Title: Unlock Forex Trading Success with the Moving Average Strategy: A Comprehensive Guide

Image: www.protradingschool.com

Introduction:

In the realm of forex trading, where volatility can often seem like an unruly force, finding a reliable strategy to navigate market fluctuations is paramount. Enter the Moving Average (MA) strategy, a time-honored approach that offers a way for both novice and seasoned traders to ride the waves of the forex market.

The MA strategy is a versatile tool that has stood the test of time. By smoothing out price fluctuations and revealing underlying trends, it helps traders identify potential trading opportunities with increased accuracy. Embarking on a journey with the MA strategy is akin to unlocking a treasure map that can guide you towards consistent profits.

Understanding the Moving Average Strategy

At its core, the MA strategy involves calculating the average price of an asset over a specified period. This average is plotted on a chart, creating a smoother line that represents the asset’s price trend. By observing the position and direction of the MA, traders can gain insights into the market sentiment and identify potential trading signals.

There are various types of MAs, each with its unique strengths and weaknesses. The most commonly used MAs include the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA). The choice of MA type depends on the trader’s preference and the market conditions.

Unlocking Hidden Trends with Moving Averages

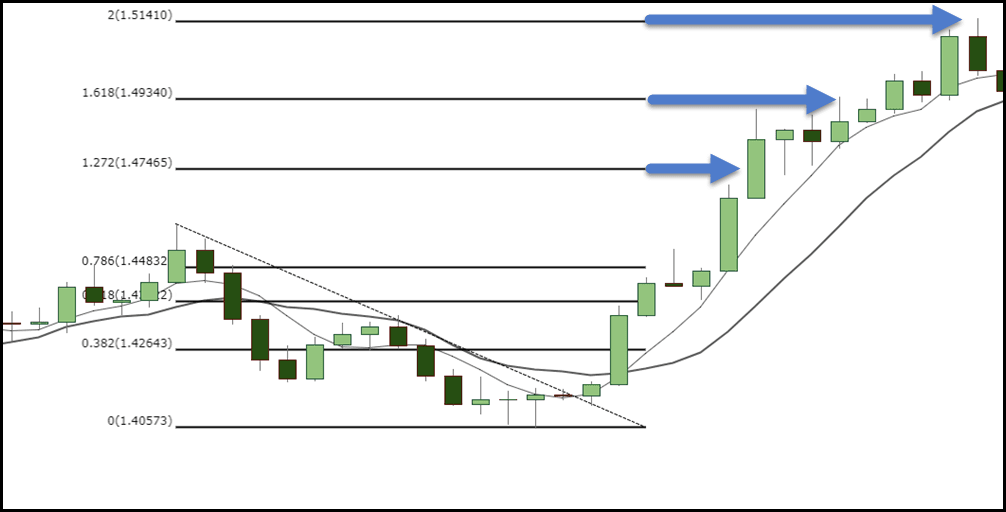

One of the primary advantages of using the MA strategy is its ability to reveal hidden trends. By filtering out market noise and highlighting the broader price movement, traders can easily identify support and resistance levels, enabling them to make informed decisions about entering and exiting trades.

Moreover, MAs help traders stay on the right side of a trend. When the price is above the MA, it indicates an uptrend, encouraging traders to consider buy positions. Conversely, when the price falls below the MA, it suggests a downtrend, signaling potential sell opportunities.

Trading with Moving Averages

The MA strategy can be applied in multiple ways to suit different trading styles. Crossovers, where the price crosses the MA, are a common signal for entry or exit points. A bullish crossover occurs when the price moves above the MA, while a bearish crossover occurs when the price falls below the MA.

Another popular technique involves using MAs as dynamic support and resistance levels. When the price touches the MA, it often acts as a temporary support or resistance zone. Traders can anticipate potential reversals or bounces by observing the price action in relation to the MA.

Expert Insights on Moving Average Strategy

Renowned forex experts have long advocated for the effectiveness of the MA strategy. Technical analyst John Bollinger, creator of the Bollinger Bands indicator, emphasizes the importance of using multiple MAs with different periods to capture long-term and short-term trends.

Traders alike extol the virtues of the MA strategy. “Moving averages have provided me with an invaluable compass in the often chaotic forex market,” shares experienced trader Mark Jenkins. “By understanding the interplay between price and MAs, I’ve been able to navigate market fluctuations with greater confidence.”

Embracing the Moving Average Advantage

Incorporating the Moving Average strategy into your forex trading arsenal can empower you with:

- Enhanced trend identification capabilities

- Improved entry and exit point selection

- Objective decision-making backed by data

- Reduced emotional trading based on gut instincts

- Increased confidence in your trading strategies

Remember, mastering the MA strategy is a journey that requires practice, patience, and a keen eye for market analysis. By diligently studying price charts, observing the behavior of MAs, and seeking guidance from reliable sources, you will unlock the true potential of this time-tested trading tool.

Conclusion:

The Moving Average strategy is an invaluable asset for forex traders, offering a reliable framework for navigating market volatility. By understanding the mechanics of MAs, applying them effectively, and embracing the insights of industry experts, you can transform your forex trading experience and move confidently towards achieving your financial goals.

Image: www.forexcracked.com

Forex Trading Strategy Moving Average