern trading opportunities.

Deciphering Correlation Charts: A Step-by-Step Guide

Navigating correlation charts for forex pairs is relatively straightforward. Here’s a step-by-step guide to effectively interpret the data:

- Locate the Chart: Various financial data platforms and forex brokers provide correlation charts. Find a reliable source that offers up-to-date and comprehensive charts.

- Identify the Currency Pairs: Each row and column of the chart represents a different currency pair. Ensure you familiarize yourself with the abbreviations used to represent the pairs.

- Read the Correlations: The correlation values range from -1 to +1. A value close to +1 indicates a strong positive correlation, while a value near -1 signifies a strong negative correlation. Zero indicates no correlation.

- Consider Historical Data: Analyze the correlation over different time frames – daily, weekly, or monthly – to gain insights into the stability and consistency of the relationship between the pairs.

Image: idonayojujid.web.fc2.com

Expert Insights and Actionable Tips for Using Correlation Charts

Harnessing the full potential of correlation charts requires both understanding and practical application. Here are some expert insights and actionable tips:

- Look Beyond the Obvious: Consider correlations among less commonly traded pairs as they may provide unique trading opportunities and insights.

- Don’t Rely Solely on Correlations: While correlations offer valuable information, they should not be the sole basis for trading decisions. Incorporate other technical analysis tools and market research for a comprehensive assessment.

- Monitor Correlations Regularly: Currency correlations are dynamic and can change over time. Consistently monitor correlation charts to stay abreast of shifting market dynamics.

- Consider Cross-Currency Correlations: Analyze correlations not just between individual pairs but also between pairs sharing a common currency. This can provide insights into the overall market sentiment and potential trading opportunities.

Correlation Chart For All Forex Pairs

Conclusion

Understanding correlation charts for forex pairs is an invaluable asset for both novice and experienced traders. By leveraging this knowledge, traders can make informed decisions, implement effective diversification strategies, and safeguard their portfolios against potential risks. Remember, the world of forex trading is ever-changing, so continuous learning and adaptation are essential. By embracing the insights and tips outlined in this guide, you can navigate the choppy waters of the financial markets with increased confidence and achieve your trading goals.