Unveiling the Secrets of Forex: A Comprehensive Guide to Previous HH LH LL HL

Image: forum.amibroker.com

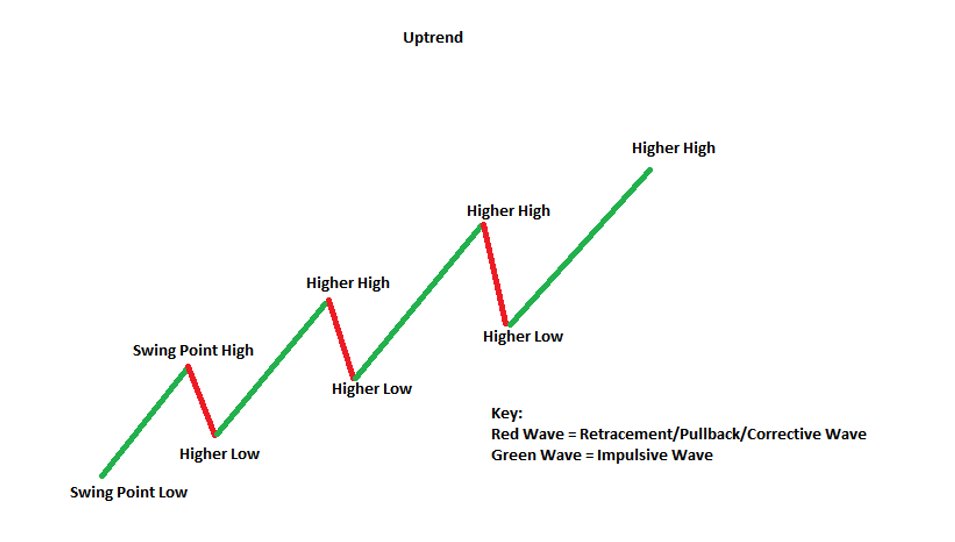

In the turbulent waters of forex trading, identifying market trends is crucial for success. One of the most powerful technical analysis tools is the HH LH LL HL pattern, which provides valuable insights into price movements and potential trading opportunities. In this comprehensive article, we delve into the intricacies of this pattern, empowering you with the knowledge and strategies to navigate the forex market with confidence.

What is HH LH LL HL?

HH LH LL HL is an abbreviation for a price pattern consisting of four distinct points:

- HH (Higher High): The highest point reached during an uptrend.

- LH (Lower High): The highest point reached after a pullback in an uptrend, lower than the previous HH.

- LL (Lower Low): The lowest point reached during a downtrend.

- HL (Higher Low): The lowest point reached after a rally in a downtrend, higher than the previous LL.

Significance in Forex Trading

The HH LH LL HL pattern offers valuable insights into market sentiment and potential price reversals. Traders can use this pattern to:

- Identify trend direction: When the HHs and HLs are consistently rising, it indicates an uptrend. Conversely, when the LLs and LHs are consistently falling, it signifies a downtrend.

- Anticipate trend reversals: A break below a LL or above a HH can signal a potential trend reversal.

- Set entry and exit points: Traders can use support and resistance levels created by the HHs, LHs, LLs, and HLs to identify potential trading zones.

How to Identify HH LH LL HL Pattern

Identifying a HH LH LL HL pattern involves observing the following criteria:

- The HH should be higher than the LH.

- The LH should be lower than the HH.

- The LL should be lower than the LH.

- The HL should be higher than the LL.

- The pattern should occur within a clear trend.

Variations of HH LH LL HL Pattern

Besides the classic HH LH LL HL pattern, there are several variations traders should be aware of:

- Inverted HH LH LL HL: This pattern forms when the LH, LL, and HL are higher than the HH, indicating a potential downtrend reversal.

- Truncated HH LH LL HL: This pattern forms when the LH or HL is missing, indicating a weaker potential for trend reversal.

- Double Bottom HH LH LL HL: This pattern forms when the LH and LL are formed within a previous HH LH LL HL pattern, strengthening the likelihood of an uptrend reversal.

Trading Strategies Using HH LH LL HL Pattern

Traders can incorporate the HH LH LL HL pattern into various trading strategies. Some common strategies include:

- Breakout trading: Traders can enter trades when the price breaks above a previous HH (uptrend) or below a previous LL (downtrend).

- Pullback trading: Traders can look for opportunities to enter trades in the direction of the trend during pullbacks at LHs or HLs.

- Support and resistance trading: Traders can use the HHs and LHs (in an uptrend) or the LLs and LHs (in a downtrend) as support and resistance levels.

Conclusion

The HH LH LL HL pattern is an invaluable tool for forex traders. By understanding the nuances of this pattern, traders can gain a competitive edge in identifying market trends, anticipating reversals, and making informed trading decisions. Remember, technical analysis is an art, not a science. Always supplement your analysis with other indicators and factors to make sound trading choices. Embrace the power of HH LH LL HL and unlock the secrets to successful forex trading.

Image: equity.guru

Forex Previous Hh Lh Ll Hl