In today’s interconnected financial world, forex investments have emerged as a sought-after avenue for savvy investors seeking diversification and potential returns. However, understanding the tax implications of these investments is paramount to ensure compliance and optimize financial strategies.

Image: trade-in.forex

Navigating the Tax Labyrinth

Under the Income Tax Act, forex investments fall under the ambit of “profits and gains from business or profession.” Consequently, any profits realized from forex trading are subject to income tax at the applicable rates based on the individual’s tax bracket. This includes both short-term capital gains (held for less than 24 months) and long-term capital gains (held for 24 months or more). However, certain exemptions and deductions may apply, depending on the specific circumstances of the investment.

Breaking Down the Exemptions

Specific exemptions are available for forex investments under Section 10(38) of the Income Tax Act. Notably, profits or gains from forex investments do not constitute business income if they are derived from an individual’s own funds and not carried out through a regular course of business. In such cases, these gains are exempted from income tax and are not considered taxable under the Income Tax Act.

Additionally, forex investors may be eligible for certain deductions to reduce their taxable income. These deductions may include expenses incurred in the course of forex trading, such as brokerage fees, trading platform charges, and research and analysis costs. By claiming these deductions, investors can lower their taxable income, resulting in reduced tax liability.

Trading Strategies and Tax Consequences

The tax implications of forex investments can vary depending on the trading strategies employed. For instance, day trading, which involves frequent buying and selling of currencies within a short period, typically results in short-term capital gains. These gains are taxed at the ordinary income tax rate based on the investor’s tax bracket.

On the other hand, swing trading involves holding currency positions for a longer period, usually days or weeks. Profits realized from swing trading qualify as long-term capital gains, which are subject to a lower tax rate compared to short-term capital gains. Thus, investors may consider adopting longer-term trading strategies to minimize their tax burden.

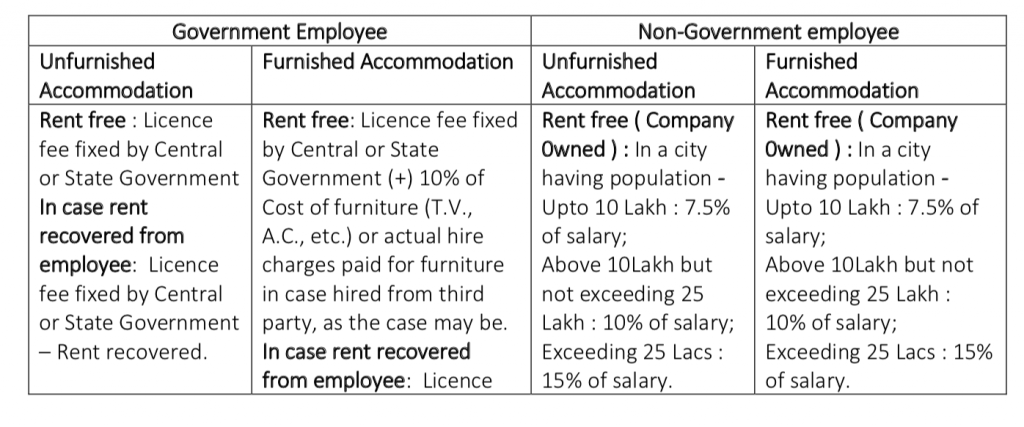

Image: www.consultease.com

Embracing Technology for Tax Optimization

In the digital age, technology offers powerful tools to optimize tax strategies for forex investments. Automated trading platforms, for example, can help investors track their trades, calculate gains and losses, and generate tax reports. These tools provide valuable insights into trading activities and aid in accurate tax reporting.

Moreover, online tax calculators are readily available to assist forex investors in estimating their tax liabilities and making informed decisions. By leveraging technology, investors can enhance their tax compliance and potentially reduce their overall tax burden.

FAQs on Forex Investment Taxability

- Q: What are the tax implications of forex investments in India?

- A: Forex investments are subject to income tax under the Income Tax Act. Profits and gains from forex trading are taxed as business income, with short-term capital gains taxed at the ordinary income tax rate and long-term capital gains taxed at a lower rate.

- Q: Are there any exemptions available for forex investors?

- A: Yes, profits from forex investments conducted using an individual’s own funds and not carried out through a regular course of business are exempt from income tax under Section 10(38) of the Income Tax Act.

- Q: How can I reduce my tax liability on forex investments?

- A: Forex investors can consider adopting longer-term trading strategies, such as swing trading, to qualify for long-term capital gains tax rates. Additionally, they can claim eligible deductions for expenses incurred in the course of trading, such as brokerage fees and research costs.

Forex Investment Taxability Income Tax Act

Conclusion

Navigating the complexities of forex investment taxability under the Income Tax Act requires a thorough understanding of the relevant provisions. By leveraging exemptions, deductions, and appropriate trading strategies, investors can optimize their tax liabilities and maximize their returns. Embracing technology for tax optimization can further enhance tax compliance and decision-making.

Forex investments offer immense potential for diversification and capital growth, but it is essential to factor in the tax implications to make informed and strategic investment choices. Whether you are an experienced forex trader or a novice just starting your journey, understanding the tax aspects of these investments is crucial for maximizing your financial success and ensuring tax compliance.