The Allure of Currency Trading

From the bustling exchanges of Manhattan to the frenzied trading floors of London, the world of foreign exchange (forex) captivates the imagination. This thrilling arena, where fortunes are won and lost, has long held sway as one of the most alluring pursuits in the financial landscape. But beneath the glamour and excitement lies a realm of complexity, where understanding the mechanics of forex is paramount to success.

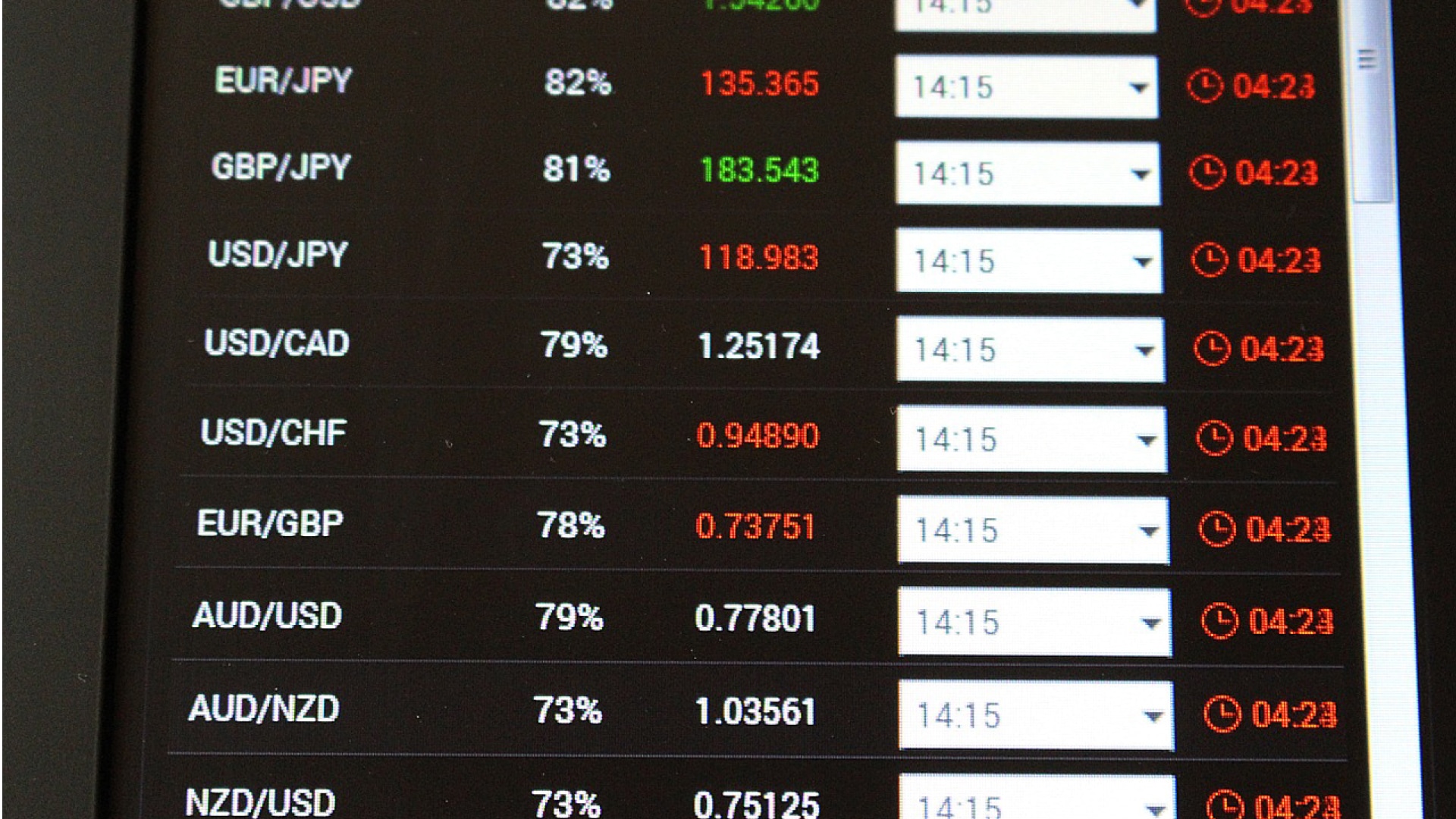

Image: corporatefinanceinstitute.com

Forex under the Banking Prism

Within the intricate tapestry of banking services, forex trading occupies a unique niche. Unlike traditional banking functions such as lending, savings, and money transfers, forex revolves solely around the buying and selling of currencies. This specialized sphere operates within a vast decentralized network involving banks, non-financial institutions, and individuals. The sheer volume of transactions executed daily, surpassing trillions of dollars, highlights the colossal scale of this global marketplace.

Definition of Forex Banking

Forex banking, in essence, encompasses the provision of services related to the exchange of currencies. This entails facilitating transactions between market participants, offering competitive exchange rates, and providing access to trading platforms. Forex banks act as intermediaries, enabling their clients to buy, sell, or exchange currencies at negotiated rates.

Services Provided by Forex Banks

The spectrum of services rendered by forex banks extends beyond mere currency conversion. They often furnish their clients with financial instruments such as forwards, futures, and options, enabling them to mitigate risk or speculate on currency movements. Additionally, they may offer advisory services, customized investment strategies, and access to real-time market data to empower their clientele.

Image: topforexbrokers.net

Evolution and Significance of Forex

The origins of forex can be traced back to the days of the gold standard, when nations pegged their currencies to the value of gold. However, the system’s demise after World War II gave rise to the flexible exchange rate regime, where currencies fluctuate freely against each other. This evolution, coupled with the advent of electronic trading platforms, propelled forex into becoming the robust and dynamic market it is today.

The significance of forex cannot be understated. It underpins international trade and commerce, facilitates cross-border investments, and allows central banks to manage their monetary policies. Moreover, it offers a plethora of opportunities for investors and speculators seeking to capitalize on currency movements.

Latest Trends and Developments in Forex

The forex market is constantly evolving, driven by technological advancements and geopolitical events. One prominent trend is the increasing popularity of retail forex trading, as technological advancements have made it more accessible to individuals. Another development to watch is the emergence of cryptocurrencies, which are gaining traction as alternative assets.

As global economies grapple with various challenges, the forex market remains a volatile and ever-changing landscape. Keenly monitoring these trends and developments is essential for traders seeking to make informed decisions and manage risk effectively.

Tips and Expert Advice for Forex Traders

- Understand the fundamental and technical factors influencing currency pairs.

- Set clear trading goals and develop a sound trading strategy.

- Manage risk by employing stop-loss orders and controlling leverage.

- Practice discipline and avoid overtrading to maintain objectivity.

Explanation of Tips and Expert Advice

Seasoned forex traders emphasize the importance of having a solid understanding of the geopolitical landscape and economic data that can influence currency pairs. Furthermore, developing a well-defined trading strategy that aligns with an individual’s risk tolerance and investment horizon is crucial.

Effective risk management is paramount, and traders should always implement stop-loss orders to limit potential losses. Additionally, controlling leverage is essential to avoid excessive risk exposure. Maintaining discipline and avoiding the temptation to overtrade helps preserve objectivity and prevent emotional decision-making.

FAQs on Forex Banking

-

Q: What is the difference between a forex bank and a traditional bank?

A: Forex banks specialize in currency exchange and related services, while traditional banks offer a wider range of financial products, including lending, savings, and investments. -

Q: Is forex trading suitable for everyone?

A: Forex trading involves risk, and individuals should carefully consider their financial situation, investment goals, and risk tolerance before engaging in it.

Forex Come Under Which Banking Services

Conclusion

Forex trading, while offering immense opportunities for profit, is a complex and demanding endeavor. Embarking on this journey requires a thorough understanding of the market, meticulous risk management, and a disciplined approach. By carefully weighing the information presented in this article, you can gain valuable insights to navigate the complexities of forex and potentially unlock its transformative power.

Are you ready to delve deeper into the enthralling world of forex? The time is now to explore its possibilities and leverage its potential to enhance your financial future.