Introduction

Image: otnitcwotis.blogspot.com

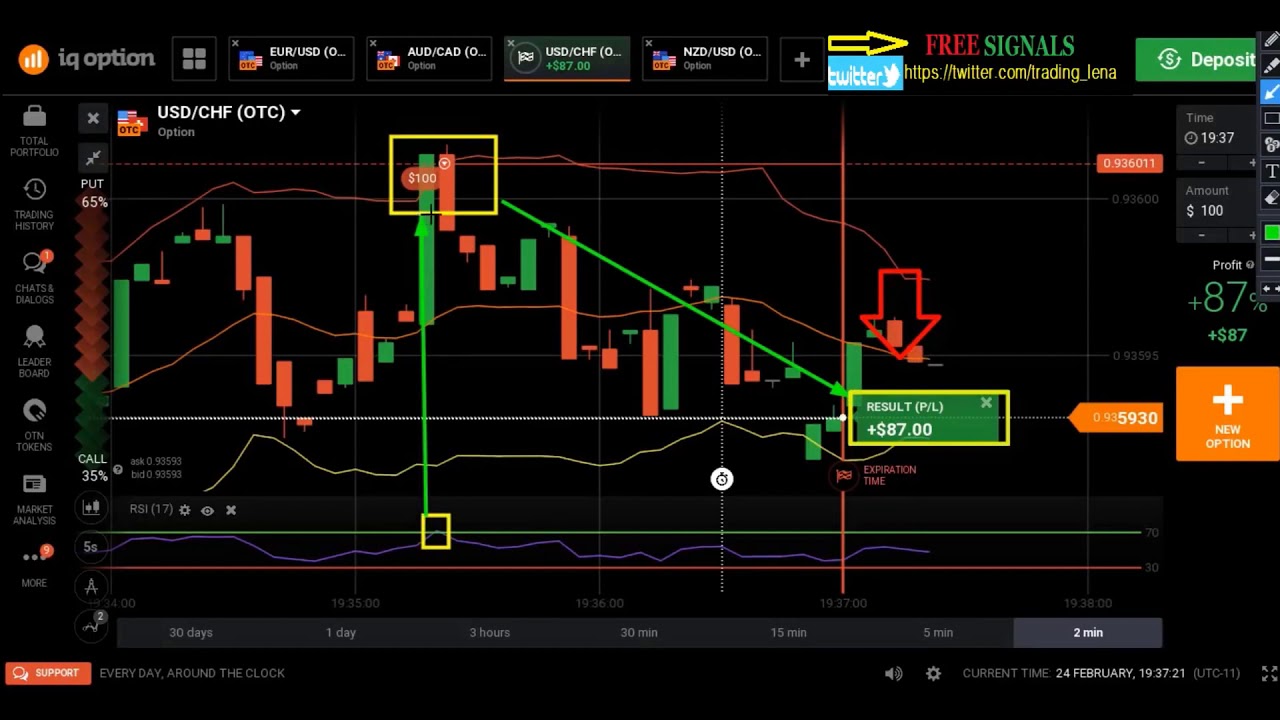

In the dynamic arena of forex trading, mastering the art of understanding and utilizing the impact of expiration time is paramount to maximizing your trading potential. IQ Option, a cutting-edge online trading platform, recognizes this significance and empowers its users with a comprehensive range of expiration time options. Understanding how expiration time influences the success of your trades is crucial, providing you with a profound advantage in the ever-evolving forex market.

Understanding Expiration Time

Expiration time is the predetermined date and time at which an options contract ceases to exist. In IQ Option forex trading, you have the flexibility to select an expiration time that aligns with your trading strategy. A short-term trader may favor expirations within minutes or hours, while a long-term investor may prefer expirations measured in days or even months.

Impact on Trade Duration

The expiration time you choose effectively determines the duration of your trade. Short-term expirations demand quick decision-making and agility, whereas extended expirations allow you to make more calculated decisions and adopt a strategic approach. Selecting an appropriate expiration time is essential for managing risk and aligning your trade with your specific investment goals.

Influence on Market Volatility

Market volatility plays a significant role in forex trading. Significant price movements can occur before the expiration of the contract, potentially leading to substantial profit or loss. Therefore, choosing an appropriate expiration time is crucial. If you anticipate significant market fluctuations, a shorter expiration time allows you to capitalize on these movements. Conversely, a longer expiration time may be more suitable when the market is relatively stable.

Relationship with Profitability

Expiration time has a direct impact on your profitability. Understanding the precise moment at which your option expires is crucial for assessing its value. If the option closes “in-the-money,” or at a favorable price, you stand to gain a profit. However, if the option expires “out-of-the-money,” or at an unfavorable price, your investment will incur a loss. Selecting an expiration time that balances the potential for profit against the risk of loss is a vital element of successful forex trading.

Managing Risk

Proper risk management is the cornerstone of any effective trading strategy. Expiration time plays a pivotal role in managing risk. Short-term expirations, while offering the potential for quick gains, carry a greater degree of risk due to their sensitivity to market fluctuations. Conversely, longer expirations provide more breathing room, allowing traders to make well-calculated decisions and adjust their strategy as needed.

Customization in IQ Option

IQ Option empowers its users with an impressive range of expiration time options, enabling traders to customize their trading experience. From short-term expirations measured in seconds to long-term expirations extending to days or weeks, IQ Option offers flexibility that caters to diverse trading styles.

Conclusion

Mastering the concepts surrounding expiration time is a game-changer in the world of IQ Option forex trading. By understanding the implications of different expiration periods on trade duration, market volatility, profitability, risk management, and customizable options, you gain an edge over other market participants. Embrace this knowledge, continuously refine your trading strategy, and reap the rewards of savvy expiration time management.

Image: www.berotak.com

Forex In Iq Option Expiration Time