Introduction

Planning a trip to Thailand? Navigating the country’s vibrant markets and tranquil temples involves thoughtful preparation, including choosing the right method to manage your finances. Forex cards and traveler’s cheques are two popular options, each offering unique advantages and drawbacks. This article unravels the distinctions between these payment methods, empowering you to make an informed decision that aligns with your travel style and requirements.

Image: www.isranews.org

Forex Card: The Digital Convenience

Forex cards, also known as currency cards or travel cards, are prepaid cards that store multiple currencies, eliminating the hassle of carrying physical cash. They function like debit cards, allowing you to make purchases and withdraw local currency from ATMs. Top up the card before your journey and enjoy the freedom of cashless transactions throughout your adventure.

Benefits of Forex Cards:

-

Convenience: The digital nature of forex cards makes them incredibly convenient. No more bulky wallets or worries about carrying large sums of cash.

-

Multiple Currencies: Forex cards hold various currencies, enabling you to avoid unfavorable exchange rates when switching between different countries.

-

Security: In the unfortunate event of loss or theft, forex cards can be canceled and replaced promptly, minimizing the risk of significant financial loss.

-

Wide Acceptance: Forex cards are widely accepted by merchants and ATMs in Thailand, offering flexibility and ease of use.

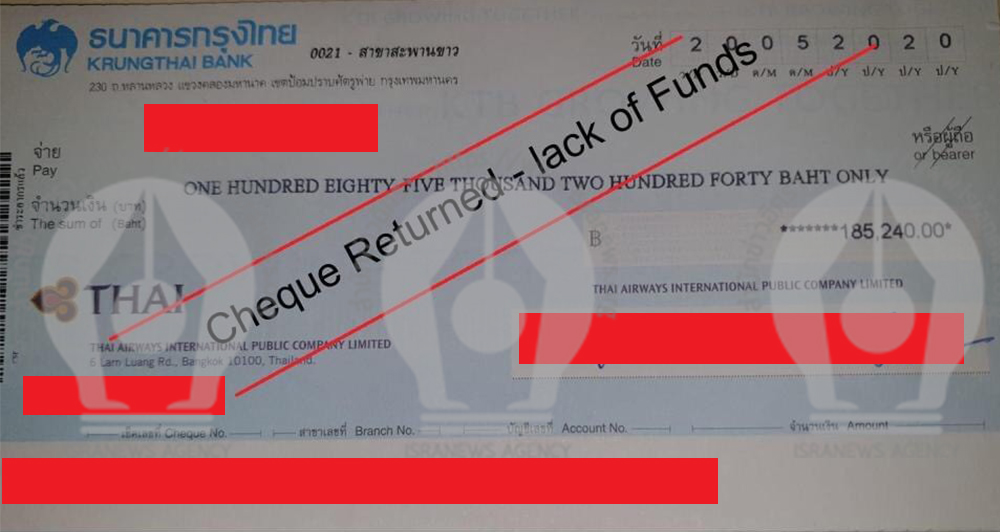

Traveler’s Cheques: The Traditional Security

Traveler’s cheques have been a trusted method of carrying funds abroad for decades. These paper-based cheques are issued in specific denominations, ensuring a secure and universally accepted form of payment.

Image: www.thaiembassy.com

Benefits of Traveler’s Cheques:

-

Security: Traveler’s cheques provide enhanced security compared to cash, as they require both a signature and countersignature to activate.

-

Universal Acceptance: Traveler’s cheques are accepted by a wide range of businesses in Thailand, both large and small.

-

Refundable: Lost or stolen traveler’s cheques can be replaced, offering peace of mind in case of emergencies.

Choosing the Right Option

The best choice between a forex card and traveler’s cheques depends on individual preferences and travel plans. Consider these factors to make an informed decision:

For Convenience and Flexibility: Forex Card

If seamless transactions and cashless convenience are your priorities, a forex card is the clear choice. Its digital format eliminates the burden of carrying cash, and the ability to hold multiple currencies provides cost-effective currency exchange.

For Maximum Security: Traveler’s Cheques

If security is your primary concern, traveler’s cheques offer an added layer of protection. Their signature and countersignature system minimizes the risk of unauthorized use, and the refundability aspect provides a safety net in the event of loss or theft.

Additional Considerations

Beyond the core benefits, consider these factors when choosing between forex cards and traveler’s cheques in Thailand:

-

Transaction Fees: Forex cards may incur transaction fees for ATM withdrawals and currency conversions. Traveler’s cheques typically have lower transaction fees, but some vendors may charge a processing fee when accepting them.

-

Expiration Dates: Traveler’s cheques have an expiration date, while forex cards typically do not. Keep this in mind when purchasing traveler’s cheques to avoid having to convert them back to cash before they expire.

-

Purchase Protection: Some forex cards offer purchase protection, providing coverage in case of damaged or lost purchases. This added benefit may be an incentive for those seeking comprehensive travel protection.

Forex Card Vs Travellers Cheque Thailand

Conclusion

Navigating the vibrant tapestry of Thailand should be an enriching experience, and choosing the right payment method can enhance your journey. Forex cards offer convenience, flexibility, and safety, while traveler’s cheques prioritize security and may be more suitable for those who prefer traditional payment methods. By weighing the advantages and drawbacks outlined in this article, you can make an informed decision that complements your travel style and ensures a smooth and memorable adventure in the Land