The world of foreign exchange trading (forex) can be an exhilarating journey, but it also demands a keen eye for risk analysis. Just as a shrewd sailor vigilantly scans the horizon for approaching storms, a successful forex trader must meticulously examine the financial landscape to mitigate threats and position themselves for success. One crucial aspect of this risk assessment lies in scrutinizing a company’s balance sheet, the cornerstone of any prudent forex risk analysis.

Image: www.chegg.com

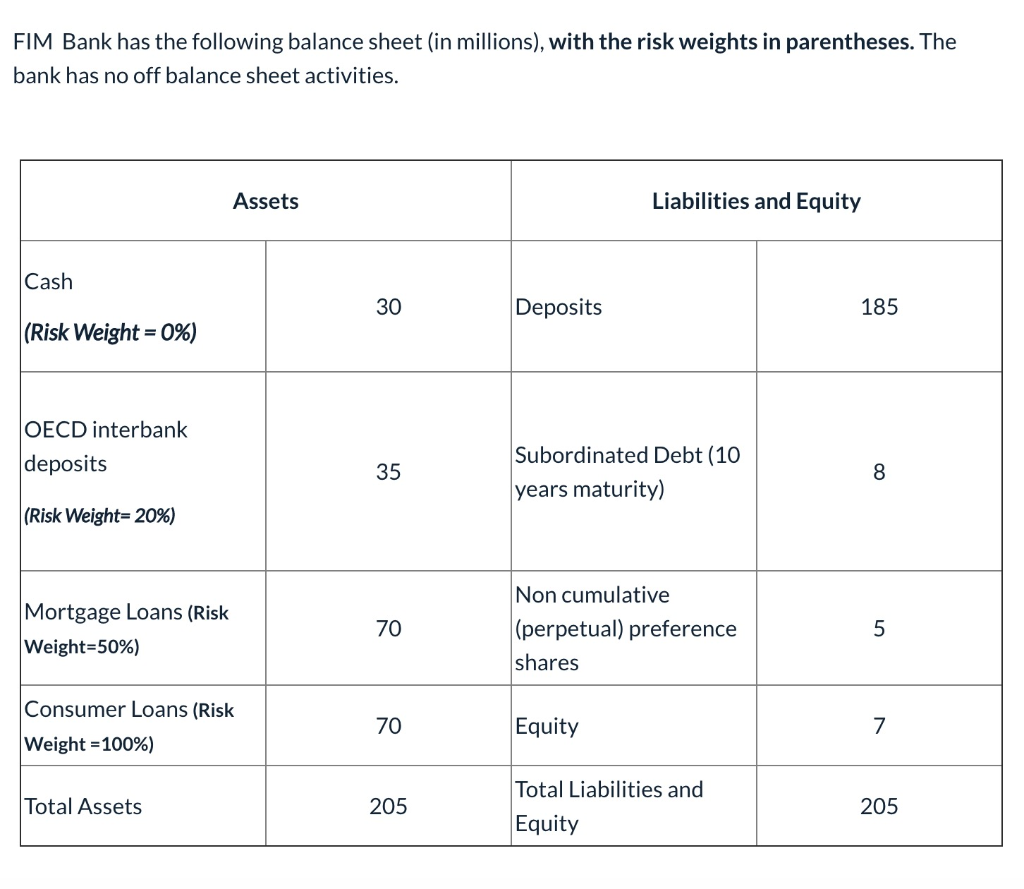

Balance Sheet: A Snapshot of a Company’s Financial Health

The balance sheet offers a panoramic view of a company’s financial position at a specific point in time. It portrays the company’s assets, liabilities, and equity, providing essential insights into its overall financial strength and health. By scrutinizing the balance sheet, forex traders can ascertain the company’s ability to meet its obligations and gauge its risk profile.

Asset Examination

Assets consist of the company’s resources, such as cash, accounts receivable, inventory, and equipment. Forex traders should meticulously assess the liquidity and recoverability of these assets. Current assets, such as cash and marketable securities, are easily convertible into cash, while fixed assets, such as property, may be less liquid. Non-current assets, such as intangible assets, might be harder to value and carry significant uncertainty.

Liability Assessment

Liabilities represent a company’s financial obligations, including short-term liabilities (due within a year) and long-term liabilities (due after a year). Forex traders should evaluate the company’s debt load and its ability to service its obligations. High levels of debt or short-term liabilities relative to assets can indicate financial stress.

Image: www.pinterest.com.au

Equity Evaluation

Equity represents the residual interest in the company’s assets after deducting liabilities. Positive equity signifies that a company’s assets exceed its liabilities. Conversely, negative equity suggests a company is insolvent. Forex traders should analyze the company’s equity trends over time to ascertain its financial stability.

Latest Trends and Developments in Forex Risk Analysis

The forex risk analysis landscape is constantly evolving, driven by technological advancements, market volatility, and geopolitical shifts. To stay ahead of the curve, forex traders should stay abreast of the latest trends and developments:

- Artificial intelligence (AI) and machine learning (ML) are increasingly used to automate risk analysis, providing traders with real-time insights and predictive models.

- Regulatory changes and compliance requirements are reshaping the risk management landscape, necessitating a proactive approach to adherence.

- Data security and cyber threats are critical concerns, prompting forex traders to invest in robust risk management strategies to protect sensitive information.

Expert Tips and Advice for Navigating Forex Risks

Seasoned forex traders have a wealth of experience and insights to share. Here are a few practical tips to enhance your risk analysis:

- Diversify your portfolio: Forex traders should spread their investments across multiple currencies and asset classes to reduce exposure to specific market risks.

- Manage leverage prudently: Leverage can amplify both profits and losses; therefore, traders should use it cautiously and in line with their risk tolerance.

- Implement stop-loss orders: Stop-loss orders automatically exit trades when a predetermined price is reached, thereby limiting potential losses.

- Monitor market news and economic data: A watchful eye on market events and economic indicators can help traders anticipate market shifts and adjust their risk management strategies.

Remember, these tips are general guidelines and should be tailored to your individual circumstances, risk appetite, and investment objectives.

Frequently Asked Questions (FAQs)

- Q: What is forex risk analysis?

A: Forex risk analysis involves examining a company’s financial statements, particularly its balance sheet, to assess its financial health and identify potential risks and opportunities.

- Q: Why is it important to consider the balance sheet in forex risk analysis?

A: The balance sheet provides insights into a company’s assets, liabilities, and equity, allowing forex traders to evaluate the company’s financial stability, liquidity, and solvency.

- Q: What key metrics should forex traders look for in a balance sheet?

A: Forex traders should examine the company’s asset liquidity, debt-to-equity ratio, working capital, and overall financial trends over time.

- Q: How can forex traders stay updated on the latest trends in risk analysis?

A: Forex traders can stay informed by reading industry publications, attending webinars and conferences, and networking with other professionals in the field.

Forex Risk Analysis In Balance Sheet

Conclusion

Forex risk analysis is a cornerstone of successful foreign exchange trading. By scrutinizing a company’s balance sheet and employing sound risk management strategies, forex traders can minimize financial risks and position themselves for optimal returns. Remember, understanding and managing risk is key to unlocking opportunities in the forex market while protecting your investments. As the financial landscape continues to evolve, staying engaged with the topic will enhance your ability to navigate risks and seize the opportunities that the forex market offers.

Are you interested in learning more about forex risk analysis and honing your trading skills? Share your insights or ask questions in the comments section below, and let’s explore the intricacies of forex risk management together!