The world of finance can be a bewildering labyrinth, with enigmatic terms and intricate concepts that leave many scratching their heads. Among these mysteries lies the enigmatic realm of forex, the foreign exchange market that governs global currency transactions. Understanding the role of forex in current and capital accounts is crucial for navigating the complexities of international trade and economic growth. In this comprehensive guide, we embark on a journey to demystify this intriguing subject, unraveling the intricacies of forex and its impact on nations’ financial well-being. Buckle up, as we venture into the uncharted waters of forex, exploring its profound significance in shaping the economic landscape.

Image: cacube.in

Deciphering the Enigma: Forex and Its Impact

Forex, the abbreviation for foreign exchange, embodies the global marketplace where currencies are traded and exchanged. This dynamic arena facilitates international commerce, enabling countries to purchase goods and services from one another. The interplay of supply and demand dictates the fluctuating values of currencies, mirroring the ever-changing economic conditions and political landscapes. Forex serves as the lifeblood of global trade, connecting economies and fostering economic growth.

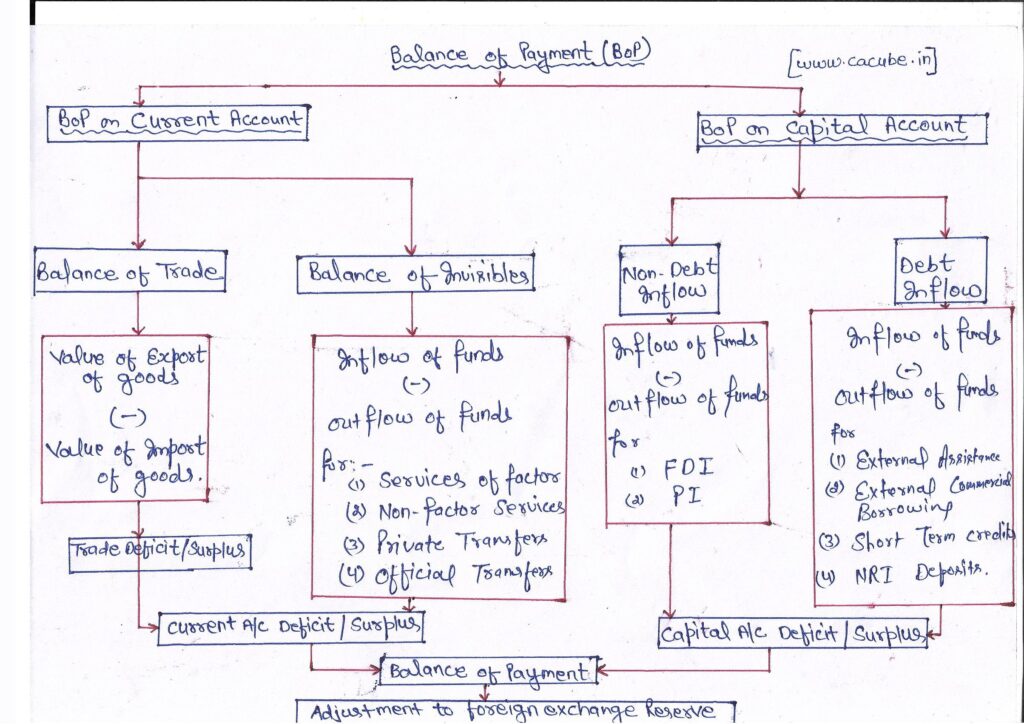

Navigating the Currents: Forex in Current Accounts

Current accounts meticulously record the flow of goods and services between countries over a specific period, typically a quarter or a year. These accounts capture the value of exports, imports, and other income streams, providing a snapshot of a nation’s balance of trade. An account surplus arises when exports exceed imports, indicating a net influx of foreign currency. Conversely, an account deficit occurs when imports surpass exports, resulting in a net outflow of currency. Forex plays a pivotal role in managing current accounts, as central banks intervene to stabilize currency fluctuations that may arise due to trade imbalances.

Venturing into Capital: Forex in Capital Accounts

Capital accounts delve into the realm of long-term investments, encompassing foreign direct investment (FDI), portfolio investment, and other capital flows. FDI signifies investments made by companies in foreign subsidiaries, while portfolio investment involves purchases of stocks, bonds, and other financial instruments. Capital accounts provide insights into the attractiveness of a country’s investment climate, reflecting the confidence of international investors. Forex serves as the gateway for capital flows, facilitating the movement of funds across borders and influencing a nation’s economic growth prospects.

Image: topforexbrokers.net

Unveiling the Interwoven Tapestry

The interplay between current and capital accounts presents a captivating narrative of a country’s economic trajectory. Current account surpluses often attract capital inflows, as investors seek higher returns on their investments. Conversely, current account deficits may lead to capital outflows, as investors seek more stable environments for their capital. Understanding the intricate relationship between forex, current accounts, and capital accounts provides valuable insights into a nation’s economic health and prospects for future growth.

Harnessing the Forex Advantage: Strategies for Success

In the ever-evolving world of forex, strategic decision-making is paramount for maximizing returns. For individuals and businesses alike, understanding market trends, interpreting economic data, and employing sound risk management techniques are essential. Leveraging the expertise of experienced financial professionals can provide invaluable guidance in navigating the complexities of forex trading. By proactively managing forex risks and seizing opportune moments, individuals and businesses can unlock the potential of this dynamic market, harnessing its power to drive economic growth and financial prosperity.

Forex In Current Account Or Capital Account

Conclusion: Embracing the Currency Conundrum

Forex, current accounts, and capital accounts are intertwined threads in the tapestry of global finance. Understanding their intricate interplay is crucial for businesses, investors, and policymakers alike. By unraveling the complexities of this dynamic ecosystem, we unlock the potential to navigate the ever-changing financial landscape with confidence and strategic foresight. Stay abreast of market trends, seek expert guidance, and embrace the challenges and opportunities that forex presents. Remember, knowledge is the key that unlocks the door to financial success in the ever-evolving world of forex.