Image: preferforex.com

In the dynamic world of forex trading, long-term strategies are the pillars of sustainable profitability. To navigate the evolving market landscape and secure consistent gains, traders rely on a meticulously crafted arsenal of strategy indicators. This comprehensive guide will delve into the realm of forex long-term strategy indicators, empowering you with the knowledge and tools to forge a path towards trading triumph.

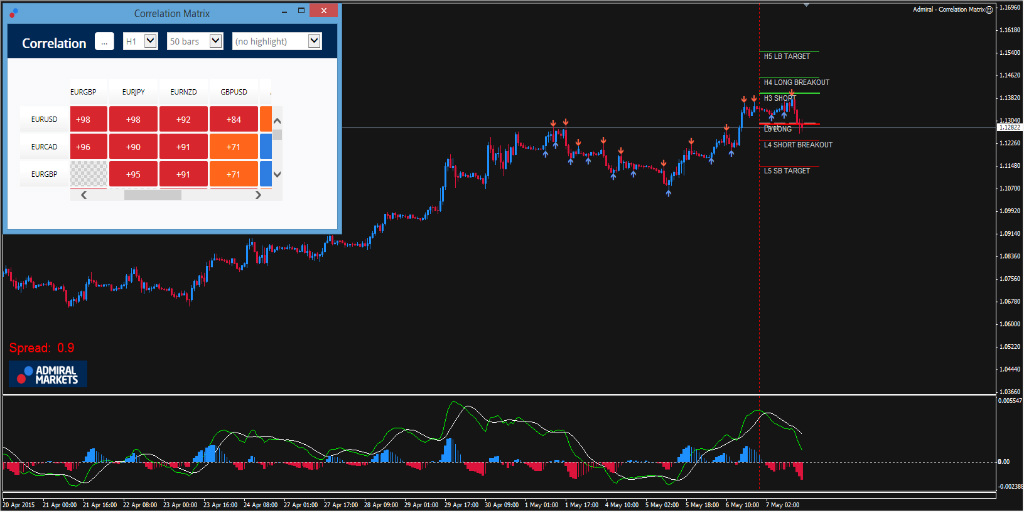

Unveiling the Forex Long-Term Strategy Indicator Suite

Strategy indicators are technical analysis tools that provide valuable insights into market behavior. By interpreting price action, volume, and momentum data, these indicators help traders identify market trends, predict price movements, and make informed trading decisions. Long-term strategy indicators focus on patterns that evolve over extended periods, providing a deep understanding of market dynamics.

Essential Long-Term Strategy Indicators for Forex

-

Moving Averages (MAs): MAs smooth out price fluctuations, revealing underlying trends. Longer-duration MAs (e.g., 50-day, 200-day) serve as crucial trend identifiers.

-

Relative Strength Index (RSI): RSI measures price momentum, identifying overbought and oversold conditions. It helps traders determine market sentiment and potential trend reversals.

-

Exponential Moving Average (EMA): EMAs react more quickly to price changes compared to MAs. They provide timely signals and can forecast potential trend continuations.

-

Ichimoku Cloud: The Ichimoku Cloud combines multiple indicators into a single representation. It visualizes support and resistance levels, market momentum, and trend direction.

-

Fibonacci Levels: Fibonacci levels are mathematical retracement and projection levels based on historical price patterns. They help traders identify areas of potential price support and resistance.

Utilizing Indicators for Strategic Advantage

-

Trend Identification: Long-term indicators provide clear signals regarding market trends. Uptrends are indicated by rising MAs, while downtrends are indicated by falling MAs.

-

Support and Resistance Levels: Indicators like Ichimoku Cloud and Fibonacci levels identify areas of strong support and resistance. These levels act as potential turning points in price action.

-

Momentum Assessment: RSI and EMAs gauge market momentum. Rising momentum indicates a strengthening trend, while falling momentum suggests a potential trend reversal.

-

Timely Market Entries: Indicators provide timely signals for market entries. For example, a breakout above a key EMA can indicate a bullish breakout opportunity.

Harnessing Expert Insights and Practical Tips

-

Expert Advice: Listen to renowned traders, read their books, and attend webinars to gain valuable insights and trading strategies.

-

Backtesting and Demotrading: Test your indicators and trading strategies using historical data (backtesting) or through demo accounts (demo trading). This helps refine your approach and minimize risks.

Conclusion: A Path to Trading Excellence

Mastering long-term forex strategy indicators is the cornerstone of consistent trading success. By leveraging these tools, traders can gain a deep understanding of market behavior, identify market trends, and make informed trading decisions. This guide has equipped you with the knowledge and resources necessary to construct a formidable long-term trading strategy. Embrace the power of strategy indicators, embark on your trading journey, and conquer the forex market!

Image: admiralmarkets.com

Forex Long Term Strategy Indicators