In the fast-paced world of forex trading, having access to real-time and accurate data is crucial for making informed decisions. This is where forex data in Excel format comes into play, offering traders a powerful tool to analyze market trends, identify trading opportunities, and maximize their profits.

Image: investexcel.net

Forex data in Excel allows traders to import and manipulate large amounts of data, providing a comprehensive view of the market. This data can include currency pairs, bid and ask prices, historical charts, and fundamental indicators. By leveraging the power of Excel’s advanced formulas and functions, traders can perform complex calculations, create custom indicators, and develop their own trading strategies.

Understanding Forex Data in Excel

Forex data in Excel is typically organized in a table format, with each row representing a specific currency pair on a particular date. The columns in the table contain various pieces of information, such as:

- Currency Pair: This column identifies the two currencies involved in the trading pair, such as EUR/USD or GBP/JPY.

- Date: This column specifies the date on which the data was recorded.

- Open Price: This column shows the opening price of the currency pair at the beginning of the trading day.

- High Price: This column represents the highest price the currency pair reached during the trading day.

- Low Price: This column shows the lowest price the currency pair reached during the trading day.

- Close Price: This column reflects the closing price of the currency pair at the end of the trading day.

In addition to these core columns, forex data in Excel can also include other columns such as volume, bid price, ask price, and spread. These additional columns provide traders with a more comprehensive picture of the market, enabling them to make more informed trading decisions.

Benefits of Using Forex Data in Excel

Using forex data in Excel offers numerous benefits to traders, including:

- Data Visualization: Excel’s powerful charting capabilities allow traders to visualize forex data in various ways, such as line charts, bar charts, and candlesticks. This visual representation makes it easier to spot trends, identify patterns, and track market fluctuations.

- Data Analysis: Excel’s advanced formulas and functions enable traders to perform complex calculations and data analysis. They can calculate moving averages, Bollinger Bands, MACD, and other technical indicators to identify trading opportunities and assess market sentiment.

- Historical Analysis: Forex data in Excel allows traders to analyze historical market data to understand the past performance of different currency pairs. This information can help them make informed predictions about future market movements.

- Backtesting: Traders can use Excel to backtest their trading strategies by using historical data. This helps them evaluate the performance of their strategies and identify any areas for improvement.

- Automation: Excel supports automation through macros and add-ins, allowing traders to automate their trading processes. This can save time and reduce the risk of human error.

Overall, forex data in Excel provides traders with a powerful and versatile tool to make informed trading decisions and improve their trading performance.

Expert Insights and Actionable Tips

To maximize the benefits of using forex data in Excel, it’s essential to consult with experts in the field and follow these actionable tips:

- Data Accuracy: Always verify the accuracy of your forex data by comparing it with reliable sources.

- Technical Analysis: Utilize technical indicators and chart patterns to identify trading opportunities and assess market sentiment.

- Risk Management: Use stop-loss orders and position sizing to manage your risk exposure.

- Continuous Learning: Stay up-to-date on market news and events that may affect the forex market.

- Practice and Patience: Trading is a skill that takes time and practice. Don’t get discouraged by losses, and be patient in your pursuit of success.

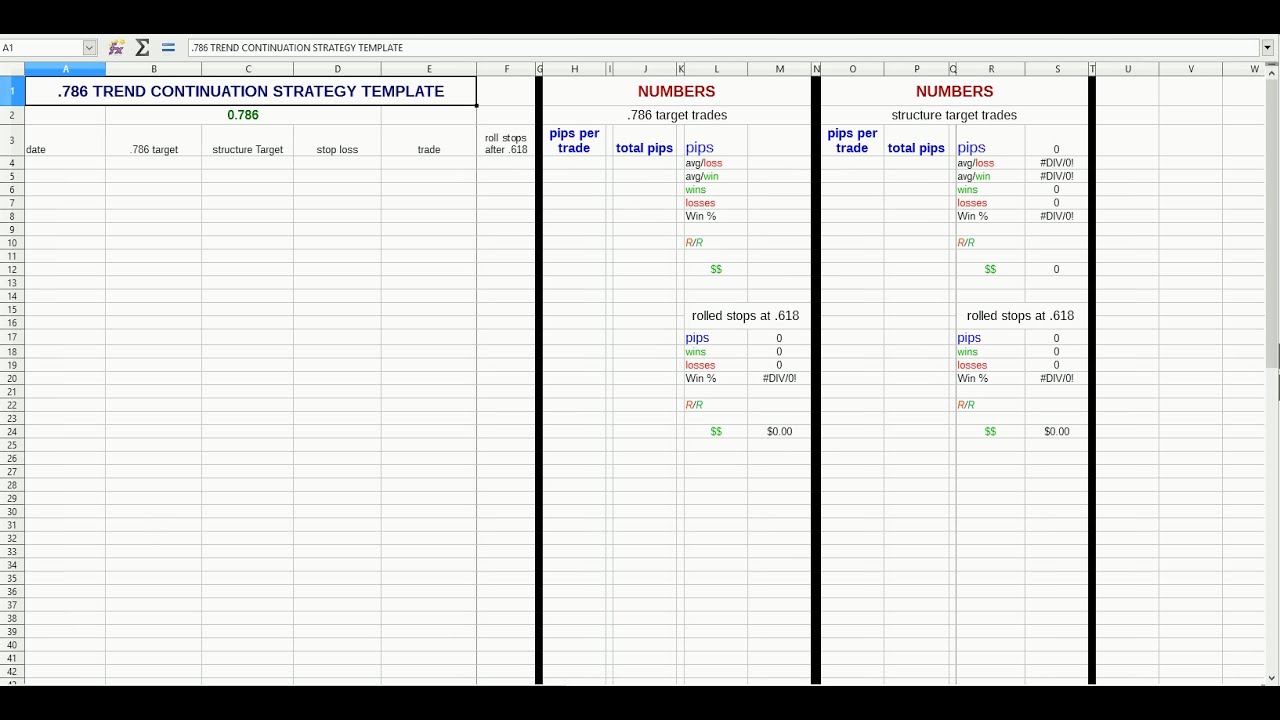

Image: www.youtube.com

Forex Data In Excel Format

Conclusion

Forex data in Excel is an invaluable resource for traders of all levels. By understanding the basics of forex data and applying the insights and tips outlined in this article, traders can enhance their trading strategy, increase their trading success rate, and achieve their financial goals. Remember, financial success is not a destination but a journey that requires dedication, learning, and a commitment to continuous improvement.