In the fast-paced and exhilarating world of forex trading, time is money. Traders rely on real-time data to make informed decisions that can potentially yield significant returns. Among the most valuable datasets in their arsenal is forex tick data, a granular record of price movements that reveals hidden opportunities. When combined with an understanding of supply and demand principles, tick data empowers traders to identify market imbalances and anticipate price reversals with remarkable accuracy.

Image: forexbotworthit.blogspot.com

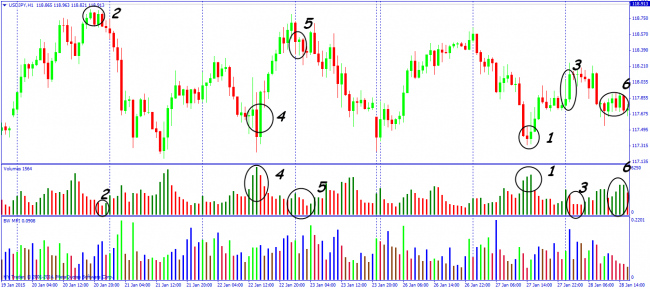

Tick data captures every single price change in a specified currency pair, providing traders with an unprecedented level of market insight. By analyzing tick volumes and time intervals, traders can uncover patterns and anomalies that often precede significant price movements. Furthermore, tick data enables the identification of market liquidity, essential for executing trades at the best possible prices and minimizing slippage.

Supply and demand, the fundamental forces that govern market movements, manifest themselves in tick data. When supply exceeds demand, prices tend to fall as sellers offload their positions. Conversely, when demand outstrips supply, prices typically rise as buyers scramble to acquire the limited asset. By monitoring tick data, traders can pinpoint supply and demand imbalances, allowing them to position themselves accordingly and capitalize on potential profits.

The Power of Tick Data in Supply and Demand Analysis

Tick data provides traders with a wealth of information that can be used to identify supply and demand imbalances and predict future price movements. Some of the most important tick data metrics include:

- Tick Volume: The number of ticks that occur in a given timeframe. High tick volume indicates strong market activity, while low tick volume suggests a period of consolidation or inactivity.

- Tick Range: The difference between the highest and lowest prices of a tick. A wide tick range indicates high volatility, while a narrow tick range suggests a more stable market.

- Time between Ticks: The amount of time that elapses between each tick. Long intervals between ticks often indicate low trading activity, while short intervals indicate a high level of market excitement.

By combining these tick data metrics with an understanding of supply and demand, traders can develop a comprehensive picture of the market and identify potential trading opportunities. For example, a sudden surge in tick volume accompanied by a wide tick range could indicate an imminent breakout or reversal. Conversely, a period of low tick volume and narrow tick range may suggest a potential pause or consolidation in the market.

Image: pocugyko.web.fc2.com

Forex Tick Data And Supply And Demand

Practical Applications of Tick Data and Supply and Demand Analysis in Forex Trading

Tick data and supply and demand analysis can be applied to a wide range of forex trading strategies, including:

- Scalping: Scalpers seek to profit from small price movements by entering and exiting trades within seconds or minutes. Tick data provides them with the real-time market information they need to make quick and accurate trading decisions.

- Day Trading: Day traders hold positions for longer periods of time, typically within the same trading day. They use tick data to identify potential trend reversals and capitalize on intraday price fluctuations.

- Swing Trading: Swing traders hold positions for a few days or weeks, aiming to profit from larger price swings. They use tick data to identify long-term supply and demand imbalances and make informed trading decisions based on market fundamentals.

Whether you’re a seasoned trader or just starting your journey in the forex market, mastering the art of tick data and supply and demand analysis can give you a significant advantage. By leveraging the power of this data and understanding the forces that drive price movements, you can unlock unparalleled trading opportunities and achieve greater success in the dynamic realm of forex trading.