In the dynamic and ever-evolving world of forex, a trader’s weapon of choice can make all the difference. While countless platforms and brokerage firms vie for your attention, unraveling the complexity of their offerings can be overwhelming. This comprehensive guide will demystify the intricate yet essential concepts of ECN, STP, and NDD forex brokers, empowering you with the knowledge to make informed decisions that fuel your trading success.

Image: www.brokersome.com

Unveiling the Forex Landscape: ECN vs STP vs NDD

ECN (Electronic Communication Network), STP (Straight-Through Processing), and NDD (No Dealing Desk) are three fundamental pillars of the modern forex trading ecosystem. Understanding their nuances will unlock a competitive advantage for any trader:

-

ECN: An ECN acts as a hub, connecting buyers and sellers directly without the intervention of a bank or broker. It offers real-time pricing and enhanced transparency.

-

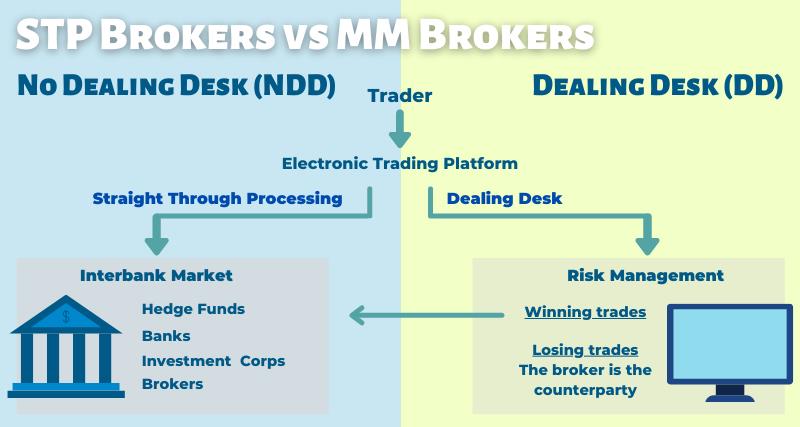

STP: STP brokers pride themselves on seamless trade execution, channeling orders straight to liquidity providers, minimizing slippage.

-

NDD: NDD brokers go one step further, eliminating any potential conflict of interest by refraining from taking the other side of their clients’ trades.

Navigating the Labyrinth of ECN, STP, and NDD

Each type of forex broker offers its unique set of benefits and drawbacks:

ECN:

-

Pros:

- Direct market access, reducing spreads and potential biases.

- Transparency and accuracy in pricing.

-

Cons:

- Can require higher minimum deposits and commissions.

- May not be suitable for smaller or less experienced traders.

STP:

-

Pros:

- Fast and efficient order execution.

- Reduced slippage, providing better price accuracy.

-

Cons:

- Not as transparent as ECN brokers.

- May have slightly higher spreads than ECN brokers.

NDD:

-

Pros:

- Eliminates conflicts of interest, ensuring fair trading conditions.

- Enhanced trust and security.

-

Cons:

- Can have wider spreads compared to ECN brokers.

- May offer limited liquidity in certain market conditions.

Choosing the Right Forex Broker: A Journey of Empowerment

Finding the ideal forex broker is a journey of careful consideration, aligning your goals and preferences with an appropriate platform. Take the following factors into account:

-

Trading Style and Volume: High-frequency traders may prefer ECN brokers for tighter spreads, while beginners might find NDD brokers more comfortable.

-

Deposit Size: ECN brokers often require higher minimum deposits.

-

Trading Instruments: Ensure the broker you choose offers the currencies and instruments you trade in.

-

Reputation: Look for brokers with a proven track record of reliability and transparency.

Igniting Your Trading Potential: Embracing Expertise

Master traders have honed their skills through years of experience and strategic guidance. Here are some pearls of wisdom to ignite your trading potential:

-

Seek mentorship from experienced traders to accelerate your learning curve.

-

Leverage advanced trading tools and platforms to gain an edge.

-

Continuously monitor market trends and economic events to inform your trading decisions.

-

Embrace risk management as a cornerstone of your trading strategy.

Conquering the Conclusion: A Call to Action

The world of forex trading is a horizon of opportunity, but it requires a profound understanding of the tools and techniques at your disposal. By harnessing the power of ECN, STP, and NDD forex brokers, you can elevate your trading to new heights. Embark on this journey of financial freedom, solitude, and success, knowing that the knowledge you’ve acquired today is your most formidable weapon in the unforgiving battlefields of forex.

Image: www.cashbackforex.com

Ecn Stp Ndd Forex Brokers