Unveiling the Importance of an MIS Reporting System

In the ever-evolving forex broking industry, having an efficient Management Information System (MIS) reporting system is crucial for success. An MIS provides real-time insights into key business metrics, enabling brokers to make informed decisions, optimize operations, and stay ahead of the competition.

Image: bestforexscalpingcourse1.blogspot.com

An effective MIS reporting system offers a comprehensive view of the brokerage’s performance. It aggregates data from various departments, including trading, sales, finance, and operations, providing a holistic understanding of the business. This allows brokers to identify areas for improvement, set targets, and monitor progress in real-time.

Defining and Understanding an MIS Reporting System

An MIS reporting system is a software tool that serves as a centralized platform for collecting, processing, and analyzing data from across an organization. It combines data from multiple sources, such as trading platforms, CRM systems, accounting software, and other internal systems.

The system utilizes this data to generate reports and dashboards that provide a real-time snapshot of the brokerage’s performance. These reports can include trading volumes, client activity, revenue and expense analysis, compliance metrics, and other key indicators.

Key Considerations for Implementing an MIS Reporting System

Implementing an MIS reporting system is a strategic initiative that requires careful planning and execution. Here are key considerations to ensure a successful implementation:

- Data Integration: The system should seamlessly integrate with existing systems to ensure data accuracy and consistency.

- Data Security: Measures must be in place to protect sensitive data, including client information and financial transactions.

- Flexibility and Scalability: The system should be adaptable to evolving business needs and capable of handling future growth.

- Usability and Accessibility: The system should be user-friendly and accessible to stakeholders across the organization.

Tips and Expert Advice for Creating an Effective MIS Reporting System

To ensure your MIS reporting system meets the specific needs of your brokerage, consider these expert tips:

- Define Clear Objectives: Determine the specific goals you want to achieve with the system.

- Identify Key Performance Indicators (KPIs): Select metrics that accurately reflect your brokerage’s performance and goals.

- Collaborate with Stakeholders: Involve all relevant departments in the implementation process to ensure buy-in and effective utilization.

- Use Visualization Tools: Make data easy to interpret by using charts, graphs, and dashboards.

- Monitor and Adjust: Regularly review report findings and make adjustments to the system as needed.

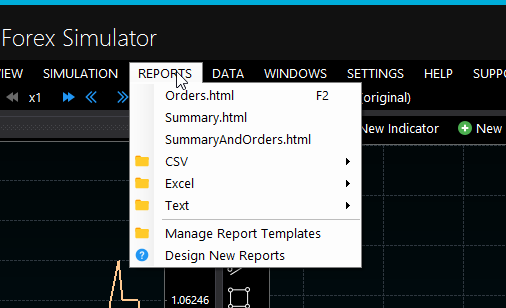

Image: forexsimulator.com

FAQs about MIS Reporting Systems for Forex Brokerages

- Q: What are some of the benefits of an MIS reporting system?

A: Improved decision-making, better risk management, increased operational efficiency, and enhanced compliance.

- Q: What features should I look for in an MIS reporting system?

A: Data integration capabilities, customizable reports, real-time dashboards, and support for multiple currencies and languages.

- Q: Can an MIS reporting system reduce the risk of compliance issues?

A: Yes, by providing centralized access to compliance-related data, monitoring key metrics, and generating reports that meet regulatory requirements.

Creating An Mis Reporting System For A Forex Broking Co

Conclusion

An effective Management Information System reporting system is an essential tool for forex brokers to stay ahead in the competitive market. By implementing a system that meets the specific needs of your brokerage, you can gain valuable insights into your operations, improve decision-making, and drive success.

Embrace the benefits of an MIS reporting system and enhance your brokerage’s performance and competitiveness. Are you ready to unlock the power of data and revolutionize your forex broking operations?