Introduction

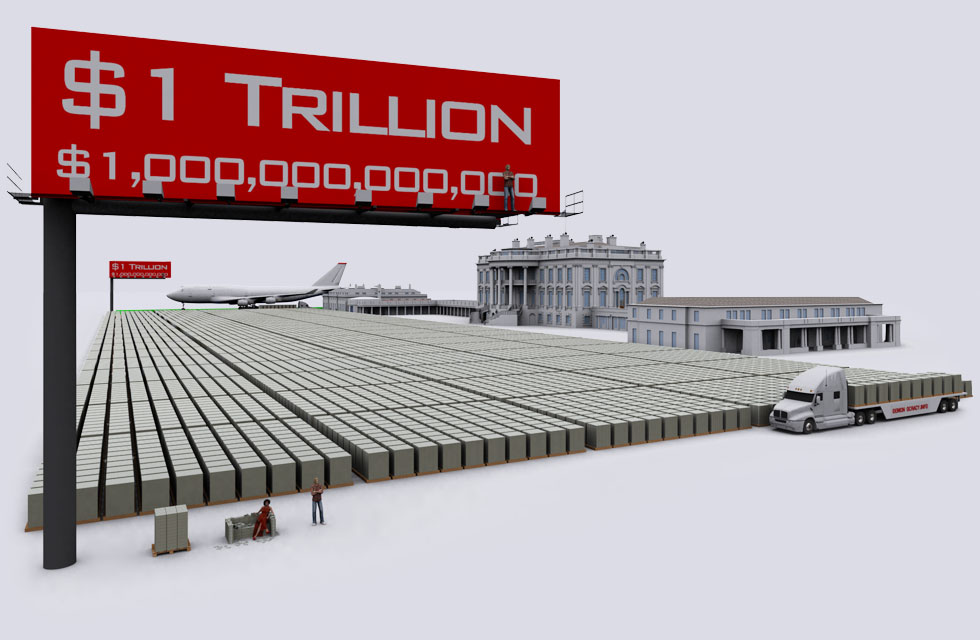

In a realm of global finance, where fortunes are traded in the blink of an eye, the world of foreign exchange (forex) stands as a financial behemoth, an arena where staggering sums of money exchange hands every single day. The magnitude of forex trading surpasses even the most extravagant imaginations, with trillions of dollars circulating across borders, fueling global commerce and shaping the economic landscape.

Image: courses.markettraders.com

As we embark on this captivating journey, we invite you to step behind the scenes and witness the awe-inspiring scale of forex trading. From its origins to its present-day dominance, we will delve into the intricate mechanisms that drive this dynamic market, exploring the trillions that flow through its digital veins.

The Genesis of Forex Trading

The roots of forex trading can be traced back to the days of ancient civilizations, as different cultures sought to exchange goods and services. However, it was not until the 20th century that forex trading emerged in its modern form, with the establishment of the Bretton Woods system in 1944. This system pegged various national currencies to the US dollar, creating a stable exchange rate environment and facilitating international trade.

The Rise of the Trillion-Dollar Market

With the collapse of the Bretton Woods system in 1973 and the subsequent advent of floating exchange rates, the forex market underwent a remarkable transformation. The liberalization of currency exchange controls unleashed a surge in trading activity, aided by the rapid advancements in communication and information technology.

The 1980s witnessed the emergence of electronic trading platforms, further fueling the growth of the forex market. These platforms enabled traders to execute orders with unprecedented speed and efficiency, attracting a broader spectrum of participants and increasing the overall liquidity.

The Colossal Dimensions of Forex Trading

Today, the forex market stands as the largest financial market in the world, with an estimated daily trading volume surpassing $6.6 trillion. This staggering figure dwarfs the combined trading volumes of all other financial markets, including stocks, bonds, and commodities.

The sheer size of the forex market is attributed to several key factors:

- Global Economic Interdependence: The interconnectedness of modern economies generates a constant demand for currency conversion, driving the vast majority of forex trades.

- Hedge Funds and Investment Banks: Major financial institutions leverage forex trading to manage risk, speculate on currency movements, and optimize investment returns.

- Central Banks: Central banks intervene in the forex market to influence exchange rates and maintain monetary stability.

- Retail Traders: Individual traders, armed with online platforms and accessible information, participate in the forex market for various reasons, including profit-seeking and educational purposes.

Image: ar.inspiredpencil.com

Trillions in Motion

The trillions that flow through the forex market have a profound impact on global economies. Currency fluctuations can influence prices of goods and services, affecting trade patterns and economic growth. Moreover, forex trading serves as a barometer of economic sentiment, providing insights into investor confidence and expectations.

Forex Trading How Many Trillion Dollars

https://youtube.com/watch?v=FfYMIhxG-1g

Conclusion

The forex market, with its trillions in daily trading volume, is a testament to the interconnectedness of our globalized world. It serves as a vital mechanism facilitating international trade, shaping economic destiny, and offering opportunities for both risk management and profit-seeking. As we witness the continued expansion of this financial behemoth, it is clear that the trillions in flux will continue to shape the economic landscape for years to come.