In the ever-evolving world of forex trading, staying ahead of the curve is crucial. The forex bank order flow indicator is an indispensable tool that allows traders to decipher the intentions of institutional participants, gaining an unparalleled advantage in the fast-paced markets. Let’s delve into the world of bank order flow indicators, unraveling their significance and unlocking their potential for successful trading strategies.

Image: forexbotworthit.blogspot.com

Navigate the Currency Currents with Bank Order Flow Indicators

Bank order flow indicators provide a glimpse into the buy and sell orders placed by large financial institutions, revealing where the “smart money” is flowing. By analyzing these orders, traders can identify potential market turning points, anticipate price movements, and make informed trading decisions. Understanding the collective behavior of these market movers gives traders a significant edge in navigating the choppy waters of currency exchanges.

Unveiling the Secrets of Institutional Transactions

The beauty of bank order flow indicators lies in their ability to capture the intentions of large market players. Unlike retail traders who execute smaller transactions, institutions tend to execute larger orders over a longer time frame. By monitoring their order flow, traders can glean valuable insights into potential market moves and leverage that information to their advantage.

Essential Elements of Bank Order Flow Indicators

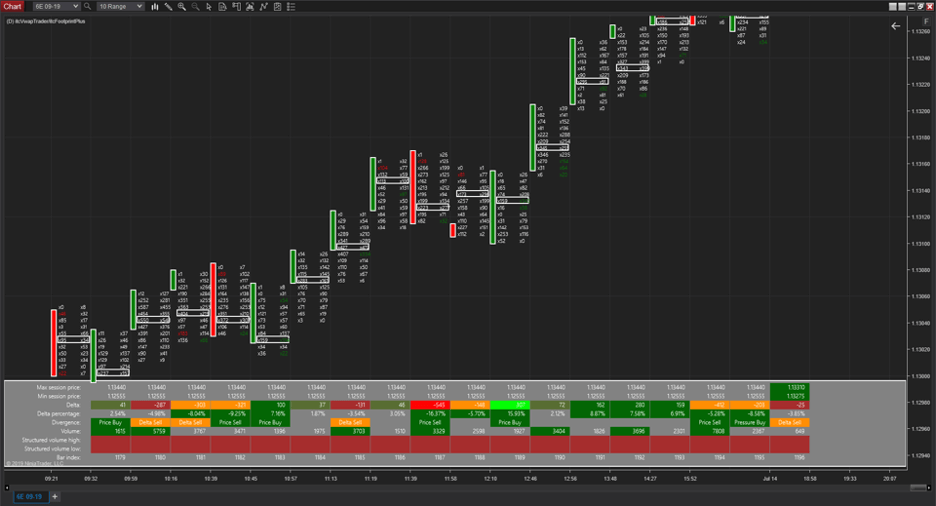

Understanding the anatomy of bank order flow indicators is paramount for successful application. These indicators provide the following crucial data points:

- Bid/Ask Depth: Depicts the number of orders at each price level, indicating the strength of the buy and sell pressure.

- Cumulative Delta: Tracks the net difference between buy and sell orders, showcasing the dominance of one side of the market.

- Volume Profile: Displays the volume traded at each price level, identifying areas of support and resistance.

Trading Tactics Enhanced by Bank Order Flow Indicators

The insights gleaned from bank order flow indicators can dramatically enhance trading strategies. Savvy traders employ these indicators in various ways, including:

- Market Direction Identification: Determine the prevailing market trend by identifying the dominant buying or selling pressure.

- Trade Entries and Exits: Time entries and exits precisely by identifying potential market reversals through order flow analysis.

- Stop Loss and Take Profit Placement: Optimize the risk-reward ratio by setting stop losses and take profits at key support and resistance levels revealed by the indicator.

Expert Tips for Utilizing Bank Order Flow Indicators

To maximize the potential of bank order flow indicators, follow these expert tips:

- Use Multiple Indicators: Combine bank order flow indicators with other technical and fundamental analysis tools to increase confidence in trading decisions.

- Understand Market Context: Consider the broader market sentiment, economic data, and news events to provide context to order flow patterns.

- Monitor Consistently: Stay vigilant and monitor bank order flow indicators closely to capture short-term shifts in market sentiment.

Frequently Asked Questions about Bank Order Flow Indicators

Q. Are bank order flow indicators suitable for all trading styles?

A. While they are primarily valuable for short-term traders, traders of all styles can benefit from incorporating them into their analysis.

Q. Can bank order flow indicators guarantee trading success?

A. No indicator can guarantee trading success; however, they can significantly improve decision-making and enhance trading strategies.

Q. How do I interpret the cumulative delta when analyzing bank order flow?

A. A positive cumulative delta indicates net buying pressure, while a negative delta suggests net selling pressure. Look for divergence between the delta and price action to identify potential market turning points.

Conclusion

The forex bank order flow indicator empowers traders with the ability to decode the intentions of institutional traders, providing a unique vantage point in the competitive world of forex trading. By wielding the power of these indicators, traders can enhance their strategies, anticipate market movements, and maximize their trading potential. Are you ready to ride the waves of the forex market with confidence and precision? Let the bank order flow indicator be your guiding force.

Image: howtotrade.com

Forex Bank Order Flow Indicator