India’s foreign exchange (forex) reserves are the fourth largest in the world, providing a crucial safety net against economic uncertainties. These reserves, primarily consisting of foreign currencies, gold, and Special Drawing Rights (SDRs) issued by the International Monetary Fund (IMF), play a pivotal role in maintaining economic stability and supporting the country’s external obligations. To fully grasp the significance of India’s forex reserves, let us embark on a comprehensive exploration of their composition, management, and impact on the nation’s financial landscape.

Image: timesofindia.indiatimes.com

Composition and Sources of India’s Forex Reserves

India’s forex reserves primarily comprise foreign currency assets held by the Reserve Bank of India (RBI), which include U.S. dollars, euros, yen, and British pounds. Gold, the traditional safe haven asset, constitutes a significant portion of the reserves. Additionally, SDRs, which are reserve assets created by the IMF to supplement members’ official reserves, form a small but important component.

The RBI acquires foreign exchange through various sources, including:

- Export earnings from sectors such as IT, pharmaceuticals, and textiles

- Inward remittances from overseas Indians

- Foreign direct investment

- Foreign portfolio investment

Management of Forex Reserves

The RBI is entrusted with the responsibility of managing India’s forex reserves. The central bank follows a prudent investment strategy, guided by the objective of preserving capital while earning a reasonable return. This entails investing in low-risk, highly liquid instruments, such as U.S. Treasury bills, bonds issued by developed countries, and gold.

The RBI continuously monitors global economic conditions and adjusts its investment strategy accordingly. For instance, during periods of global economic uncertainty, the RBI may increase its allocation to gold, which is considered a safe haven asset.

Importance of Forex Reserves for India

India’s ample forex reserves serve as a vital economic buffer and offer numerous benefits to the nation:

-

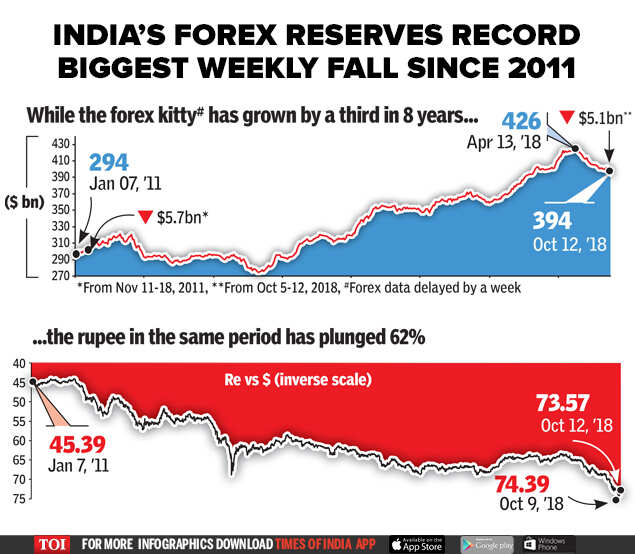

Stabilizing the Rupee: Forex reserves allow the RBI to intervene in the foreign exchange market and stabilize the value of the Indian rupee. This helps prevent excessive fluctuations in the currency’s value, which can have negative consequences for trade, investment, and economic growth.

-

Meeting External Obligations: Forex reserves provide the necessary liquidity to meet India’s external obligations, such as import payments, debt servicing, and foreign investment commitments.

-

Confidence-Building: Ample forex reserves instill confidence among foreign investors and credit rating agencies, signaling India’s ability to meet its financial commitments. This confidence attracts foreign capital inflows and supports economic growth.

-

Managing Economic Crises: In times of economic crisis or external shocks, such as a sharp decline in exports or a global financial crisis, forex reserves provide the government with the flexibility to implement stabilizing measures, such as fiscal stimulus or exchange rate intervention.

Image: financialtribune.com

Forex Reserves Vise India Place

Forex Reserves: A Window into India’s Economic Health

The level and composition of India’s forex reserves are closely watched by economists, investors, and policymakers as indicators of the country’s economic health. A strong and growing forex reserve position signals economic resilience, while a declining or stagnant reserve position can raise concerns about external vulnerabilities.

As India continues to integrate with the global economy, the importance of forex reserves is likely to grow even further. The government and the RBI are committed to maintaining adequate forex reserves to ensure the stability and growth of the Indian economy.