Introduction

Image: www.reviewhome.co

The world of forex trading, a high-stakes arena of currency exchange, demands precision and a razor-sharp understanding of market trends. In this dynamic realm, every edge counts, and mobile traders are increasingly turning to the power of technical indicators to navigate the complexities of the financial landscape. Among these, the pivot point indicator stands out as a beacon of guidance, offering invaluable insights into potential market reversals and support and resistance levels. By harnessing the capabilities of your mobile device and the pivot point indicator, you can unlock a gateway to empowered and profitable trading decisions.

Delving into the Pivot Point Indicator: A Cornerstone of Market Intelligence

Pivot points serve as reference points that delineate critical price levels in the forex market. They are calculated based on the previous trading session’s high, low, and closing prices, providing a comprehensive snapshot of price fluctuations and market sentiment. By analyzing the relationship between the current price and these pivot points, traders can gain a deeper understanding of potential market movements and identify potential trading opportunities.

Harnessing the Power of a Mobile Forex Trader with the Pivot Point Indicator

The advent of mobile forex trading platforms has revolutionized the way traders access and analyze market data. By equipping your mobile device with a forex trader app that seamlessly integrates the pivot point indicator, you can enjoy the flexibility and convenience of real-time price monitoring and charting on the go. This unparalleled mobility enables you to seize trading opportunities in a time-sensitive market, empowering you to execute trades with precision and confidence.

Navigating the Pivot Point Ecosystem

The pivot point indicator encompasses a range of key components that collectively inform trading decisions. These pivotal points include the central pivot point (PP), which serves as the benchmark from which other pivot points are derived. Resistance levels (R1, R2, R3) lie above the PP and indicate potential resistance or selling pressure. Conversely, support levels (S1, S2, S3) below the PP signal potential support or buying opportunities.

Mastering Pivot Point Strategies for Enhanced Trading

Effective utilization of the pivot point indicator requires a keen understanding of trading strategies that leverage its insights. One popular strategy is to establish support and resistance levels based on the pivot points. When the price rises above a resistance level or falls below a support level, it can indicate a potential trend reversal and a subsequent trading opportunity. By aligning your trading actions with these trend reversals, you can increase your chances of profitable trades.

Unlocking the Value of Expert Insights

The forex market is an ever-evolving landscape that demands continuous learning and adaptation. To enhance your understanding of pivot point trading, seek guidance from seasoned traders and market experts. Industry thought leaders often share valuable insights, trading strategies, and market analysis that can further refine your trading acumen. By tapping into the collective wisdom of experts, you can refine your trading strategies and make more informed decisions.

Embracing a Mobile Trading Revolution

The convergence of mobile forex trading and the pivot point indicator has created a formidable alliance, empowering traders with unprecedented access to market intelligence and real-time trading capabilities. By embracing this mobile revolution, you can elevate your trading journey, unlock new levels of profitability, and confidently navigate the dynamic waters of the forex market.

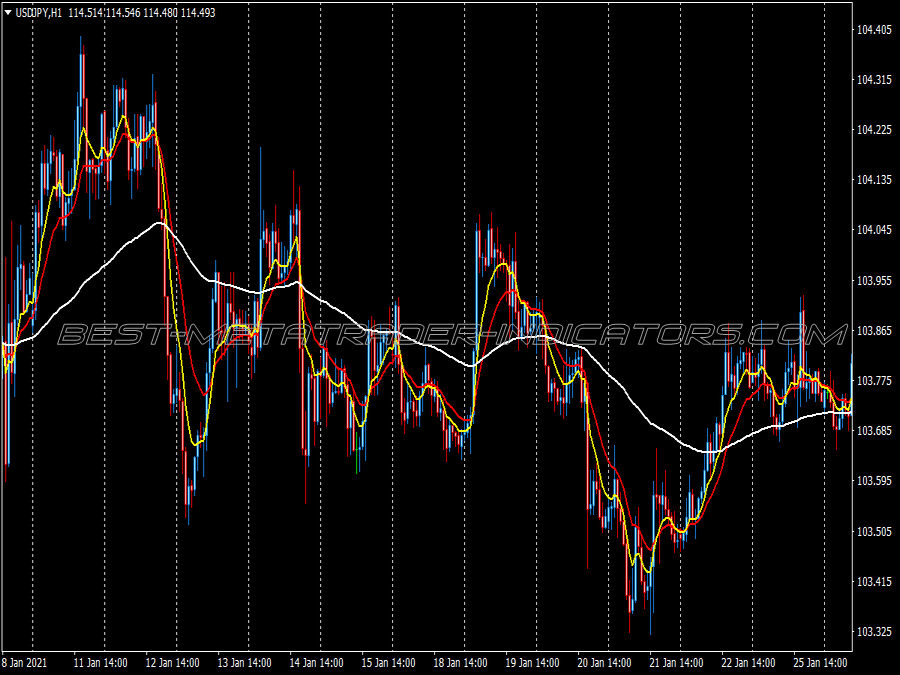

Image: www.best-metatrader-indicators.com

Forex Mobile Trader With Pivot Point Indicator

https://youtube.com/watch?v=gFxaf8NCYTk