In the high-stakes world of forex trading, success hinges on mastering the intricate nuances of the market, and understanding lot size is an essential piece of this puzzle. My journey into this realm began with a gripping anecdote: a close mentor’s tale of a beginner trader who, armed with eager ambition but little knowledge, recklessly ventured into a trade with an oversized lot size. The consequences were swift and brutal, the losses spiraling beyond redemption. This sobering tale ignited within me an unwavering determination to delve into the depths of lot size, exploring its implications and unraveling its significance in shaping the fortunes of forex traders.

Image: www.unlitrader.com

Navigating the Labyrinth of Forex Lot Sizes

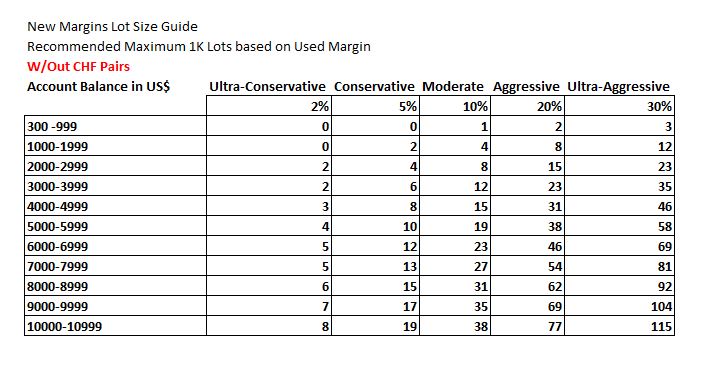

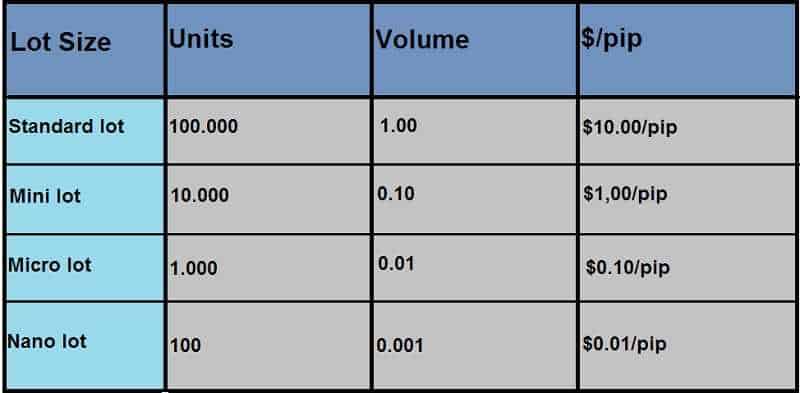

A forex lot represents a standardized unit of currency pairs traded in the market. It serves as a fundamental building block for all forex transactions, influencing a trade’s overall magnitude and risk exposure. Standard lot sizes encompass the micro lot (0.01), mini lot (0.1), standard lot (1), and mega lot (10), although variations exist across different brokers. Selecting an appropriate lot size is a critical decision that requires careful consideration of account size, trading strategy, and risk tolerance.

Understanding the Significance of Leverage and Margin

Leverage, a powerful tool in forex trading, allows traders to amplify their trading positions with borrowed capital. However, it is a double-edged sword, magnifying both potential profits and losses. The amount of leverage used is inversely related to lot size; for instance, a 100:1 leverage ratio for a $10,000 account enables a $100,000 trading position (1 standard lot). Margin, on the other hand, refers to the amount of funds required to maintain an open position. Higher lot sizes require higher margins, which can strain account balances and increase the likelihood of margin calls.

Matching Lot Sizes to Trading Strategies

Choosing an optimal lot size hinges upon a trader’s trading strategy. Scalpers, who seek quick profits from small price movements, typically opt for micro or mini lots, which minimize risk exposure. Conversely, long-term traders focused on capturing broader trends may opt for standard or mega lots to maximize potential returns. Position traders, who hold trades for extended periods, often prioritize risk management and choose lot sizes that align with their predetermined risk appetite.

Image: homecare24.id

Expert Insights and Tips for Informed Trading

“The key to successful lot size selection lies in understanding one’s own risk tolerance and trading strategy,” advises seasoned forex trader, Mark Jenkins. “Beginners should err on the side of caution and start with micro or mini lots until they develop a solid foundation.” Additionally, expert trader, Sarah Carter, emphasizes the importance of considering market conditions. “During high volatility periods, it’s prudent to reduce lot sizes to mitigate potential losses,” she cautions, “while more stable conditions may provide opportunities for larger positions.”

Risk Management Techniques and Disciplined Trading:

Implementing sound risk management practices is paramount for forex traders. Adhering to a predefined risk-to-reward ratio helps control potential losses. Additionally, practicing disciplined trading, avoiding emotional decision-making, and consistently using stop-loss orders are crucial for long-term success.

Frequently Asked Questions: Unraveling the Mysteries of Lot Sizes

Different Lot Size In Forex Trading

Conclusion: Empowering Forex Traders with the Knowledge of Lot Size

Understanding the impact of lot size is an essential cornerstone for every forex trader. By mastering this vital aspect, traders can optimize their trades, navigate market conditions effectively, and safeguard their financial well-being. Are you ready to embark on a journey to unlock the potential of lot size in forex trading?