Harness the Power of Price Action with the Crude Trap

Navigating the volatile world of forex trading can be a daunting task. But with the right strategy and technical analysis, you can identify profitable opportunities and make informed trading decisions. Enter the Crude Trap strategy, a potent technical analysis tool that empowers you to pinpoint potential trend reversals and capitalize on price movements on the MetaTrader 4 (MT4) platform.

Image: www.forexcracked.com

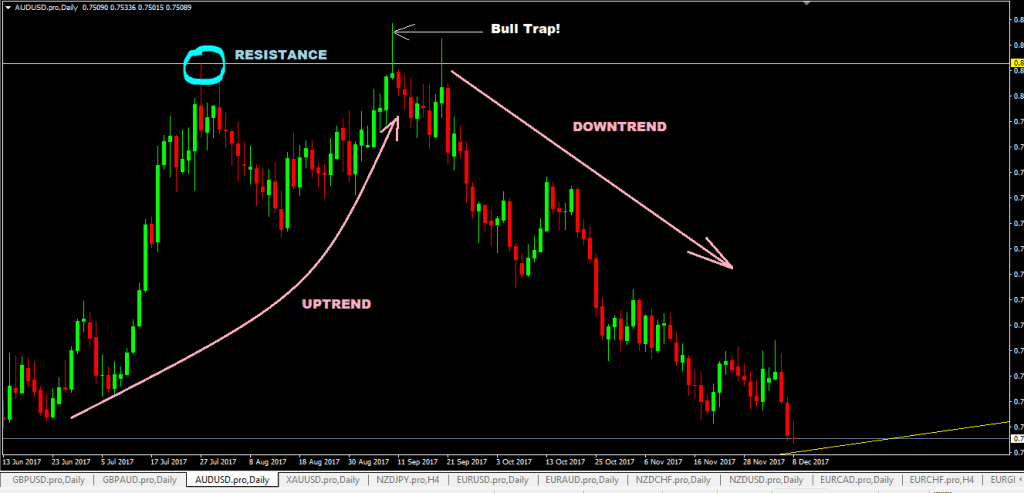

The Crude Trap strategy utilizes a combination of candlestick patterns and technical indicators to identify price action patterns that often precede trend reversals. By implementing this strategy on the MT4 platform, you gain access to a powerful suite of tools that enhance your chart analysis and trading execution.

Defining the Crude Trap

The Crude Trap strategy is predicated upon the principle of price action and the formation of specific candlestick patterns. A valid Crude Trap occurs when the following criteria are met:

- An uptrend: The market has been in an uptrend for a significant period.

- A down candle: A large red candle forms, signaling a potential reversal.

- A smaller green candle: A smaller green candle follows the down candle, indicating a corrective move.

- A breakout: If the price breaks below the low of the smaller green candle, it confirms the Crude Trap pattern.

The formation of a Crude Trap pattern suggests that the uptrend is losing momentum, increasing the probability of a trend reversal and a potential decline in price.

Identifying Trend Reversals with the Crude Trap

The Crude Trap strategy is particularly effective in identifying potential trend reversals. By utilizing the MT4 platform’s advanced charting tools, you can track price action in real-time and identify the formation of a Crude Trap pattern.

When a Crude Trap pattern forms, it provides a valuable signal that a trend reversal may be underway. By acting on these signals, you can adjust your trading positions accordingly, potentially capturing profitable opportunities and mitigating losses.

Trading the Crude Trap on MT4

Implementing the Crude Trap strategy on the MT4 platform involves a combination of technical analysis and risk management strategies. Here’s a step-by-step guide:

- Confirm the uptrend: Identify an existing uptrend using technical indicators like moving averages or trendlines.

- Monitor price action: Pay attention to the formation of candlestick patterns, particularly the down candle (large red candle) and the corrective green candle.

- Watch for the breakout: If the price breaks below the low of the corrective green candle, enter a short position.

- Set stop-loss and take-profit levels: Determine appropriate stop-loss and take-profit levels based on your risk tolerance and market conditions.

- Manage your risk: Implement proper risk management strategies to limit potential losses and protect your capital.

By adhering to these steps and leveraging the MT4 platform’s charting capabilities, you can effectively implement the Crude Trap strategy and enhance your trading performance.

Image: www.forexmt4indicators.com

Expert Tips for Enhancing Your Trading

Seasoned forex traders recommend the following tips to augment your Crude Trap strategy:

- Combine the Crude Trap with other technical indicators: Enhance the reliability of your signals by incorporating additional indicators like RSI or MACD.

- Pay attention to market volatility: Forex markets can exhibit periods of high volatility, which can affect the accuracy of the Crude Trap strategy.

- Use a paper trading account: Practice your trading strategies using a paper trading account before committing real capital.

FAQ: Unraveling the Crude Trap

Q: What is the success rate of the Crude Trap strategy?

A: The success rate depends on various factors, including market conditions, trader skill, and risk management practices.

Q: Can the Crude Trap strategy be used in all market conditions?

A: The Crude Trap strategy is most effective in trending markets. In choppy or range-bound markets, its accuracy may be diminished.

Q: What are the recommended timeframes for using the Crude Trap strategy?

A: The Crude Trap strategy can be applied to multiple timeframes, but higher timeframes (e.g., daily, weekly) often provide more reliable signals.

Crude-Trap-Forex-Trading-Strategy Mt4

Conclusion

Harnessing the power of the Crude Trap strategy on the MT4 platform empowers you with a valuable tool for analyzing price action and identifying potential trend reversals in the forex market. By applying the techniques outlined in this article and adhering to the expert tips provided, you can enhance your trading strategies and make more informed decisions. Embrace the power of technical analysis and unlock the potential for profitable forex trading.

Are you ready to elevate your forex trading game? Join the ranks of savvy traders who have adopted the Crude Trap strategy and reap the rewards of informed trading.