When venturing into the world of international finance, navigating the intricacies of payment options can be daunting. Forex cards and American Express (AMEX) cards are two prevalent options that offer distinct advantages and drawbacks. Understanding their key differences is paramount to selecting the most suitable option for your specific needs.

Image: www.kenznow.com

Forex Cards: A Specialized Tool for International Transactions

Forex cards, also known as foreign exchange cards, are prepaid cards specifically designed for travelers and expats. They are loaded with a foreign currency and can be used to make payments in that currency or withdraw local currency from ATMs. Forex cards offer a range of benefits, including:

- Fixed exchange rates: Forex cards lock in an exchange rate at the time of loading, protecting against currency fluctuations.

- No foreign transaction fees: Unlike traditional debit or credit cards, forex cards typically do not incur foreign transaction fees, saving you money on every purchase.

- Wide acceptance: Forex cards are accepted at millions of merchants worldwide, including those in remote or less developed areas.

- Travel-friendly features: Forex cards often include additional features tailored to travelers, such as travel insurance and airport lounge access.

However, forex cards also have some limitations to consider:

- Loading fees: Forex cards may charge a fee for loading funds, which can vary depending on the provider and amount loaded.

- Usage restrictions: Forex cards may have daily or monthly spending limits and may not be suitable for high-value transactions.

- Inactivity fees: Some forex cards charge a monthly inactivity fee if the card is not used for a certain period.

AMEX Cards: A Renowned Brand with Global Acceptance

American Express (AMEX) cards are a well-established and respected brand in the world of credit and charge cards. They are accepted at a vast network of merchants and ATMs worldwide, offering a convenient and secure payment option. AMEX cards come with a range of benefits, including:

- Rewards and loyalty programs: AMEX offers various rewards and loyalty programs that allow cardholders to earn points or cash back on their spending.

- Travel perks: Certain AMEX cards offer travel-related perks, such as airport lounge access, travel insurance, and baggage delay coverage.

- Concierge services: AMEX Platinum and Centurion cardholders have access to exclusive concierge services that can assist with travel arrangements, restaurant reservations, and other lifestyle needs.

- Premium benefits: AMEX Platinum and Centurion cards come with premium benefits such as elite status in airline and hotel loyalty programs, extended warranties, and purchase protection.

However, AMEX cards also have some drawbacks to be aware of:

- Annual fees: While some AMEX cards have no annual fee, many of the premium cards incur a substantial annual fee.

- High interest rates: AMEX cards typically have higher interest rates than traditional credit cards, making it important to pay off balances promptly to avoid interest charges.

- Limited acceptance: While AMEX is widely accepted, it may not be as universal as some other card networks, particularly in smaller or less developed establishments.

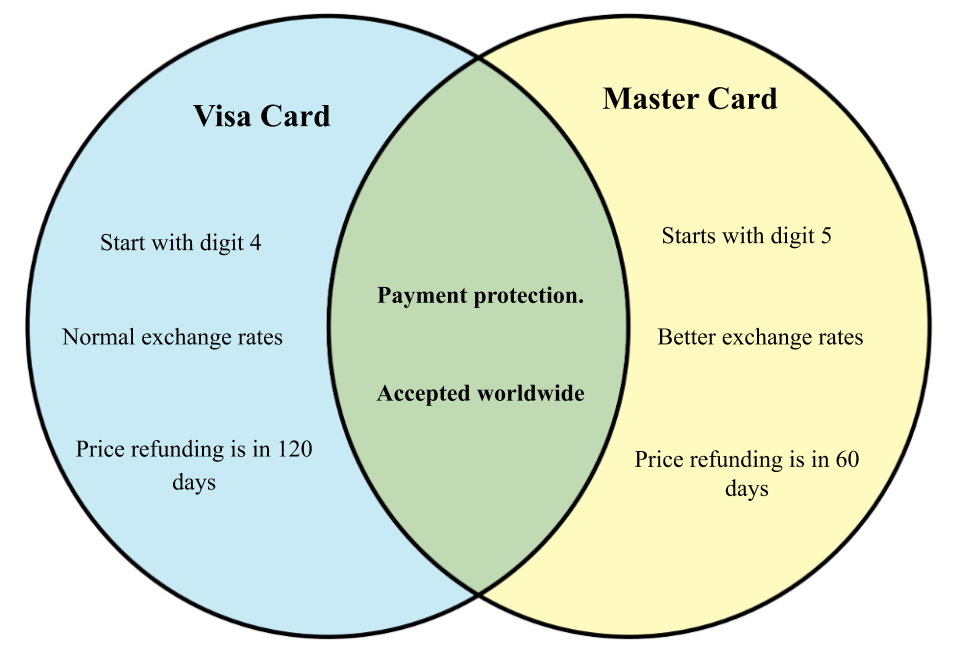

Image: whyunlike.com

Difference Between Forex Card And Amex Card

Choosing the Right Option: Forex Card vs. AMEX Card

The decision between a forex card and an AMEX card depends on your specific needs and preferences. Forex cards are ideal for travelers and expats who need to make foreign currency transactions frequently and benefit from fixed exchange rates and no foreign transaction fees. AMEX cards are a