Forex trading involves a delicate balance between maximizing profits and minimizing losses. To achieve this, understanding the concepts of entry target and stop-loss calculation is crucial. In this comprehensive guide, we’ll delve into these essential strategies, empowering you with the knowledge to navigate the forex market effectively.

Image: www.youtube.com

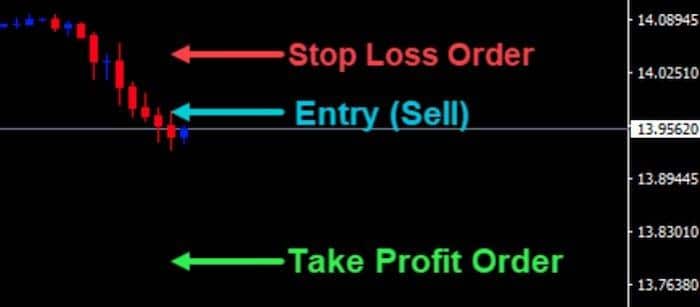

The Anatomy of a Successful Trade

Entry Target

The entry target represents the ideal price point at which you enter a trade. It is determined by analyzing market trends, support and resistance levels, and potential entry points.

Identifying the optimal entry target requires a thorough knowledge of technical analysis. By studying charts and candlestick patterns, you can gauge the market’s sentiment and predict potential price movements. A well-chosen entry target can significantly enhance your chances of a profitable trade.

Stop-Loss

A stop-loss order is a safety net designed to protect your capital from excessive losses. It defines the point at which your position will automatically close if the market moves against you.

Determining the ideal stop-loss level depends on your risk tolerance and the volatility of the currency pair you’re trading. Placing your stop-loss too close to your entry target may lead to premature exits, while setting it too far away may increase your potential losses.

Image: forextraders.guide

Expert Tips for Effective Calculation

1. Embrace Risk Management

Effective entry target and stop-loss calculation hinges on understanding your risk appetite. Define your maximum acceptable loss for each trade and adjust your stop-loss accordingly. Managing risk is crucial for long-term trading success.

[Read: Why Risk Management is Essential for Forex Trading](https://myforexblog.com/risk-management-forex-trading/)

2. Technical Analysis Unleashed

Harness the power of technical analysis to identify potential entry targets and stop-loss levels. Study price charts, candlestick patterns, and technical indicators to discern market trends and anticipate support and resistance zones.

[Learn: Introduction to Technical Analysis for Forex Trading](https://myforexblog.com/technical-analysis-forex-trading/)

FAQs: Unraveling Common Questions

Q: How close should I set my stop-loss to my entry target?

A: The optimal distance between your stop-loss and entry target depends on factors such as risk tolerance, volatility of the currency pair, and trading strategy.

Q: What are the different types of stop-loss orders?

A: Common stop-loss orders include market orders, limit orders, and trailing stop-loss orders. Each type offers unique benefits and uses.

Entry Target Target And Stoploss Calculation In Forex

Conclusion

Mastering entry target and stop-loss calculation is essential for successful forex trading. By leveraging the strategies and tips outlined in this guide, you can increase your accuracy, manage risk effectively, and ultimately enhance your profitability. Embrace these concepts, embark on your trading journey with confidence, and witness the transformative power of well-calculated trades.

Are you ready to explore the world of forex trading with precision? Join our exclusive trading community today and let’s navigate the markets together!