As globetrotters and business travelers, the convenience of forex cards, also known as travel money cards, cannot be overstated. These cards enable seamless and secure transactions in foreign currencies, eliminating the need to carry large amounts of cash or deal with currency exchange hassles. However, understanding the per-transaction charges associated with forex cards is crucial to avoid unexpected costs and budget overruns.

Image: leverageedu.com

Navigating the Maze of Forex Card Per-Transaction Charges

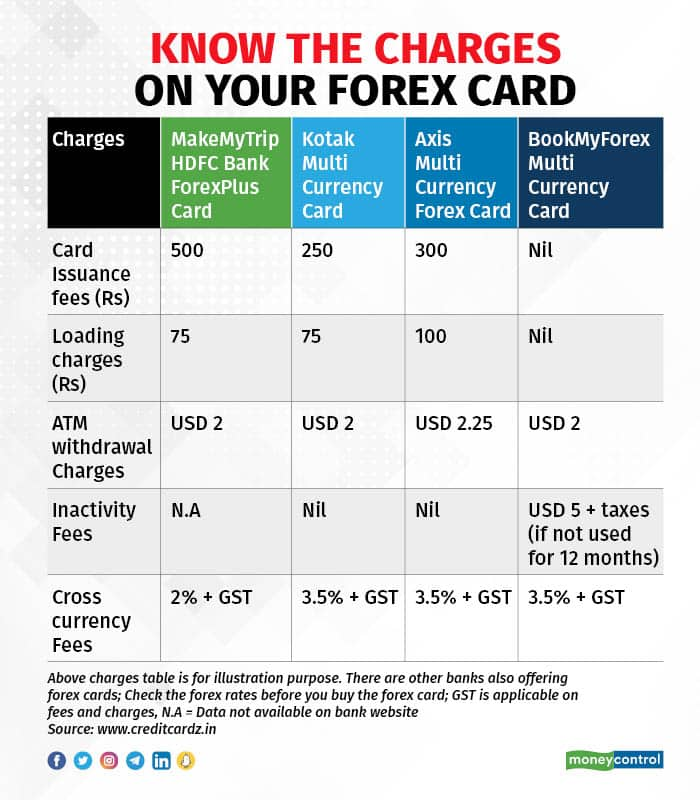

Forex cards, while offering a convenient mode of international payments, typically come with transaction fees levied for each use. These charges can vary depending on the card issuer, transaction type, and destination country. It’s important to scrutinize the fee schedule of your forex card provider before embarking on your travels to ensure you’re fully informed about the costs involved.

Transaction Fee: A Standard Charge

The most prevalent per-transaction charge is the transaction fee, often expressed as a percentage of the transaction amount. This fee can range from 1% to 3% and applies to all transactions made using the card, including purchases, ATM withdrawals, and currency conversions.

ATM Withdrawal Fees: Additional Costs for Cash Access

ATM withdrawals using a forex card can incur additional fees, typically charged by both the card issuer and the ATM operator. The card issuer may charge a withdrawal fee of around $5 to $10, while the ATM operator may impose its own surcharge. It’s advisable to use ATMs affiliated with your card issuer’s network to minimize these charges.

Image: www.moneycontrol.com

Currency Conversion Markup: Hidden Costs in Exchange Rates

When using a forex card to make purchases or withdraw cash in a currency different from the card’s base currency, a currency conversion markup comes into play. This markup, usually ranging from 2% to 5%, is added to the interbank exchange rate and can result in slightly less favorable exchange rates compared to direct currency exchange services.

Foreign Currency Transaction Fees: Additional Charges for Non-Base Currencies

Some forex cards impose foreign currency transaction fees for transactions made in a currency other than the card’s base currency. These fees, typically a fixed amount or a percentage of the transaction value, can vary based on the card issuer and the currency being used.

Minimizing Forex Card Transaction Charges: Tips for a Cost-Effective Journey

Armed with an understanding of the potential per-transaction charges, savvy travelers can adopt strategies to minimize these costs and make the most of their forex cards:

1. Choose a Card with Low Fees: Compare and Contrast Providers

Thoroughly research and compare the fee structures of different forex card providers before selecting one. Opt for a card with low transaction fees, ATM withdrawal fees, and currency conversion markups.

2. Prioritize Card Issuer’s Network ATMs: Reduce Withdrawal Charges

When withdrawing cash, prioritize ATMs affiliated with your card issuer’s network. This strategy can significantly reduce or even eliminate ATM withdrawal fees imposed by the ATM operator.

3. Plan Cash Withdrawals Wisely: Minimize ATM Fees

Plan your cash withdrawals in larger amounts to reduce the frequency of transactions and minimize the cumulative ATM fees. This approach is particularly effective if your card issuer charges a fixed withdrawal fee.

4. Use Local Currency as Much as Possible: Avoid Currency Conversion Markups

When making purchases, endeavor to use the local currency to avoid the currency conversion markup applied by your forex card provider. This practice ensures you get the most favorable exchange rates.

5. Be Mindful of Forex Card Expiration Dates: Avoid Unnecessary Fees

Forex cards typically have expiration dates, and using an expired card can result in additional charges. Regularly check your card’s expiration date and renew it promptly to ensure seamless transactions.

Forex Card Per Transaction Charges

Conclusion: Informed Decisions for Cost-Effective Forex Transactions

Understanding the per-transaction charges associated with forex cards empowers travelers and business professionals to make informed decisions about their foreign currency needs. By choosing a fee-friendly card, utilizing ATMs within the card issuer’s network, planning cash withdrawals wisely, and using local currencies whenever possible, you can effectively minimize costs and maximize the convenience of your forex card.

Remember, the fees and charges can vary widely between different forex card providers, so it’s crucial to conduct your due diligence and select the card that best aligns with your travel or business needs. With the right forex card and a strategic approach, you can enjoy the benefits of secure and hassle-free foreign currency transactions without breaking the bank on fees.