In the realm of international finance, exchange rates play a pivotal role in facilitating seamless transactions across borders. The intricate world of forex rates encompasses an array of variations, each catering to specific scenarios. Embark on an enlightening journey as we delve into the depths of various forex rates, empowering you with a comprehensive understanding of this fascinating aspect of the financial landscape.

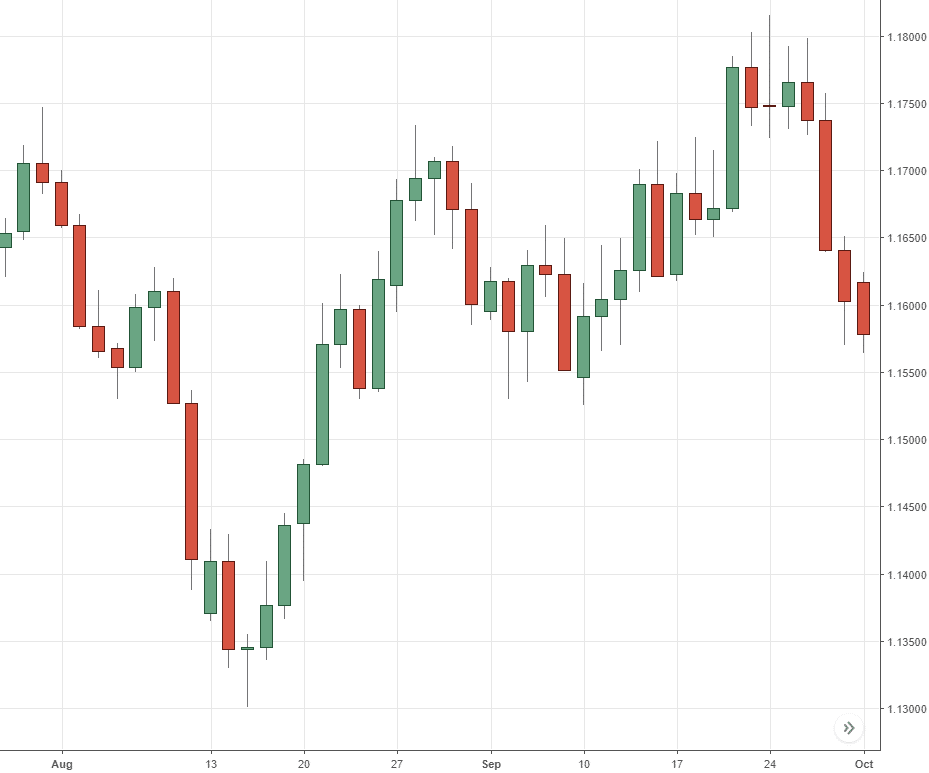

Image: www.tradingwithrayner.com

Navigating the Dynamics of Forex Rates

At its core, a forex rate represents the value of one currency relative to another. This ratio determines how much of one currency is required to exchange for a specified amount of the other. The dynamic interplay between supply and demand drives the fluctuations in forex rates, making them a constant subject of analysis and speculation.

Spot Rates: Capturing Real-Time Currency Values

Spot rates, also known as current rates, provide a snapshot of the exchange rate prevailing at the exact moment a transaction takes place. They represent the prevailing market price for immediate currency exchange and are often used for smaller transactions or when timely execution is essential.

Forward Rates: Anticipating Future Currency Values

In contrast to spot rates, forward rates offer a glimpse into the projected exchange rate at a specified future date. These rates are determined by factors such as interest rate differentials, economic outlooks, and market expectations. Forward rates are commonly employed for hedging against currency fluctuations in long-term transactions or speculative trading.

Image: indzara.com

Cross Rates: Indirect Currency Exchange

Cross rates arise when two currencies are directly exchanged without involving the U.S. dollar as an intermediate currency. Cross rates play a significant role in international trade and investment, as they allow for direct comparisons between currencies and eliminate the need for multiple currency conversions.

Swap Rates: Enhancing Currency Exchange Efficiency

Swap rates involve the simultaneous exchange of two different currencies on a spot date and their reverse exchange at a specified future date. This type of transaction enables banks and other financial institutions to manage currency risk effectively and capitalize on interest rate differentials.

Expertise and Insights: Unlocking the Secrets of Forex Rates

Understanding forex rates requires a combination of theoretical knowledge and practical experience. Seasoned finance professionals possess a wealth of insights that can guide traders and investors in making informed decisions.

According to industry experts, “technical analysis plays a critical role in forecasting short-term currency movements, while fundamental analysis offers a broader perspective on long-term trends.” By harnessing these analytical tools and staying abreast of market developments, traders can gain a competitive edge in the ever-evolving world of forex rates.

FAQs: Answering Your Pressing Forex Rate Queries

Q: What factors influence forex rate fluctuations?

A: Fluctuations in forex rates are driven by a complex interplay of economic, geopolitical, and monetary policy factors, including economic growth, inflation, interest rates, political stability, trade balances, and supply and demand dynamics.

Q: How can I minimize currency risk when making international transactions?

A: To mitigate currency risk, consider hedging strategies such as forward contracts or options. Additionally, diversifying your investments across multiple currencies can help spread the risk.

Different Types Of Forex Rates

Conclusion: Empowered Decisions in the Forex Arena

Understanding the intricacies of different forex rates forms a cornerstone of global finance. By embracing the knowledge presented in this comprehensive guide, you gain a valuable resource to navigate the complexities of the forex market. Whether you’re a seasoned trader or an aspiring investor, mastering forex rates unlocks the door to informed decision-making and empowers you to make the most of the ever-evolving currency landscape.

Join the ongoing discourse by sharing your thoughts and questions in the comment section below. Let’s collectively delve deeper into the fascinating world of forex rates.