Forex Reserves of Countries: An Introduction

Every country holds foreign exchange reserves as a part of their economic policies. These reserves include not only foreign currencies but also gold, and are used to maintain exchange rate stability, pay for imports, and meet other international obligations. Understanding the status of these reserves is essential for analyzing a country’s economic health and financial stability.

Image: www.mining.com

Delving into Forex Reserves and Gold Holdings

Forex reserves are primarily comprised of various currencies, such as the US dollar, euro, and British pound. They are held in different forms, including cash, deposits in foreign banks, government bonds, and treasury bills. Gold, being a valuable asset, is also considered as part of forex reserves and plays a significant role in boosting the liquidity and reliability of a nation’s financial footing.

Analyzing the Global Landscape of Forex Reserves

As of 2018, China holds the largest forex reserves, followed by Japan and Switzerland. These countries have maintained high levels of reserves to support their export-oriented economies and to mitigate external shocks. Developing and emerging market economies, such as India, Brazil, and Mexico, have significantly increased their forex reserves in recent years to protect against currency fluctuations and to meet growing international trade and investment needs.

The Rationale Behind Diversifying Forex Reserves

Countries often diversify their forex reserves by holding a mix of currencies and gold. This strategy reduces the risk associated with relying heavily on a single currency, which may face fluctuations due to political, economic, or other factors. By diversifying, a country can balance the impact of currency movements and maintain the stability of its forex reserves.

Image: thegoldvault.blogspot.com

Maintaining Adequate Forex Reserves: A Balance of Risks

The optimal level of forex reserves a country should hold depends on various factors, including the size of its economy, trade patterns, vulnerability to external shocks, and the level of foreign debt. Holding a sufficient level of reserves can provide a safety net during economic crises or external conflicts, but excessive reserves may limit a country’s ability to invest in other areas of economic growth.

Understanding Current Trends and Developments

In recent years, there have been shifts in the global forex market, due to factors such as the rise of digital currencies, the increasing interconnectedness of global markets, and the persistent effects of the COVID-19 pandemic. Central banks and governments are exploring new ways to balance their forex reserves and diversify their holdings, while also addressing the challenges and opportunities presented by these evolving trends.

Tips for Enhancing Forex Reserve Management

Based on expert analyses, here are some strategies that countries can adopt to enhance their forex reserve management practices:

- Effective Investment: Invest forex reserves wisely, focusing on a mix of safe and high-yield instruments to optimize returns while minimizing risks.

- Currency Diversification: Diversify currency holdings to reduce exposure to any one currency’s fluctuations.

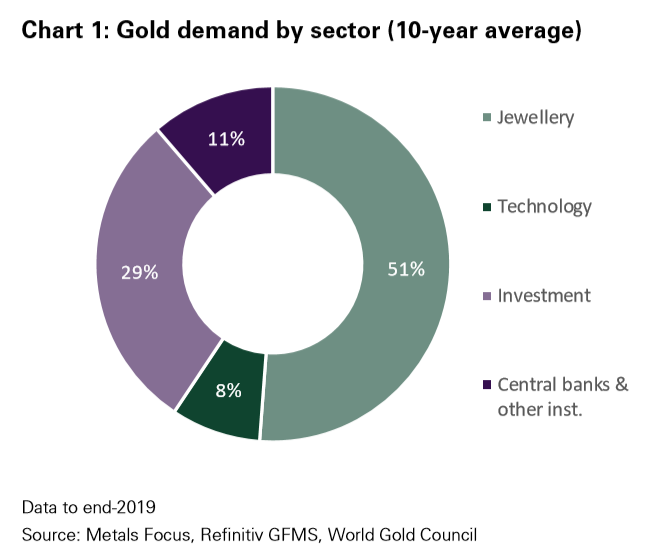

- Gold as a Strategic Asset: Gold has traditionally served as a safe haven during economic uncertainties, so maintaining a portion of forex reserves in gold can provide stability.

- Transparent and Prudent Policies: Conduct regular audits, disclose forex reserve data transparently, and maintain prudent reserve management practices to enhance confidence and stability.

Insights from the Experts

“Maintaining adequate forex reserves is a critical aspect of any country’s economic management. It provides a buffer against external shocks and helps in stabilizing exchange rates.” – Dr. Marta Ochoa, International Monetary Fund (IMF)

“Diversifying forex reserves is paramount in today’s interdependent global market. It not only reduces risks but also creates opportunities to optimize returns.” – Mr. Juan Russo, World Bank Group

Frequently Asked Questions About Forex Reserves

Q: Why do countries need to hold forex reserves?

A: Forex reserves serve as a cushion for countries to meet their external payment obligations, such as imports, debt repayments, and foreign exchange transactions.

Q: What is the impact of maintaining high levels of forex reserves?

A: High forex reserves can signal a country’s economic strength and resilience, attract foreign investment, and provide buffer against external vulnerabilities. However, excessive reserves may limit the country’s ability to invest in other economic development priorities.

Q: How can countries access their forex reserves?

A: Countries typically access their forex reserves through the central bank, which is responsible for managing the reserves and intervening in the foreign exchange market when necessary.

Forex Reserves Of Countries Including Gold 2018

Conclusion: The Significance of Forex Reserves

Forex reserves are essential for a country’s economic stability and financial security, particularly in an increasingly interconnected global economy. By effectively managing their forex reserves, including gold, countries can enhance their resilience to external shocks, maintain exchange rate stability, and foster economic growth. As the global economic landscape continues to evolve, countries must remain adaptable and agile in their forex reserve management practices, ensuring the financial well-being of their citizens and the stability of the global economy.

Thank you for reading! I’d love to hear your thoughts on the topic – please feel free to share any questions or insights in the comment section below.