The foreign exchange market, or forex, is a vast financial market where currencies from around the world are traded. As the largest and most liquid market on the planet, forex trading presents opportunities for individuals to capitalize on currency fluctuations. Understanding the different trading sessions can help you make more informed decisions and optimize your trades. In this comprehensive guide, we delve into the intricacies of the European to Indian forex trading session, unraveling its unique characteristics and providing insights to enhance your trading strategies.

Image: www.calibrateindia.com

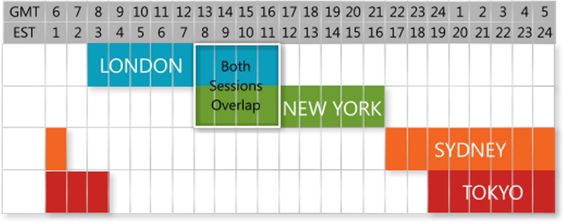

The forex market operates continuously throughout the week, with trading taking place across different geographical regions. These regions correspond to major financial centers and are known as trading sessions. The European and Indian trading sessions overlap for a period of several hours, creating a highly active and dynamic market environment. By understanding the characteristics and nuances of these sessions, traders can leverage valuable opportunities and mitigate risks.

Navigating the European Trading Session

The European trading session, also known as the London session, commences at 7:00 AM GMT and concludes at 4:00 PM GMT. This session is renowned for its high liquidity and volatility, owing to the participation of major financial institutions, hedge funds, and retail traders located in London, Frankfurt, and Zurich. The session coincides with the opening of the New York Stock Exchange and the release of key economic data from the Eurozone, making it a period of significant market activity.

The European session is characterized by its fast-paced, dynamic nature. Currency pairs involving the euro (EUR), British pound (GBP), and Swiss franc (CHF) tend to exhibit higher volatility during this session. Traders can take advantage of the increased liquidity to execute trades with tighter spreads and greater potential for profit. However, the volatility also presents risks, and traders must employ sound risk management strategies to protect their capital.

Understanding the Indian Trading Session

The Indian trading session commences at 9:15 AM IST and concludes at 4:00 PM IST. This session overlaps with the European session for a period of approximately two and a half hours, offering a unique opportunity for traders to capitalize on cross-session market trends. The session is marked by moderate liquidity and volatility, as it coincides with the opening of the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

During the Indian trading session, currency pairs involving the Indian rupee (INR) tend to exhibit increased activity. Traders can focus on pairs such as EUR/INR, GBP/INR, and USD/INR, which typically offer favorable trading conditions. However, it is important to note that the liquidity and volatility during this session may be lower compared to the European session, and spreads may be wider.

Optimizing Trading Strategies for the European to Indian Session

To maximize the opportunities presented by the European to Indian forex trading session, traders should employ strategic approaches tailored to the specific characteristics of each session. Here are some key considerations:

- Identify High-Liquidity Currency Pairs: During the European session, focus on trading major currency pairs with high liquidity, such as EUR/USD, GBP/USD, and EUR/GBP. These pairs offer tighter spreads and better execution prices.

- Capitalize on News and Economic Data: The European session coincides with the release of significant economic data from the Eurozone. Stay updated with news and announcements that may impact currency movements and adjust your trading strategies accordingly.

- Monitor Central Bank Announcements: Central bank meetings and policy announcements can significantly affect currency markets. Keep an eye on scheduled events and anticipate potential market reactions.

- Leverage Cross-Session Trading: The overlap between the European and Indian trading sessions provides an opportunity for cross-session trading. Monitor market trends during both sessions and identify potential continuation patterns.

- Adopt Sound Risk Management: The high volatility during the European session demands prudent risk management. Use stop-loss orders, limit orders, and position sizing to protect your capital.

Image: fx2funding.com

Forex Session Europian To India

Conclusion

Understanding the dynamics of the European to Indian forex trading session is crucial for traders looking to navigate this dynamic market effectively. By leveraging the high liquidity, staying informed about economic news, and employing strategic trading approaches, traders can maximize their opportunities and mitigate risks. Remember, forex trading carries inherent risks and requires proper risk management. Always consult with a qualified financial advisor before making any trading decisions.