Venturing into the world of forex trading can be a bewildering experience, especially when it comes to choosing the right broker. Understanding the fundamental differences between ECN (Electronic Communication Networks) and market makers is crucial for making an informed decision.

Image: eaforexkiller.blogspot.com

In this article, we will delve into the intricacies of ECN forex brokers and market makers, comparing their advantages and drawbacks. By the end of this comprehensive guide, you will have a clear grasp of both models and be equipped to make an informed decision tailored to your trading needs.

ECN Forex Brokers: Unraveling the Network

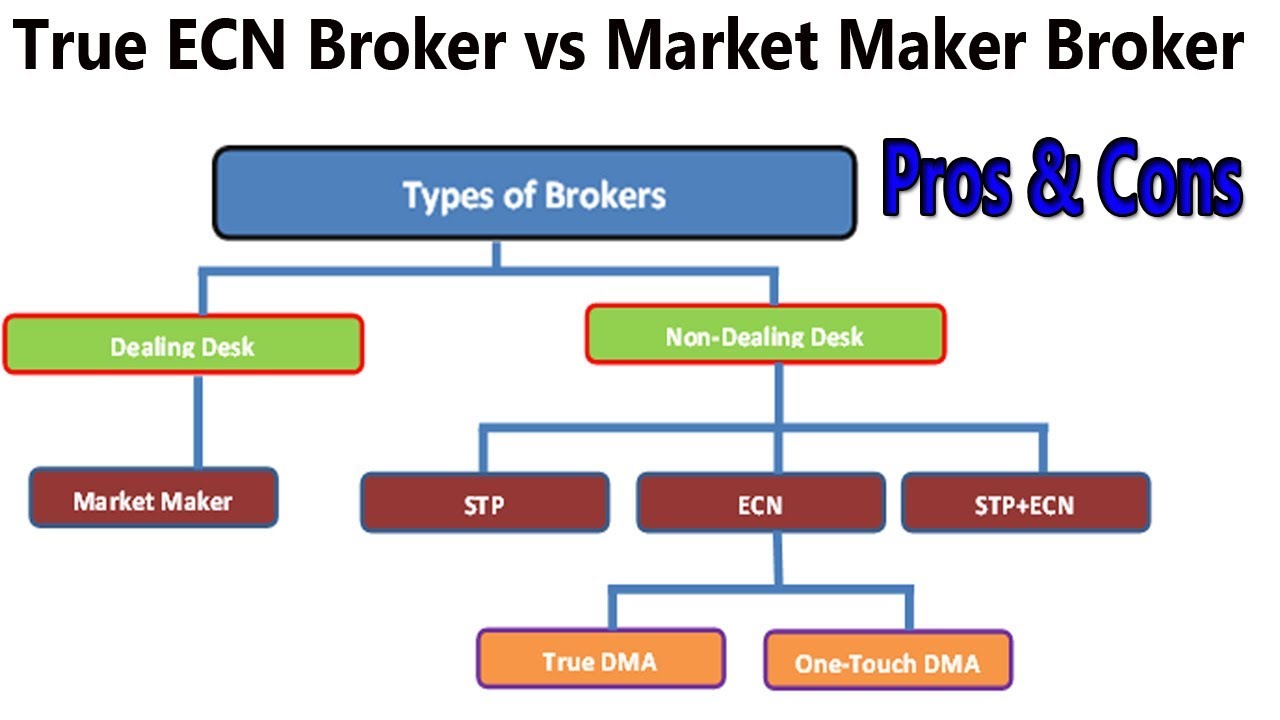

ECN forex brokers, also known as non-dealing desks, act as intermediaries between traders without taking opposite positions in the trades. They provide a transparent marketplace where traders can directly interact with each other, accessing live interbank liquidity and executing trades based on prevailing market prices.

The advantages of ECN brokers lie in their transparency, low spreads, and execution speed. Traders can benefit from higher levels of control over their trades, as they interact directly with other market participants rather than with the broker acting as a counterparty.

Market Makers: The All-Inclusive Dealers

Market makers, in contrast to ECN brokers, act as both counterparties to trades and market makers, maintaining a bid-ask spread to facilitate trading. They quote prices and trade directly with traders, assuming the risk of opposite positions in the process.

The advantages of market makers include convenience and consistently tight spreads, which can be particularly beneficial for short-term trading strategies. However, traders may also experience potential conflicts of interest, as the market maker’s profits can be influenced by the outcome of trades.

Fees and Commissions: Unveiling the Differences

ECN brokers typically charge commissions on each trade, providing transparent pricing but potentially higher costs for high-volume traders. Market makers, on the other hand, generally include their fees in the spread, resulting in a more simplified pricing structure that may be more appealing to beginner traders.

It is important to note that the optimal pricing model depends on individual trading styles and trading frequency. High-frequency traders may prefer the lower commissions of ECN brokers, while infrequent traders might favor the convenience and lower spreads offered by market makers.

Image: indexaco.com

Liquidity and Slippage: Understanding Market Impact

Liquidity, referring to the ease of executing trades without affecting market prices, is a critical consideration for traders. ECN brokers typically offer high levels of liquidity due to their direct market access, minimizing the risk of significant slippage (the difference between the expected and executed price).

Market makers, on the other hand, may have less liquidity than ECNs, as their trading volume is typically lower. This can lead to wider spreads and higher slippage, which may not be suitable for traders who prioritize execution quality and pinpoint timing.

Regulation and Transparency: Ensuring Trading Safety

Both ECN brokers and market makers are subject to regulatory oversight and stringent compliance requirements, guaranteeing the integrity and safety of the trading environment. However, the level of transparency can vary depending on the broker’s operating model.

ECN brokers provide a more transparent view of the market, as they facilitate direct interaction between traders. Market makers, while providing less transparency due to their proprietary pricing models, must adhere to regulations that ensure fair and consistent trading practices.

FAQs for Forex Brokers and Market Makers

Q: Which broker model is best for beginner traders?

A: Market makers may be more suitable for beginners due to their convenience and consistently tight spreads, which can simplify the learning process.

Q: Are there any risks associated with trading with market makers?

A: While market makers are regulated and reputable, the potential for conflicts of interest should be considered, as they can profit from the outcome of losing trades.

Q: How can I determine which broker type is right for me?

A: Evaluate your trading style, frequency, and risk tolerance to determine whether the transparency and low spreads of ECN brokers or the convenience and tight spreads of market makers align better with your needs.

Ecn Forex Brokers Vs Market Makers

Conclusion

Choosing between ECN forex brokers and market makers is a crucial decision that can impact the success of your trading endeavors. Understanding the distinctions between these two models, from their pricing structures to liquidity and execution quality, is paramount.

By carefully considering your trading preferences, risk tolerance, and regulatory concerns, you can make an informed decision that aligns with your investment goals and trading style. Remember, the key to successful forex trading lies in choosing the right broker that complements your approach and provides a platform that meets your specific needs.