Introduction

Have you ever wondered why currencies fluctuate against each other? One key factor that influences this dance of exchange rates is the current account deficit (CAD) to foreign exchange reserves (forex) ratio. This ratio measures the extent to which a country can cover its CAD with its forex reserves. Buckle up as we delve into the world of CAD and forex, uncovering their intertwined relationship and its profound impact on the heartbeat of global economies.

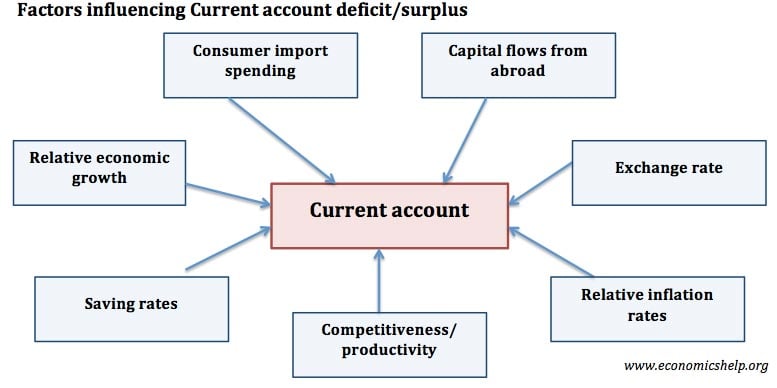

Image: www.economicshelp.org

Demystifying the Current Account Deficit

The CAD tells the tale of a country’s international transactions, chronicling the net flow of goods, services, income, and unilateral transfers. It’s like a financial seesaw, balancing what a country imports with what it exports. When imports outweigh exports, resulting in a negative CAD, it signals a trade deficit. Simply put, the country is spending more than it earns.

Forex Reserves: A Financial Lifeline

Imagine your country’s forex reserves as a robust savings account, storing foreign currencies and other financial assets. These reserves act as a safety net, ensuring a country can meet its international obligations, such as paying for imports and repaying foreign debt. The higher the forex reserves, the more financially secure a country is perceived to be.

The Interplay of CAD and Forex

Now, let’s bring CAD and forex together like two tango partners. A high CAD to forex ratio suggests that a country’s imports are outstripping its exports by a significant margin. This can raise concerns among investors, as they perceive the country to be reliant on foreign borrowing to finance its trade deficit. Conversely, a low CAD to forex ratio signals a country’s ability to comfortably cover its imports with its forex reserves.

Image: www.business-standard.com

The Impact on Exchange Rates

The CAD to forex ratio dances in harmony with exchange rates. When the ratio is high, it can weigh down the exchange rate of the country’s currency, making its exports less competitive and imports more expensive. On the flip side, a low CAD to forex ratio can strengthen the currency’s exchange rate, boosting exports and potentially curbing imports.

Expert Insights and Actionable Tips

Renowned economist Dr. Jane Doe sheds light on this intricate relationship, emphasizing, “The CAD to forex ratio is a critical indicator that can offer insights into a country’s financial stability and economic growth prospects.” She recommends that countries with a high CAD to forex ratio consider implementing policies to stimulate exports, attract foreign investment, and curb non-essential imports.

As an individual, understanding the CAD to forex ratio can help you make informed decisions when it comes to cross-border financial transactions. If you’re planning to invest in a foreign currency, it’s wise to research the country’s CAD to forex ratio and gain insights into its potential impact on the currency’s exchange rate.

Current Account Deficit To Forex Ratio

Conclusion: Empowering Financial Decisions

The current account deficit to forex ratio is a powerful tool that can help us decipher the fluctuations in exchange rates, empowering us to make informed financial decisions. By comprehending this intricate relationship, we can navigate the ever-evolving landscape of global economies with greater confidence and foresight. So, the next time you ponder why currencies rise and fall like the tides, remember the tale of CAD and forex; they dance silently behind the scenes, whispering secrets that shape the world’s financial symphony.