Prologue: A Tale of Two Currencies

In the bustling realm of global finance, where economies intertwine and currencies dance, the relationship between the US dollar and the Indian rupee stands out as a captivating saga. This dynamic duo, representing two of the world’s largest economies, shapes international trade, influences investment decisions, and impacts the lives of countless individuals. Embark on a journey with us as we delve into the intricate world of forex rates, unraveling the factors that drive this enigmatic dance between the US dollar and the Indian rupee.

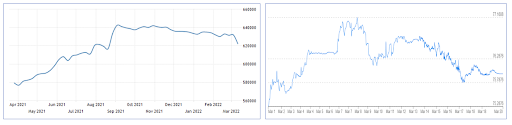

Image: quotes.ino.com

Unveiling Forex Rates: The Invisible Force

Imagine two dancers, each representing a currency, gliding across the floor of a ballroom; their every move influenced by an invisible force that connects them. This force, known as the foreign exchange rate (forex rate), determines how much of one currency is worth in terms of another. It’s a constantly fluctuating number that hinges on a complex interplay of economic, political, and psychological factors.

Factors Shaping the Forex Dance

Like the intricate choreography of a tango, the forex rate between the US dollar and the Indian rupee is shaped by a kaleidoscope of factors. Economic growth, inflation, interest rates, and political stability all play pivotal roles in determining how these currencies interact. When the US economy is booming and interest rates are rising, the demand for dollars increases, driving up its value against the rupee. Conversely, if India experiences strong economic pertumbuhan and higher interest rates, the rupee tends to strengthen against the dollar.

Economic Indicators: The Pulse of Forex Markets

Economic indicators, such as GDP growth, inflation, and unemployment rates, provide valuable insights into the health of a country’s economy and influence forex rates. Strong economic data can signal increased demand for a currency, leading to its appreciation. Conversely, weak economic indicators can raise concerns about a country’s economic stability, causing investors to seek refuge in stronger currencies.

Image: blog.iimb.ac.in

Political Stability: The Impact of Confidence

Political stability exerts a profound impact on forex rates. Countries with stable political environments attract foreign investment, boosting demand for their currencies. Conversely, political turmoil and uncertainty can erode investor confidence, leading to a flight of capital and a depreciation of the currency.

The Future of Forex: Predicting the Unpredictable

The future of forex rates is as unpredictable as the weather. However, economists analyze economic data, consider geopolitical events, and employ sophisticated models to make educated predictions. While it’s impossible to pinpoint exact numbers, understanding the factors that drive forex rates can empower individuals and businesses to make informed decisions regarding currency exchange, international trade, and investments.

Expert Insights: Navigating the Forex Maze

Renowned economists emphasize the importance of staying informed about economic and political developments that may impact forex rates. They advise investors to adopt a disciplined approach to currency trading, diversifying their portfolios and minimizing risks.

Actionable Tips: Empowering Your Forex Strategy

-

Monitor economic indicators and geopolitical news to stay abreast of factors influencing forex rates.

-

Diversify your currency holdings to spread risks and capitalize on fluctuations.

-

Consult reputable sources and seek professional advice before making significant currency exchange decisions.

Forex Rate Us Dollar To Indian Rupee

Conclusion: The Enduring Dance

The forex rate between the US dollar and the Indian rupee is a constantly evolving dance, influenced by a myriad of economic, political, and psychological factors. By understanding these factors and utilizing actionable tips, investors and individuals can navigate this dynamic landscape and make informed currency exchange decisions. As the global economy continues to evolve, the forex dance between these two currencies will captivate markets and shape the lives of countless individuals.