In the ever-volatile world of forex trading, finding currencies that consistently provide reliable signals during the European session can be a daunting task. However, by understanding market dynamics and key indicators, traders can identify currencies that minimize false signals and maximize profit potential.

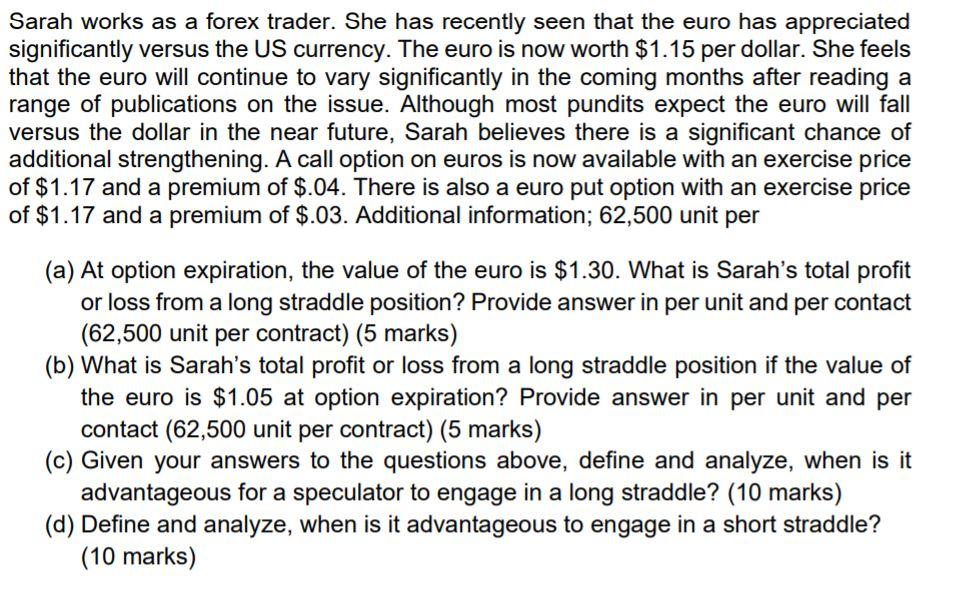

Image: www.chegg.com

Identifying Reliable Indicators

Before venturing into the European session, it’s crucial to equip yourself with a robust set of indicators that accurately gauge market sentiment and price movements. These indicators can include:

- Moving averages: These indicators smooth out price data by calculating average prices over a specified period, helping identify trends and potential reversal points.

- Bollinger Bands: These bands create a set of upper and lower boundaries around a moving average, providing insights into volatility and potential trading ranges.

- Fibonacci retracement levels: These levels identify areas of support and resistance based on historical price patterns, helping predict potential pullbacks or continuations.

Currency Pairs to Consider

Based on technical analysis and market insights, the following currency pairs have historically shown a high degree of reliability during the European session, minimizing false signals:

EUR/USD

The EUR/USD pair, also known as the euro-dollar, is the most widely traded currency pair globally. Its liquidity and high volatility make it a popular choice for traders seeking stable and reliable signals. The pair tends to exhibit stable patterns and clear trend formations during the European session, with key support and resistance levels often providing accurate trading opportunities.

Image: howtotradeonforex.github.io

GBP/USD

The GBP/USD pair, also called the pound-dollar, is another highly liquid currency pair with a strong presence during the European session. The British pound’s sensitivity to economic news and political events makes it subject to significant price swings. However, by carefully studying economic data and market sentiment, traders can capitalize on the pair’s volatility and minimize false signals.

USD/JPY

The USD/JPY pair, commonly referred to as the dollar-yen, is a currency pair with high liquidity and a relatively low spread. The Japanese yen tends to display stable patterns during the European session, with clear trend formations and predictable support and resistance levels. This makes it a reliable choice for traders seeking low-volatility trades with a high success rate.

USD/CHF

The USD/CHF pair, also known as the dollar-Swiss, is a currency pair with a reputation for stability and predictability. The Swiss franc is considered a safe haven currency, meaning it tends to strengthen during market turmoil. As a result, the USD/CHF pair often exhibits clear trends and well-defined trading ranges during the European session, offering opportunities for low-risk trades.

Expert Tips for Minimizing False Signals

In addition to selecting reliable currency pairs and technical indicators, traders can follow these expert tips to further minimize false signals during the European session:

- Use a combination of indicators: Relying on a single indicator can lead to misleading signals. Use a combination of indicators that complement each other, providing a more robust view of market sentiment.

- Consider market news: Economic news and political events can significantly impact currency prices. Monitor market news and economic data releases to make informed trading decisions.

- Implement risk management strategies: Stop-loss orders and position sizing are essential risk management tools that help mitigate potential losses. Determine appropriate stop-loss levels and trade sizes based on your risk tolerance.

Frequently Asked Questions

Q: Why is it important to avoid false signals?

A: False signals can lead to unprofitable trades and missed opportunities. By minimizing false signals, traders can improve their trading performance and increase their profitability.

Q: What is the best indicator for identifying reliable trading opportunities?

A: There is no single “best” indicator. A combination of indicators, such as moving averages, Bollinger Bands, and Fibonacci retracement levels, can provide a more comprehensive view of market sentiment.

Q: How often should I monitor my trades?

A: The frequency of trade monitoring depends on your trading style and risk tolerance. Scalpers may monitor their trades multiple times a day, while swing traders may monitor less frequently.

Forex Currencies That Don’T Give Wrong Signal At Europe Session

Conclusion

By understanding market dynamics, selecting the right currency pairs, and implementing appropriate risk management strategies, traders can significantly reduce the frequency of false signals during the European session. Remember, forex trading involves inherent risks, and it’s crucial to conduct thorough research and due diligence before making any trading decisions. If you are interested in enhancing your forex trading skills, consider taking online courses, attending webinars, and connecting with experienced traders to gain valuable insights and improve your trading performance.