A Tale of Two Trading Titans

As an avid currency enthusiast, I embarked on a cross-continental journey to explore the intricate dance of forex trading in two global powerhouses: Europe and the United States. From bustling trading floors in London to the electronic wizardry of New York, I delved into the depths of these dynamic markets, uncovering their nuances and harnessing their potential.

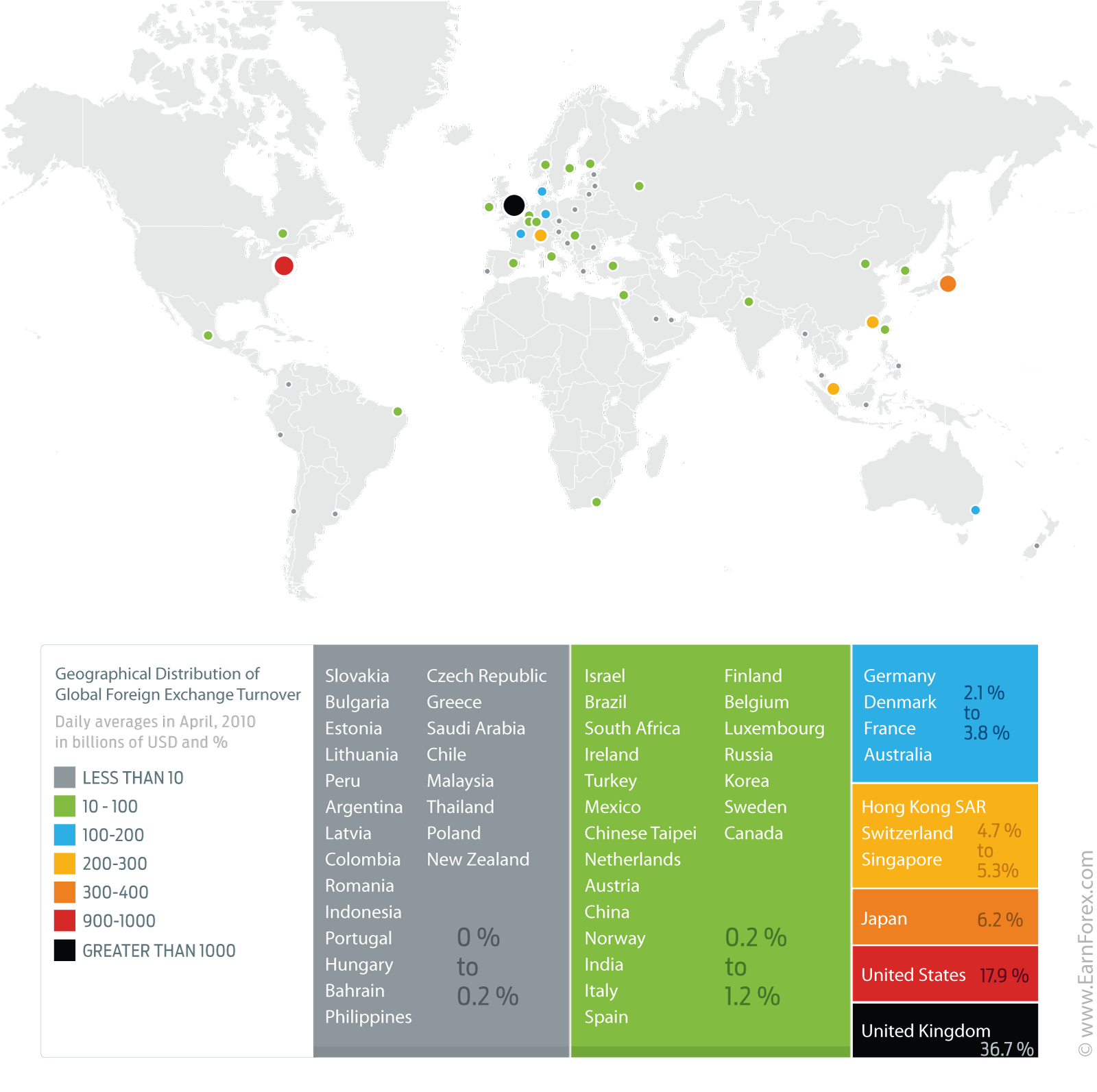

Image: www.earnforex.com

Eurozone: The Old Guard with New-Age Agility

The Eurozone, a formidable force in global finance, has witnessed a remarkable transformation in recent years. Once considered a rigid monetary bloc, it has evolved into a flexible and responsive trading environment. The introduction of the European Single Market has fostered robust interbank connectivity, creating a vast network of counterparties for currency exchange.

Bullish on the Buck: The Vigor of the US Dollar

Across the Atlantic, the US dollar reigns supreme as the world’s reserve currency. Its exceptional liquidity and global acceptance lend it an unwavering allure among traders. The Federal Reserve’s monetary policy decisions exert an immense influence on financial markets worldwide, making the US forex market a highly dynamic and lucrative landscape.

Embark on a Currency Odyssey

Image: www.forex.academy

Definition: Unraveling the Enigma of Forex

Foreign exchange, or forex, encompasses the buying and selling of one currency against another, enabling the conversion of funds for international trade, investments, and speculation. The forex market, the largest decentralized market in existence, operates 24 hours a day, connecting traders from all corners of the globe.

Genesis: Tracing the Roots of Currency Exchange

The origins of forex trading can be traced back to the ancient era of commercial exchanges, when merchants bartered goods and exchanged currencies to facilitate trade. Over the centuries, the advent of paper money, advancements in telecommunications, and the globalization of commerce propelled the forex market into its modern guise.

The Currency Trading Landscape: A Dynamic Vista

Essential Currencies: Unveiling the Key Players

The forex market is dominated by a select group of currencies known as “majors,” including the US dollar, the euro, the Japanese yen, the British pound, and the Swiss franc. These currencies enjoy high liquidity and are widely traded on exchanges due to their economic significance and global demand.

Minor Currencies: A Gateway to Emerging Markets

Beyond the majors, a vast array of minor currencies provides traders with opportunities to diversify their portfolios and tap into emerging markets. The “cross” currencies, which pair non-US dollar currencies against each other, offer unique trading opportunities and can provide substantial returns.

The Pulse of the Forex Market: Trends and Developments

Technological Advancements: Shaping the Future of Trading

The advent of electronic trading platforms and mobile apps has democratized access to the forex market, enabling traders of all levels to participate. These platforms offer advanced charting tools, real-time data, and automated trading capabilities, enhancing market visibility and execution speeds.

Emerging Economies: A Frontier for Currency Traders

The rise of emerging economies, particularly in Asia and Latin America, has created new opportunities for forex traders. The increased economic activity and currency volatility in these regions offer avenues for growth and diversification.

Proven Strategies for Forex Mastery: Insider Tips and Expert Advice

Risk Management: The Foundation of Forex Success

Managing risk is paramount in the volatile world of forex trading. Proper risk management techniques, such as setting stop-loss orders, employing leverage judiciously, and diversifying trades, help mitigate potential losses and preserve capital.

Technical Analysis: Unlocking Market Secrets

Technical analysis, the study of historical price data, empowers traders to identify trends, predict future movements, and make informed trading decisions. Chart patterns, indicators, and support and resistance levels are crucial tools for discerning market sentiment and identifying potential opportunities.

FAQ: Unraveling the Intricacies of Forex Trading

Q: Can anyone participate in forex trading?

A: Yes, forex trading is accessible to individuals of all experience levels. It requires an understanding of market fundamentals, risk management, and trading strategies.

Q: What are the advantages of forex trading?

A: Forex trading offers high liquidity, 24-hour accessibility, and opportunities for both bull and bear markets. Leverage can amplify potential returns, but it also magnifies risk.

Q: What factors influence currency exchange rates?

A: Exchange rates are influenced by a wide range of factors, including economic data, geopolitical events, interest rate differentials, and speculative flows.

Q: How do I start forex trading?

A: To begin forex trading, you need to open an account with a regulated broker. Determine your trading objectives, conduct thorough research, and develop a solid trading plan.

Europe And Usa Forex Trading

Call to Action: Embrace the Currency Odyssey

The forex market is a fascinating and ever-evolving landscape that presents countless opportunities for astute traders. By immersing yourself in its intricacies, honing your strategies, and embracing risk management principles, you can unlock the potential of the currency markets and navigate the financial tides with confidence.

Are you ready to embark on a currency odyssey that transcends borders and empowers your financial aspirations?