The information provided on this website is solely for general knowledge and informational purposes, and does not constitute professional financial advice. Forex trading involves substantial risk, and may not be suitable for all investors. Before making any investment decisions, it is essential to seek advice from a qualified financial advisor.

Image: www.wealthwithin.com.au

By accessing this website, you acknowledge and agree to the following terms of use:

- You are solely responsible for your investment decisions, and any resulting profits or losses.

- The information provided on this website is not intended to induce or encourage any specific investment strategies or decisions.

- The authors and owners of this website shall not be held liable for any losses or damages incurred as a result of relying on the information provided.

- You are advised to seek independent financial advice before making any investment decisions.

Exchange Shop and Forex Market

Introduction

The world of finance is vast and complex, with countless options and opportunities for those seeking to invest or trade. Among these, exchange shops and the forex market stand out as popular avenues for currency exchange and speculative trading, respectively. In this comprehensive guide, we will delve into the intricacies of exchange shops and the forex market, providing a thorough understanding of their operations, benefits, and risks.

Exchange Shops

Exchange shops, also known as currency exchange bureaus, are physical locations where individuals can exchange one currency for another. They typically offer a range of services, including buying and selling currencies, issuing traveler’s checks, and providing currency information.

Exchange shops are widely used by individuals traveling abroad, as they provide a convenient and secure way to obtain local currency. They also offer competitive exchange rates compared to banks and other financial institutions.

Image: www.equiti.com

Forex Market (FX)

The forex market, short for foreign exchange market, is the largest and most liquid financial market in the world. It is an over-the-counter (OTC) market where currencies are traded between banks, financial institutions, and individual traders.

The forex market plays a crucial role in international trade and finance by facilitating the conversion of one currency into another for various purposes, including global commerce, investment, and speculation.

Benefits of Using Exchange Shops and Forex Market

There are several benefits to using exchange shops and the forex market, including:

- Convenience: Exchange shops are easily accessible and provide a quick and hassle-free way to exchange currencies.

- Competitive exchange rates: Exchange shops and the forex market often offer competitive exchange rates compared to banks and other financial institutions.

- Wide range of currencies: Both exchange shops and the forex market offer a wide range of currencies to choose from.

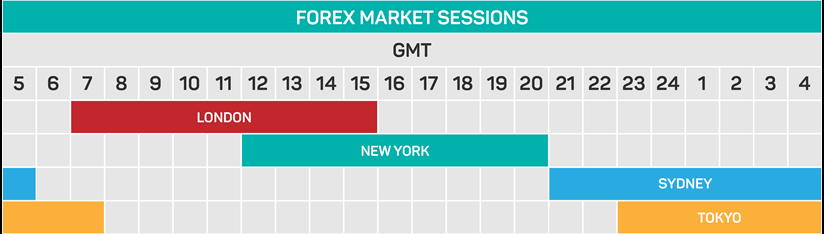

- 24/7 trading: The forex market offers 24/7 trading, allowing traders to capitalize on market movements at any time of day or night.

- High liquidity: The forex market is highly liquid, which means that buying and selling currencies can be done quickly and efficiently.

Risks Associated with Exchange Shops and Forex Market

While exchange shops and the forex market offer numerous benefits, it is important to be aware of the associated risks:

- Fluctuating exchange rates: Currency exchange rates are subject to constant fluctuations, which can result in losses if not managed properly.

- Transaction fees: Exchange shops and forex brokers may charge transaction fees, which can reduce profits.

- Counterparty risk: In the forex market, counterparty risk refers to the risk of one party failing to fulfill their obligations, which can lead to financial losses.

- Scams: There have been instances of fraudulent activities in the forex market, such as Ponzi schemes and pyramid scams.

Tips and Expert Advice for Exchange Shops and Forex Market

To maximize the benefits and mitigate the risks when using exchange shops and the forex market, it is essential to follow these tips and seek expert advice:

- Research exchange rates: Before exchanging currencies, compare exchange rates from different exchange shops or forex brokers to find the best deal.

- Choose a reputable exchange shop or forex broker: Select an exchange shop or forex broker that is licensed and regulated to ensure the safety of your funds.

- Understand the risks: Before entering the forex market, have a clear understanding of the risks involved and trade within your risk tolerance.

- Use stop-loss orders: Stop-loss orders can help limit losses if the market moves against your position.

- Consider using limit orders: Limit orders can help secure profits when the market moves in your favor.

FAQs on Exchange Shops and Forex Market

Here are some Frequently Asked Questions (FAQs) on exchange shops and the forex market:

- What is the difference between an exchange rate and a currency quote?

An exchange rate is the price of one currency in terms of another, while a currency quote is the price of a currency pair. - How do exchange shops make money?

Exchange shops make money by charging a commission or spread on the currency exchange. - What is the most traded currency pair in the forex market?

The most traded currency pair in the forex market is the EUR/USD (euro/US dollar). - What factors affect currency exchange rates?

Economic data, political events, and market sentiment can all affect currency exchange rates. - Is it possible to make money in the forex market?

Yes, it is possible to make money in the forex market, but it requires knowledge, skill, and careful risk management.

Exchange Shop And Forex Market

Conclusion

Exchange shops and the forex market offer unique opportunities for currency exchange, investment, and speculation. By understanding the operations, benefits, and risks involved, you can make informed decisions and seize trading opportunities in both markets. Remember to seek expert advice, research exchange rates, and manage your risk carefully to maximize your returns and minimize potential losses.

Are you interested in learning more about exchange shops or the forex market? Consider exploring our website for comprehensive resources and insights to guide your financial journey.