Introduction

Image: www.youtube.com

In the realm of global finance, foreign exchange rates (forex rates) play a pivotal role in facilitating international trade and investment. These rates determine the relative value of currencies, enabling cross-border transactions and capital flows. Forex rates are constantly fluctuating, influenced by a myriad of economic, political, and market forces. Understanding the factors that drive these fluctuations is crucial for businesses, investors, and individuals alike. In this comprehensive article, we delve into the intricacies of forex rate determination under a flexible market system, exploring the dynamic forces that shape these rates and the implications for global economic activity.

Basics of Forex Rates and Flexible Market

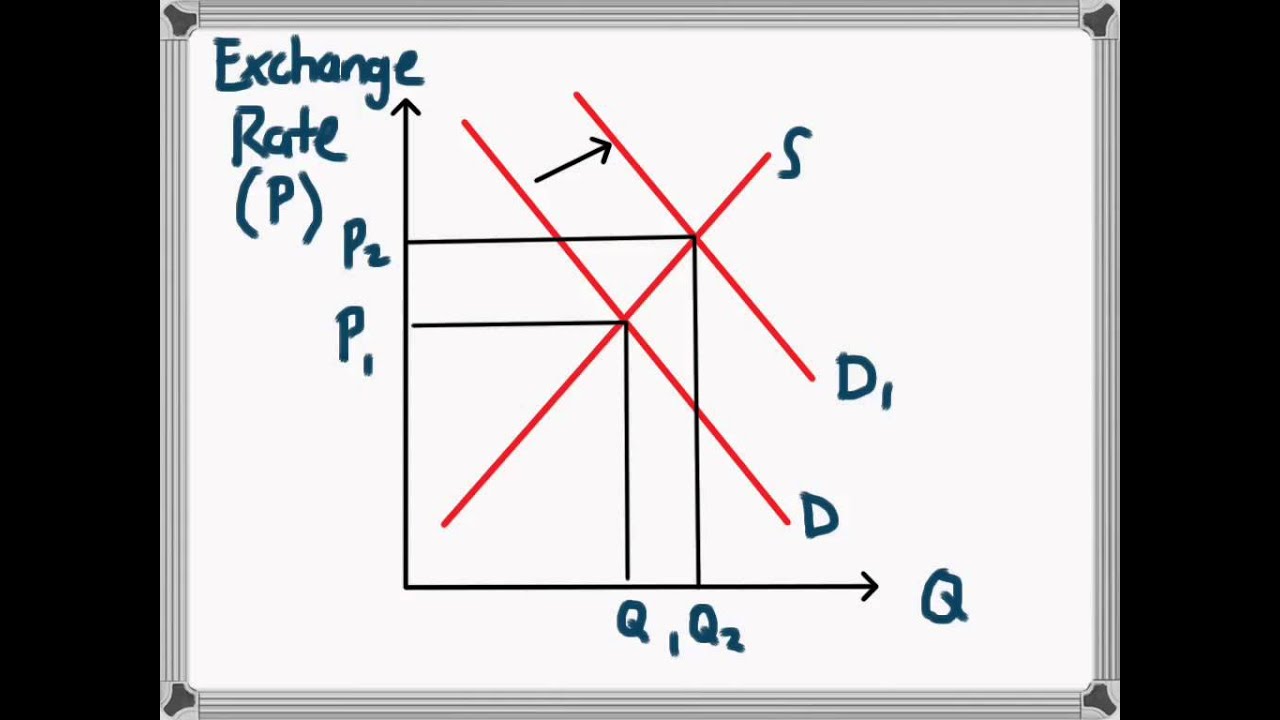

Forex rates refer to the exchange rates between different currencies. They determine the number of units of one currency required to purchase one unit of another. A flexible exchange rate system allows market forces to freely determine these rates without government intervention. In contrast to this, a fixed exchange rate system pegs the values of currencies to a particular benchmark, such as gold or another currency. Under a flexible market, changes in supply and demand for currencies drive rate fluctuations, reflecting fundamental economic conditions and market sentiment.

Influencing Factors

a. Economic Fundamentals:

Economic factors such as GDP growth, inflation, interest rates, and trade flows significantly influence forex rates. Strong economic performance, for instance, tends to strengthen a country’s currency, making it more expensive relative to others. High interest rates attract foreign investment, also boosting a currency’s value.

b. Market Sentiment:

Market perceptions and sentiments play a substantial role in rate determination. Positive news or expectations about a country’s economy or political stability can increase demand for its currency, leading to its appreciation. Conversely, negative sentiments can trigger depreciation.

c. Political and Geopolitical Events:

Political instability, wars, and geopolitical tensions can significantly impact forex rates. Uncertainty and risk aversion often lead investors to seek safe haven currencies, such as the US dollar or Swiss franc. Significant political events can also influence investor confidence and alter the direction of capital flows.

d. Central Bank Actions:

Central banks can influence forex rates indirectly by adjusting interest rates and conducting monetary policy. By altering the attractiveness of a country’s currency for investment, central banks can impact its supply and demand, thereby affecting the exchange rate.

e. Supply and Demand:

Ultimately, forex rates are dictated by the interplay of supply and demand. When there is a higher demand for a currency compared to its supply, its value will increase (appreciation). Conversely, an excess supply relative to demand will lead to depreciation.

Real-World Implications

The flexible determination of forex rates has far-reaching implications for global economic activity. Fluctuating rates can directly impact:

a. Trade:

Changes in forex rates affect the relative prices of goods and services traded internationally. Appreciation of one currency relative to another can make exports from the appreciating currency cheaper and imports more expensive, influencing trade patterns and competitiveness.

b. Investment:

Forex rates influence the cost and returns on foreign investments. Appreciation of the domestic currency can make foreign investments more expensive, potentially reducing capital inflows. Conversely, depreciation can enhance the profitability of foreign investments, attracting capital.

c. Inflation:

Depreciation of the domestic currency can lead to higher import prices and consequently, contribute to inflationary pressures. Conversely, appreciation can dampen inflationary effects by making imports cheaper.

Conclusion

The determination of forex rates under a flexible market is a complex and dynamic process influenced by a multitude of economic, political, and market factors. Understanding these factors is essential for businesses operating in the global marketplace, investors seeking to navigate the complexities of currency exchange, and individuals transacting across borders. By staying informed about the forces shaping forex rates, we can better anticipate shifts in the financial landscape and make informed decisions that adapt to the ever-changing global economy.

Image: marketequity.com

Determination Of Forex Rate Under Flexible Market