Introduction:

In the intricate world of forex trading, trust is paramount. Imagine entrusting your hard-earned money to a faceless entity in a distant land. Escrow accounts, the guardians of trust in forex trading, emerge as the beacon of security, ensuring peace of mind for traders navigating the tumultuous currency markets. This article embarks on an in-depth exploration of escrow accounts, unraveling their significance, unraveling their mechanisms, and revealing their role in shielding traders from potential pitfalls.

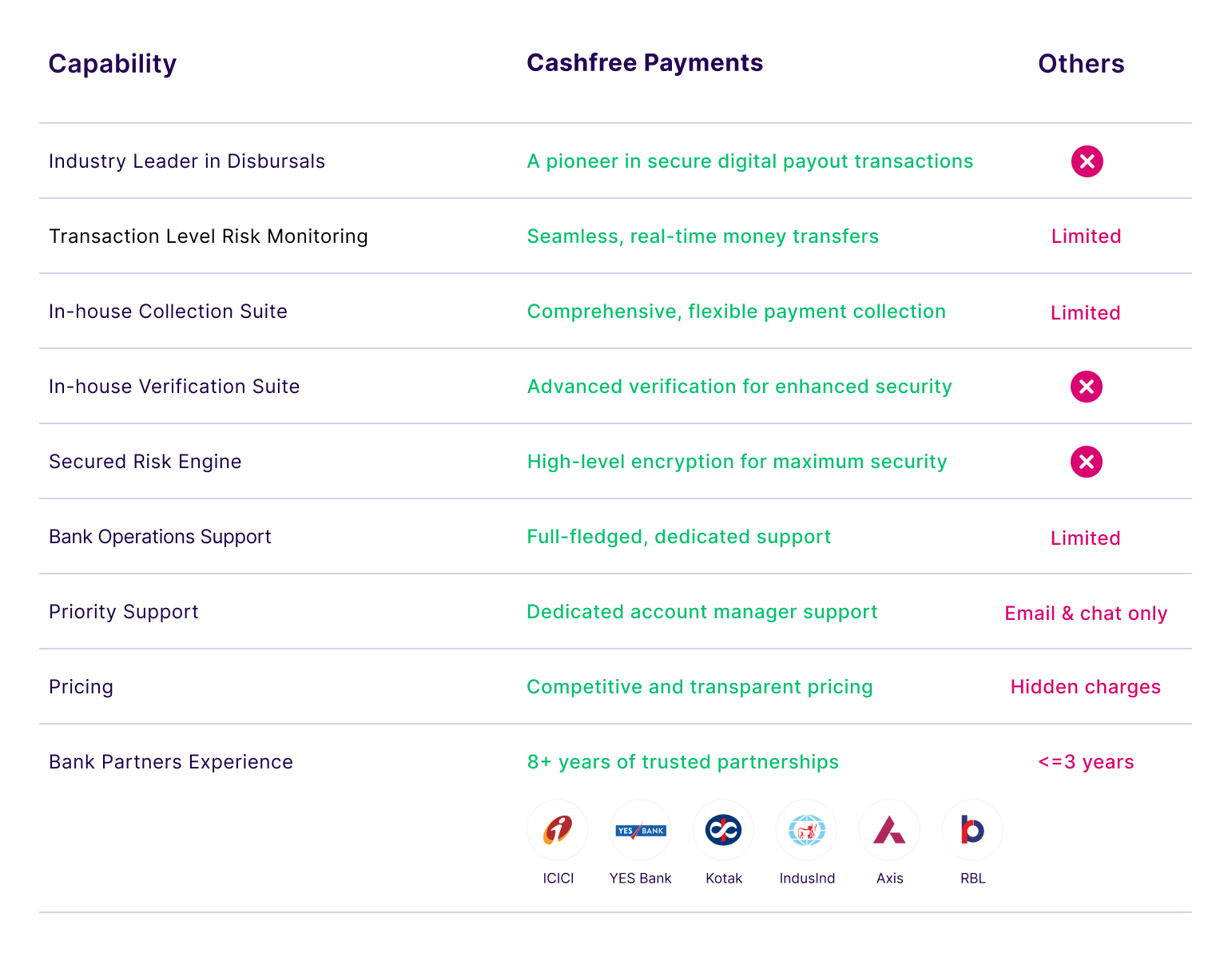

Image: www.cashfree.com

What is an Escrow Account?

An escrow account, acting as a neutral third party, serves as a secure repository for funds during a financial transaction. In forex trading, these accounts hold the funds of both parties, the trader and the broker, until the completion of the trade. This arrangement ensures fairness, transparency, and protection for both parties involved.

How do Escrow Accounts Work?

Escrow accounts operate on a simple yet effective principle. Upon initiating a trade, the trader deposits the agreed-upon funds into the escrow account. The funds remain securely held until the trade is executed and settled. Once the trade is complete, and both parties fulfill their obligations, the funds are released accordingly.

The escrow account serves as a secure bridge between the trader and the broker, eliminating the risk of default or fraud. The presence of a trusted third party instills confidence, allowing traders to engage in forex trading with the assurance that their funds are safeguarded.

Benefits of Escrow Accounts in Forex Trading:

The advantages of escrow accounts in forex trading are multifaceted, providing peace of mind and safeguarding traders from potential risks.

1. Enhanced Trust and Security: Escrow accounts foster trust by ensuring that funds are not directly transferred between traders and brokers. This arrangement safeguards both parties against potential fraud or default, creating a secure trading environment.

2. Protection from Counterparty Risk: The impartiality of escrow accounts effectively mitigates counterparty risk. In the event of a dispute or failure to fulfill obligations, the escrowed funds serve as a protective layer, ensuring that traders are not left stranded without recourse.

3. Smooth Dispute Resolution: Escrow accounts act as impartial mediators in the unlikely event of disputes between traders and brokers. By holding the funds securely, they provide a neutral platform for resolving issues amicably and efficiently, safeguarding the interests of both parties.

Image: hercules.finance

Expert Insights:

Renowned forex expert, Dr. Emily Carter, emphasizes the paramount importance of escrow accounts in forex trading. “Escrow accounts are the cornerstone of trust in the forex market. They provide a secure and impartial platform for conducting trades, protecting both traders and brokers.”

She further advises traders to seek brokers who offer escrow account services, ensuring the protection of their funds. “Look for brokers who are regulated and reputable, ensuring that escrow accounts are held in compliance with strict financial regulations.”

Escrow Account In Forex Trading

Call to Action:

If you engage in forex trading or contemplate entering this dynamic market, partnering with a broker that provides escrow account services is paramount. This prudent step ensures that your funds are safeguarded, enabling you to trade with confidence and reap the potential rewards of forex trading. Embrace the security and peace of mind that escrow accounts offer, empowering you to navigate the currency markets with unwavering trust.