Introduction

In 2016, India embarked on a bold monetary experiment with the demonetisation of high-value currency notes. This unprecedented move, aimed at combating corruption and black money, had a profound impact on the country’s financial landscape. Coinciding with this transformative event was the rising prominence of forex trading in India, opening up new avenues for investors and pushing the boundaries of international financial markets. In this comprehensive article, we will delve into the intricacies of demonetisation and forex in India, highlighting their interdependence, challenges, and the transformative effects they have wrought.

Image: www.affordablehomesgurgaon.in

Demonetisation: A Pivotal Moment

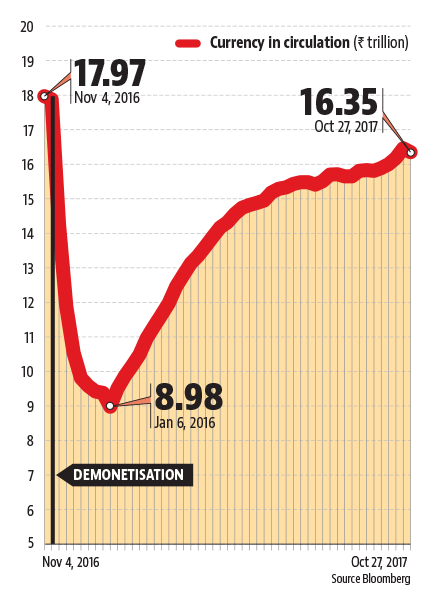

Demonetisation refers to the abrupt discontinuation of existing high-value currency notes, rendering them void in a short span. India’s demonetisation initiative, announced on November 8, 2016, targeted the ₹500 and ₹1,000 notes, which constituted over 86% of the country’s currency in circulation. The rationale behind this radical step was multifaceted: to curb corruption and the illicit accumulation of wealth, to disrupt the financing of terrorist and unlawful activities, and to encourage the adoption of digital payment methods.

Forex: The Global Financial Market

Forex, an acronym for foreign exchange, represents the vast international market where currencies are traded. It is the world’s most liquid financial market, with daily trading volumes exceeding trillions of dollars. In recent years, forex trading has gained immense popularity in India, spurred by technological advancements, access to trading platforms, and the promise of potentially lucrative returns.

Interdependence of Demonetisation and Forex

The demonetisation exercise and the ensuing rise of forex trading are inextricably linked. Demonetisation led to a sudden influx of unaccounted-for currency into banks, amounting to an estimated 99% of the targeted notes. This massive inflow created a scenario where funds were transferred from the informal economy to the formal banking system, boosting the supply of base money and strengthening India’s banking infrastructure.

Concurrently, the demonetisation move stirred up significant interest in alternative investment avenues, particularly those offering foreign exposure. The need to convert vast sums of old currency into liquid assets, coupled with the dip in interest rates on domestic deposits, steered investors towards forex. This surge in forex trading activity brought a liquidity boost to the market and amplified the awareness of global financial instruments among Indian investors.

Image: www.hindustantimes.com

Challenges and Opportunities

While demonetisation and forex have opened up new frontiers in India’s financial ecosystem, they have not been without their challenges. Post-demonetisation, India witnessed a temporary disruption in economic activities, especially in sectors reliant on cash transactions. Similarly, the influx of novice traders into the forex market posed risks due to their inexperience and the potential for misadventures.

However, these challenges were quickly overshadowed by the transformative opportunities these measures unveiled. Demonetisation has played a pivotal role in promoting financial inclusion, expanding digital payments, and strengthening the taxation base. The growth of forex trading has enabled Indian investors to diversify their portfolios, hedge against currency fluctuations, and access global investment opportunities.

Embracing a Digital Future

The confluence of demonetisation and the rise of forex in India has accelerated the country’s transition toward a less cash-dependent society and a more globalized financial outlook. Digital wallets, mobile banking, and e-commerce platforms have witnessed exponential adoption, facilitating seamless transactions and promoting financial inclusion.

In the forex market, the emergence of online trading platforms and mobile apps has lowered the entry barriers for aspiring traders, allowing them to access real-time market information and execute trades with a few clicks. However, it is crucial for traders to approach forex with caution, understanding the associated risks and seeking guidance from experienced professionals.

Demonetisation And Forex In India

Conclusion

India’s demonetisation exercise and the subsequent surge in forex trading have been game-changers in the country’s monetary landscape. Demonetisation has fueled the digitization of payments and strengthened India’s financial infrastructure, while the growth of forex has opened up new investment avenues and fostered a more globalized financial environment. As technology continues to disrupt the financial industry, the interrelationship between these two phenomena will undoubtedly shape India’s monetary future, leading to advancements in financial inclusion, innovation, and growth.