In the realm of foreign exchange (forex) trading, the strategy of “matching low and matching high” is a fundamental technique employed by traders to capitalize on market fluctuations and maximize profitability. This approach involves identifying low and high points in the price movements of currency pairs and executing trades at or near these turning points.

Image: www.dailyfx.com

Matching low refers to buying a currency pair when its price has reached a low point, while matching high entails selling a currency pair when it has hit a high point. By timing entry and exit points with precision, traders aim to enter trades at favorable prices and take profit when the price turns in the anticipated direction.

How to Identify Matching Low and High Points

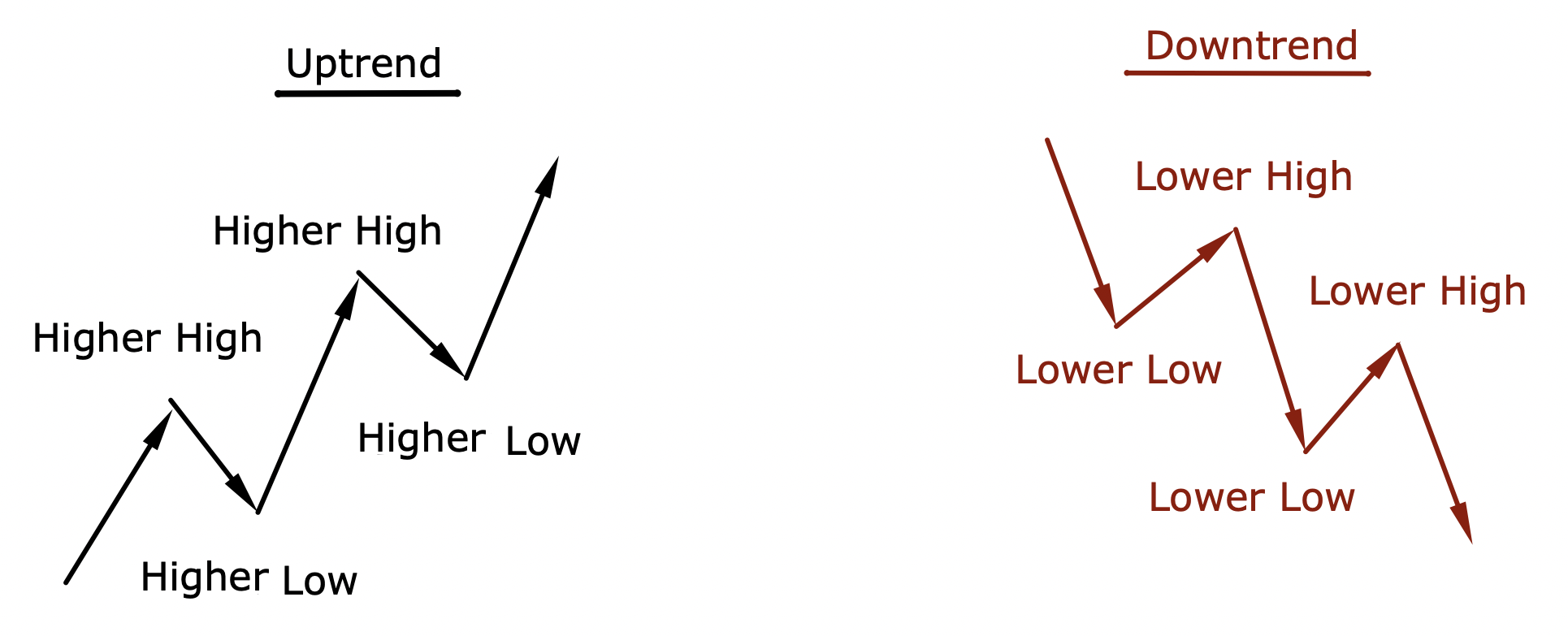

Identifying matching low and high points requires skillful analysis of technical indicators, such as support and resistance levels, moving averages, and candlestick patterns. Support levels mark points where prices have historically found buyers, indicating potential areas for buying, while resistance levels signal potential areas for selling as prices have faced resistance at those points in the past.

Moving averages, such as the moving average convergence divergence (MACD) and exponential moving average (EMA), help traders assess the trend and momentum of the market. Candlestick patterns, like the engulfing pattern, pin bar, and doji, provide visual cues and insights into potential trend reversals.

Matching Low and High in Action

Consider the hypothetical example of the EUR/USD currency pair. If the price falls sharply to $1.0500, creating a new low, a trader might enter a long trade (buy EUR/USD) with the expectation that the price will bounce from this support level. Conversely, if the price of EUR/USD rises to $1.1000, hitting a new high, a trader might initiate a short trade (sell EUR/USD), anticipating a reversal to previous resistance.

Tips and Expert Advice

To enhance your matching low and matching high strategy, consider these tips and expert advice.

- Manage risk by setting clear stop-loss orders to limit potential losses.

- Use a trading platform that offers advanced technical analysis tools and real-time market data.

- Practice patience and discipline when entering and exiting trades, avoiding emotional decision-making.

- Stay informed about market news and economic events that could impact currency prices.

- Consider using a demo account to test your strategy and build confidence before trading with real funds.

Image: www.urbanforex.com

Frequently Asked Questions

Q: What is the difference between matching low and selling low?

A: Matching low involves buying a currency pair at a low point with the expectation of an upward price movement, while selling low refers to exiting a long position at a loss when the price falls below a certain level.

Q: Can matching low and matching high be used with all currency pairs?

A: Yes, the matching low and matching high strategy can be applied to any currency pair, but some pairs, like EUR/USD and GBP/USD, may offer more trading opportunities due to their high liquidity and volatility.

Q: How do I know when to exit a matching low trade?

A: Trailing stop-loss orders can be used to gradually raise your stop-loss as the price moves in your favor. When the price reverses, the stop-loss will trigger, locking in your profits.

Forex Maching Low And Maching High

Conclusion

Mastering the art of matching low and matching high in forex trading requires patience, discipline, and a thorough understanding of technical analysis. By identifying low and high points accurately, traders can increase their chances of entering and exiting trades with favorable odds. Whether you’re a seasoned trader or just starting out, this strategy can enhance your trading toolkit and potentially boost your profitability.

Are you ready to explore the world of forex trading and leverage the power of matching low and matching high?