Introduction: A Wake-up Call for Global Economic Stability

In the rapidly evolving world of international finance, recent headlines have brought attention to a significant decline in global forex reserves. The International Monetary Fund (IMF) has reported a drop of 1.54 billion, amounting to a concerning reduction to just $365 billion. This article delves into the potential causes, implications, and actionable steps for addressing this economic challenge.

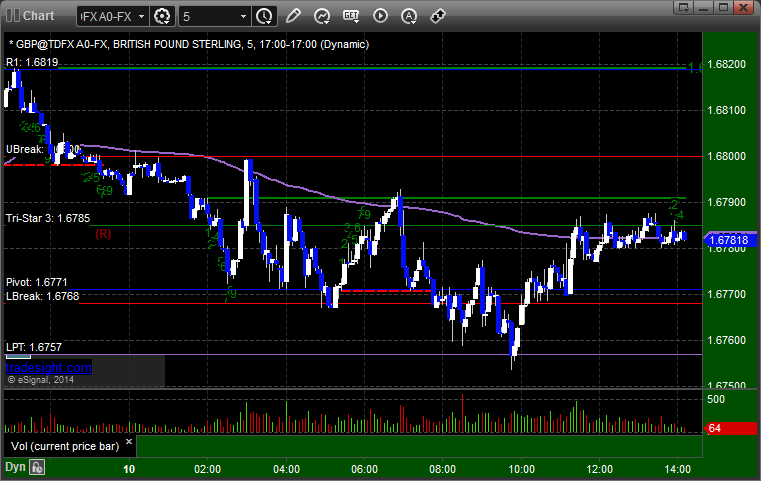

Image: www.tradesight.com

Understanding Forex Reserves: A Lifeline for Global Trade

Forex reserves, a crucial component of any country’s economic arsenal, comprise the foreign exchange held by central banks. These reserves serve multiple purposes, including stabilizing exchange rates, intervening in financial markets, and providing a buffer against external economic shocks. A high level of forex reserves offers a sense of security and flexibility in navigating global economic uncertainties.

Exploring the Causes of the Drop: A Multifaceted Perspective

Experts attribute the recent decline in forex reserves to a combination of factors. The strengthening of the US dollar has acted as a catalyst, leading central banks to sell their dollar-denominated reserves to support their struggling currencies. Geopolitical tensions and economic uncertainties, particularly in emerging markets, have further contributed to the erosion of forex reserves.

Implications for Global Economic Stability: A Shadow Over Developing Nations

The depletion of forex reserves poses significant challenges for global economic stability. For developing nations, it can restrict their ability to smooth out economic fluctuations caused by external factors. It can also make them more vulnerable to speculative attacks on their currencies. Additionally, a reduction in forex reserves limits the ability of central banks to intervene in financial markets and maintain exchange rate stability.

Image: www.thehitavada.com

Tips for Enhancing Forex Reserves: Prudent Measures for Economic Stability

To enhance forex reserves and bolster economic stability, experts recommend increasing foreign exchange earnings through exports, tourism, and inward foreign direct investment. Maintaining sound macroeconomic fundamentals, including fiscal discipline and low inflation, is equally crucial. Central banks should also explore innovative mechanisms for enhancing their reserve management strategies.

Expert Advice for Navigating the Challenges: Harnessing Collective Wisdom

Economists stress the importance of coordinated global efforts to address the issue of declining forex reserves. They advocate for enhanced international cooperation and knowledge sharing to identify and share best practices in reserve management. Encouraging long-term investments and promoting sustainable economic growth in emerging markets are additional measures that can contribute to improving the overall level of forex reserves worldwide.

FAQ: Unraveling the Complexities of Forex Reserves

- What is a forex reserve?: Forex reserves represent foreign exchange held by central banks, serving to stabilize exchange rates, intervene in financial markets, and buffer external economic shocks.

- Why are high forex reserves important?: High forex reserves provide economic stability, flexibility in currency management, and protection against external shocks.

- What are the causes of the recent drop in forex reserves?: The strengthening of the US dollar, geopolitical tensions, and economic uncertainties have all contributed to the decline in reserves.

- How can forex reserves be increased?: Increasing foreign exchange earnings, maintaining sound macroeconomic fundamentals, and exploring innovative reserve management strategies can help boost forex reserves.

Forex Reseves Drop 1.54 Bnto 365 Bn

Conclusion: Collective Action for Global Economic Well-being

The decline in global forex reserves serves as a wake-up call, highlighting the need for proactive economic management and collective action. By implementing prudent policies, cooperating internationally, and adopting expert advice, we can mitigate the challenges posed by this economic trend. A collaborative approach to enhancing forex reserves is essential for fostering global economic stability and ensuring a more resilient financial future.

Call to Action: Engage in the conversation. Are you concerned about the implications of the declining forex reserves? Share your thoughts and suggestions in the comments section below!