Introduction

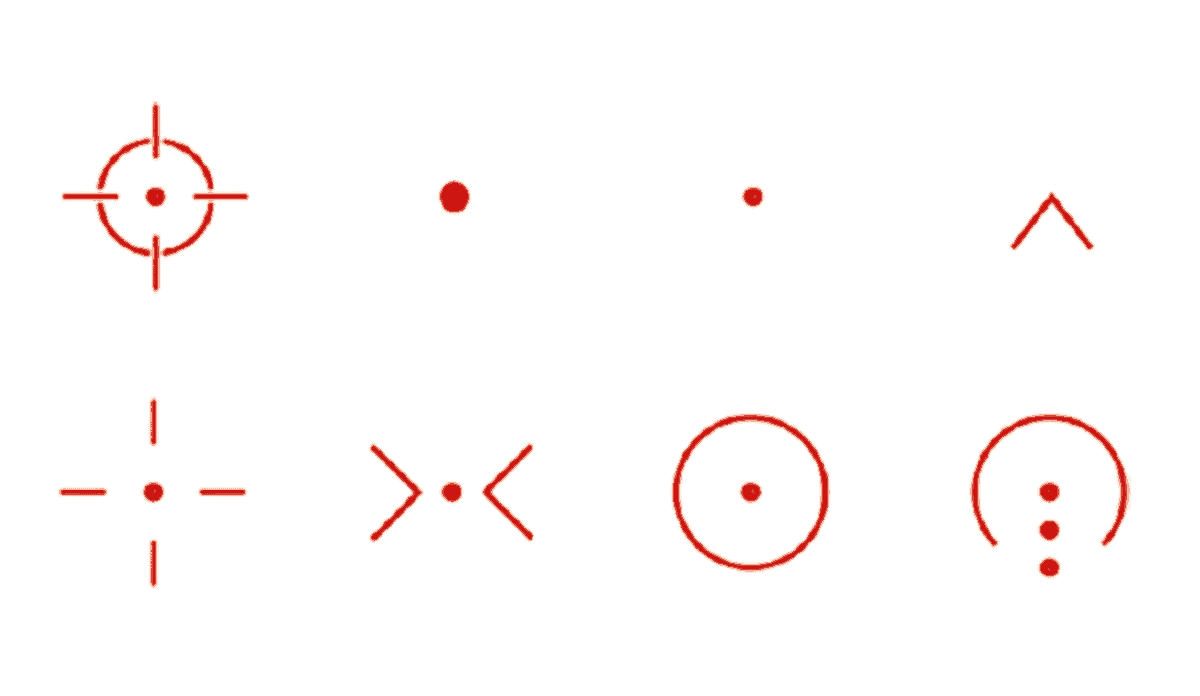

In the ever-evolving world of forex trading, traders constantly seek novel strategies to outmaneuver market volatility and maximize profits. One such strategy that has gained traction in recent times is the “Red Dot in Red Square” technique. This innovative approach combines technical analysis with a disciplined trading mindset to provide traders with a potentially lucrative edge in the forex market.

Image: retval.weebly.com

The concept of the Red Dot in Red Square strategy is built upon the premise that market reversals often occur near significant support and resistance levels. These levels are identified through the analysis of price action and volume data. The red dot in the red square represents a specific point on the chart that signals a potential trading opportunity.

The Mechanics of the Strategy

To implement the Red Dot in Red Square strategy, traders should follow these steps:

- Identify Support and Resistance Levels: Use technical indicators such as moving averages, pivot points, or Bollinger Bands to identify key support and resistance levels on the price chart.

- Wait for Price to Approach Support or Resistance: Monitor the price action as it approaches an identified support or resistance level. Look for signs of consolidation or a period of indecision.

- Enter the Trade: If the price breaks through the support or resistance level with momentum, enter a trade in the direction of the breakout.

- Place a Stop Loss: Set a stop loss order below the support level (for long trades) or above the resistance level (for short trades) to manage risk.

- Take Profit: Determine a profit target based on technical analysis or risk-reward parameters.

Example of a Red Dot Trade

Let’s illustrate the strategy with an example:

Imagine the EUR/USD currency pair is trading at 1.1000. A support level has been identified at 1.0950, and a Bollinger Band indicator suggests that the price is oversold near this support level.

Traders using the Red Dot in Red Square strategy would monitor the price action as it approaches the 1.0950 support level and wait for confirmation of a reversal. If the price were to break above this level with momentum, traders would enter a long trade with a stop loss below 1.0950 and a profit target at 1.1100.

Advantages of the Strategy

The Red Dot in Red Square strategy offers several advantages for forex traders:

- Simplicity: The strategy is straightforward and easy to understand, making it accessible to both novice and experienced traders.

- Objective Signals: The strategy relies on technical analysis, which eliminates emotions and provides objective trading signals.

- High Probability: By identifying trades near significant support and resistance levels, the strategy targets high-probability opportunities.

- Risk Management: The use of stop loss orders helps traders manage risk and protect potential profits.

- Versatility: The strategy can be applied to multiple валютные пары and timeframes.

Image: www.tradesight.com

Limitations of the Strategy

While effective, the Red Dot in Red Square strategy is not without its limitations:

- False Signals: Technical analysis can sometimes generate false trading signals, leading to losing trades.

- Late Entries: Waiting for a confirmed breakout can result in missed trading opportunities.

- Discipline Required: Adhering to the trading rules and maintaining discipline is crucial for the strategy’s success.

- Emotional Trading: Traders must avoid giving into emotions and stick to the strategy’s guidelines.

Forex Strategy Red Dot In Red Square

Conclusion

The Red Dot in Red Square strategy is a powerful technical trading technique that can provide traders with a systematic approach to identifying high-probability trading opportunities in the forex market. By combining objective technical analysis with disciplined risk management, traders can leverage this strategy to enhance their profitability and navigate market volatility more effectively. Remember that success in forex trading requires patience, adherence to trading rules, and continuous learning.