Introduction

In the ever-changing global marketplace, where currencies dance like whimsical sprites, importers in India face a formidable challenge: forex risk. The unpredictable shifts in exchange rates can wreak havoc on their bottom lines, turning profits into losses overnight. However, there is a financial superhero that can come to their rescue: forex hedging.

Image: www.pinterest.com

Forex hedging is a financial strategy that allows importers to protect themselves against adverse currency movements. It’s like wearing a protective shield that safeguards their profits from the wild swings of the forex market. By employing this strategy, importers can stabilize their cash flows, minimize losses, and ensure their businesses thrive even in turbulent economic waters.

Understanding Forex Hedging

Forex hedging is a mechanism through which importers and exporters can offset the risk associated with changes in foreign currency exchange rates. It involves entering into a contract with a financial institution that allows them to lock in an exchange rate for a future transaction.

Let’s say an Indian importer purchases goods from China. If the value of the Indian rupee (INR) against the Chinese yuan (CNY) falls before they pay for the goods, they will have to pay more INR to settle the transaction. This can result in a significant loss.

However, if the importer had entered into a forward contract, they would have locked in the exchange rate at the time the contract was executed. This means that even if the INR falls against the CNY, they will only have to pay the agreed-upon exchange rate, mitigating their risk of loss due to exchange rate fluctuations.

Types of Forex Hedging Instruments

Importers in India have access to various forex hedging instruments to suit their specific needs and circumstances. The most common types include:

- Forward Contracts: Legally binding agreements that set a fixed exchange rate for the future delivery or receipt of a defined amount of currency.

- Currency Options: Financial instruments that give importers the right, but not the obligation, to buy or sell a specific amount of foreign currency at a predetermined exchange rate on a specific date.

- Currency Swaps: Agreements between two parties to exchange cash flows in different currencies at a specified exchange rate on predetermined dates.

Benefits of Forex Hedging for Importers

The advantages of forex hedging for importers in India are compelling:

- Reduced Currency Risk: Hedging shields importers from exchange rate fluctuations, ensuring that their profit margins remain intact.

- Enhanced Profitability: By mitigating currency risk, importers can optimize their profitability and avoid the volatility of the forex market.

- Improved Cash Flow Management: Hedging allows importers to forecast their expenses accurately, enabling them to plan their cash flows more effectively.

- Increased Competitiveness: Importers can gain a competitive edge by eliminating currency volatility from their cost structure, allowing them to offer competitive prices to customers.

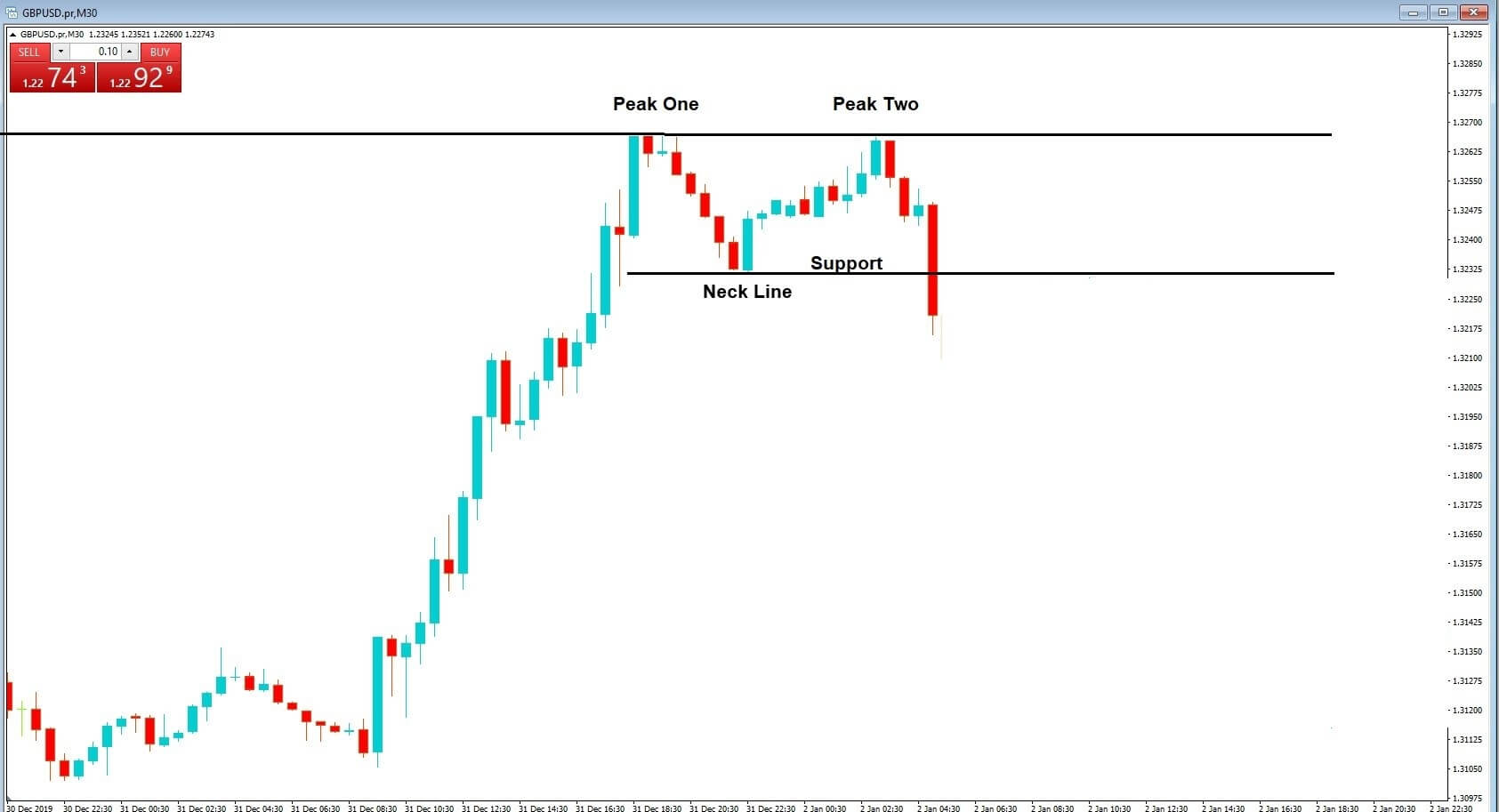

Image: www.forex.academy

How to Implement a Forex Hedging Strategy

Implementing a forex hedging strategy requires a comprehensive approach:

- Identify Risk: Importers should assess their exposure to forex risk by analyzing their import volumes and the currencies in which they transact.

- Choose Hedging Instrument: Select the most suitable hedging instrument based on the risk profile, maturity, and cost-benefit analysis.

- Execute the Hedge: Enter into a hedging contract with a reputable financial institution to lock in exchange rates.

- Monitor and Manage: Regularly monitor the effectiveness of the hedge and make adjustments as needed to ensure ongoing protection.

Forex Hedging For Importers In India

Conclusion

Forex hedging is a powerful tool that empowers importers in India to navigate the complexities of the global currency market with confidence. By embracing this strategy, they can safeguard their profits, enhance cash flow management, and drive long-term business success. Embrace forex hedging as your secret weapon against currency volatility and watch your business soar to new heights.