Amidst an escalating global economic scenario, India’s foreign exchange reserves have emerged as a bedrock of stability, safeguarding the nation’s financial resilience. These reserves, comprising foreign currencies, gold, and other monetary assets, serve as a vital buffer against external shocks and provide a cushion for international payments.

Image: www.business-standard.com

The significance of India’s forex reserves cannot be overstated. They play a pivotal role in maintaining the country’s exchange rate and ensuring the smooth flow of international trade. Moreover, these reserves bolster India’s creditworthiness in global financial markets, enabling it to access external funds at favorable terms.

Evolution of India’s Forex Reserves

India’s forex reserves have witnessed a remarkable trajectory over the past few decades. In the early 1990s, they stood at a mere $5 billion. However, through prudent economic management and a growing foreign exchange kitty, the reserves have multiplied exponentially in recent years.

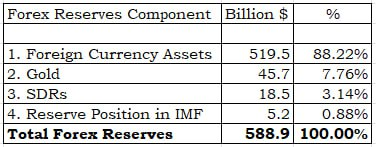

As of March 2023, India’s forex reserves surpassed $600 billion, marking a historic milestone. This surge is attributed to factors such as increased foreign inflows, robust exports, and the Reserve Bank of India’s dedicated efforts to add to the reserves. The growth of the forex reserves has cemented India’s position as one of the top ten countries globally in terms of foreign exchange holdings.

Benefits of Robust Forex Reserves

India’s strong forex reserves offer numerous benefits to the nation. Firstly, they provide a buffer against external shocks, such as geopolitical tensions or global financial crises. The reserves can be used to intervene in the foreign exchange market and maintain exchange rate stability, thereby protecting the Indian economy from external volatility.

Secondly, robust forex reserves enhance India’s creditworthiness. International rating agencies such as Moody’s and Fitch take into account a country’s forex reserves when assessing its financial strength. Higher reserves indicate a reduced risk of default, leading to lower borrowing costs for the government and businesses.

Thirdly, forex reserves provide a cushion for international payments. They ensure that India has sufficient funds to meet its obligations to foreign creditors and import essential goods such as oil and machinery. This helps to maintain the country’s balance of payments in check.

Image: www.drishtiias.com

Forex Reserve Of India Pib

Conclusion

India’s forex reserves are a vital component of the nation’s financial toolkit. They provide a bulwark against external shocks, enhance creditworthiness, and support international payments. The robust growth of these reserves in recent years is a testament to India’s sound economic management. As the global economic outlook remains uncertain, India’s strong forex reserves will continue to serve as a pillar of stability, safeguarding the nation’s financial resilience in the face of ongoing challenges.