Forex trading can often be a daunting task, especially when it comes to managing risk. One of the key elements for effective risk management is determining the appropriate lot size for your trades. To simplify this process, the US100 lot size calculator comes into play. This tool can significantly enhance your trading strategy by providing accurate lot size recommendations tailored to your specific risk tolerance and trading goals.

Image: notariaurbina.cl

So, what exactly is a lot size?

In the world of Forex, a lot represents a standardized unit of currency. The most common lot size is the standard lot, which is equivalent to 100,000 units of the base currency. However, there are also mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units). Choosing the right lot size is crucial as it directly impacts your potential profits and losses.

The Importance of Using a US100 Lot Size Calculator

Utilizing a US100 lot size calculator offers several key advantages. Firstly, it eliminates the guesswork and ensures that your lot size aligns with your risk appetite and trading capital. Secondly, it helps you maintain discipline and avoid taking on excessive risks that could jeopardize your trading account.

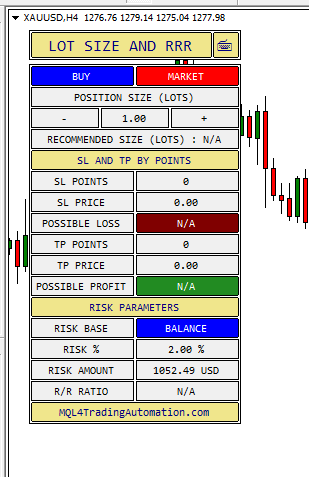

Furthermore, the US100 lot size calculator considers various factors, such as your account balance, risk tolerance, stop-loss levels, and market volatility. By factoring in these parameters, the calculator provides personalized recommendations that are tailored to your individual trading strategy.

Understanding the Formula

The US100 lot size calculator typically employs a formula to determine the appropriate lot size. This formula considers your account balance, risk tolerance (expressed as a percentage), stop-loss level (expressed in pips), and the current market value of one pip.

For instance, if you have an account balance of $10,000, a risk tolerance of 1%, a stop-loss level of 50 pips, and the current market value of one pip for the US100 is $1, the calculator might recommend a lot size of 0.2. This calculation implies that you are risking a maximum of $100 on each trade (1% of your account balance), and the chosen lot size would result in a potential loss of $100 if the price moves against you by 50 pips.

Tips and Expert Advice

To get the most out of the US100 lot size calculator, it’s essential to follow these tips and expert advice:

- Determine your risk appetite: Before using the calculator, assess your risk tolerance and determine what percentage of your account balance you are comfortable risking on a single trade.

- Define your trading strategy: Clearly outline your trading plan, including your entry and exit points, stop-loss levels, and profit targets. This will provide a framework for the calculator to make appropriate recommendations.

- Consider market volatility: Keep in mind that market conditions can change rapidly. Adjust your lot size accordingly to account for increased or decreased volatility.

- Monitor your trades: Once you have executed a trade, continuously monitor its performance. If the market moves against you significantly, consider adjusting your lot size to manage your risk.

- Seek professional guidance: If unsure about determining your risk tolerance or optimizing your trading strategy, consult with a financial advisor or experienced trader.

Image: fxdatapanel.com

Frequently Asked Questions

- Q: What is the difference between a standard lot, mini lot, micro lot, and nano lot?

A: The difference lies in the unit size of the base currency. A standard lot represents 100,000 units, a mini lot represents 10,000 units, a micro lot represents 1,000 units, and a nano lot represents 100 units. - Q: How do I calculate my risk tolerance?

A: Risk tolerance varies from person to person. To determine yours, consider your financial situation, investment goals, and emotional resilience. - Q: Can I trade with a lot size smaller than a nano lot?

A: Yes, some brokers offer fractional lot sizes, allowing you to trade with even smaller amounts. - Q: Is it advisable to use the maximum lot size recommended by the calculator?

A: It’s generally not recommended to trade with the maximum lot size suggested by the calculator. Leave a margin of safety and consider your risk tolerance. - Q: Can I use the US100 lot size calculator for other currency pairs?

A: While the calculator is designed for the US100 index, you can use it for other currency pairs by adjusting the relevant parameters.

Us100 Lot Size Calculator

Conclusion

Harnessing the power of the US100 lot size calculator can significantly enhance your Forex trading experience by providing valuable risk management insights. By accurately determining the appropriate lot size for your trades, you can optimize your strategy, enhance risk management, and increase your chances of success in the dynamic world of Forex trading.

Are you interested in learning more about the US100 lot size calculator and its applications? Share your questions or insights in the comments below.